Korea’s venture cycle is entering a new phase shaped not by government-led stimulus but by returning institutional capital. The latest investment and fund formation data reveal a marketplace regaining momentum after two cautious years, with private LPs driving most of the recovery. For global investors tracking Asia-Pacific venture flows, Korea’s shift toward deep tech and late-stage resilience signals a structural transition worth examining closely.

New Investment Surges to ₩13.6T, Signaling a Clear Market Recovery

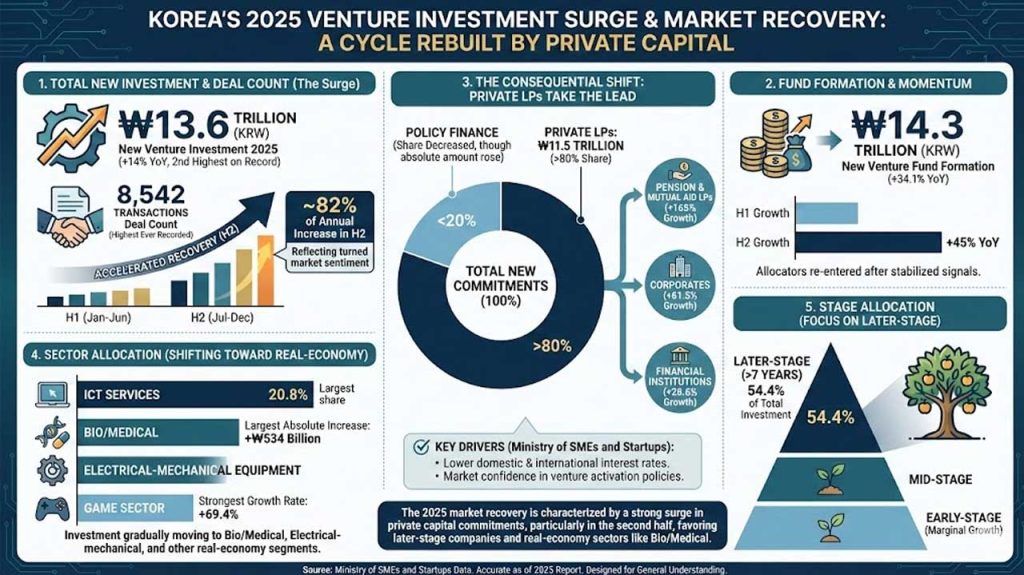

New venture investment in 2025 reached 13.6 trillion KRW, a 14% increase from the prior year and the second-highest figure on record. Meanwhile, deal count hit 8,542 transactions, the highest ever recorded.

The recovery accelerated sharply in the second half of the year. About 82% of the annual increase occurred between July and December, reflecting a turn in market sentiment after several risk-off quarters.

New venture fund formation reached 14.3 trillion KRW, a 34.1% rise from the previous year. Second-half fund formation grew 45% year-on-year, reinforcing the view that allocators re-entered the market only after economic and policy signals stabilized.

Korea’s Venture Investment 2025: A Cycle Rebuilt by Private Capital

The most consequential shift in Korea’s venture market is not the total investment volume but who is supplying the capital.

Private LPs — pensions, mutual aid associations, corporates and financial institutions — contributed 11.5 trillion KRW, accounting for more than 80% of all new venture fund commitments.

Pension and mutual aid LPs expanded commitments by 165%, while corporates grew their allocations by 61.5%, and financial institutions increased by 28.6%.

The Ministry of SMEs and Startups says the trend reflects two conditions:

- Lower domestic and international interest rates

- Market confidence in the administration’s venture activation policies

Although policy finance also increased, its overall share decreased as private LPs took the lead.

Sector allocation patterns also shifted. ICT services still attracted the largest share (20.8%), but investment gradually moved toward bio/medical, electrical-mechanical equipment, and other real-economy segments.

The bio/medical category posted the largest increase in absolute investment (+534 billion KRW), while the game sector recorded the strongest growth rate (+69.4%).

Government Signals Support but Acknowledges Gaps

Han Seong-sook, Minister of SMEs and Startups, stated that the simultaneous rise in investment volume and fund formation reflects meaningful recovery:

“Both venture investment and fund-formation surged and the expansion of private capital drove fund formation. We will strengthen support so venture firms can scale into unicorns and become engines of innovation for our economy.”

The ministry also highlighted structural challenges. Investment continues to lean toward later-stage firms.

Later-stage companies of more than 7 years received 54.4% of total investment, while early-stage startups showed only marginal growth. In response, the government plans to increase mother-fund allocations for early-stage investment and introduce targeted programs such as the Startup Fever Fund for initial founders.

A Turning Point for Korea’s Venture Market and Global LPs

The data reveals three structural signals that matter for global venture participants:

1. Korea’s venture market is moving into a private-led cycle.With 80% of capital now originating from private LPs, Korea is no longer dependent on policy-driven injections. For international LPs evaluating Asia-Pacific exposure, this suggests a more predictable and market-responsive investment environment.

2. The unicorn landscape is shifting away from consumer platforms.Four new unicorns emerged in 2025: Rebellions and FuriosaAI (AI semiconductors), Benow (cosmetics manufacturing), and Galaxy Corporation (AI-enabled entertainment-tech).

This broadening underscores Korea’s growing competitiveness in deep tech, where global scale and cross-border partnerships are essential.

3. Late-stage funding strength contrasts with early-stage stagnation.A clear preference for validated growth companies signals maturation, but it also creates stress points in the pipeline. Early-stage constriction may shape Korea’s long-term innovation capacity unless new financing mechanisms — including foreign LP inflows — fill the gap.

These dynamics position Korea differently from other Asia-Pacific markets where consumer platforms still dominate unicorn formation and where government-driven funding cycles remain stronger.

What to Watch in 2026

Korea enters 2026 with a venture market that has regained momentum, backed by stronger institutional confidence and a widening deep tech base.

Yet the next stage of growth will depend on whether early-stage funding can recover, and how successfully Korean startups can convert late-stage capital into global expansion, partnerships and exits.

For global LPs and cross-border investors, Korea now provides clearer signals: a market turning toward deep tech, a capital base that is stabilizing organically, and policy initiatives that target structural gaps rather than headline figures.

How these forces align will shape Korea’s competitiveness as a venture hub in the Asia-Pacific region.

Key Takeaway on Korea’s Venture Investment Trends 2025

- Korea recorded KRW 13.6 Trillion in new venture investments, the second-highest ever.

- Private LPs supplied 80% of new fund capital, signaling a structural market shift.

- Second-half investment and fund formation drove the recovery.

- Investment flowed toward bio/medical, AI, electrical-mechanical equipment, and game sectors.

- Later-stage firms attracted most funding, while early-stage activity remained weak.

- Four new unicorns emerged: Rebellions, FuriosaAI, Benow, Galaxy Corporation.

- Government plans larger early-stage allocations through expanded mother-fund programs.

- Korea is transitioning toward a private-led, deep-tech-oriented venture market, with implications for global LPs and Asia-Pacific capital flows.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.