Korea’s trade governance is facing renewed scrutiny after a Seoul court ruled that the Korea Customs Service (KCS) had unlawfully taxed domestic manufacturers due to faulty wood classification. The ruling has reignited concerns among small and medium-sized enterprises (SMEs) and trade experts over the nation’s administrative precision, FTA credibility, and the urgent need for digital customs reform to safeguard SME competitiveness.

Court Rules Against Customs in Misclassification Case

A recent case revealed that over ten Korean flooring manufacturers overpaid nearly KRW 10 billion (around USD 7.2 million) in customs duties because the Korea Customs Service misclassified Indonesian plywood species under the wrong tariff category.

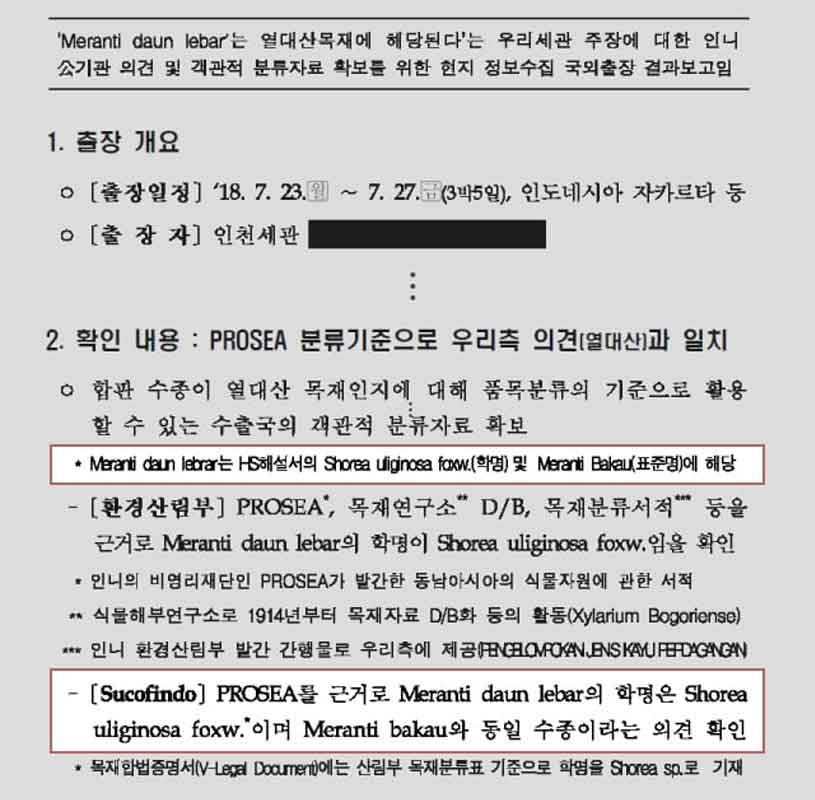

The companies, including mid-sized flooring producer Company A, had imported Meranti Daun Lebar (Shorea sp.) plywood from Indonesia under the Korea–ASEAN Free Trade Agreement (FTA), which grants a 5 percent preferential tariff. However, beginning in 2021, the Customs Service re-categorized the wood as Meranti Bakau (Shorea uliginosa Foxw.), subject to a 10 percent general tariff, and demanded retroactive payments.

The dispute ended in May 2025, when the Seoul Administrative Court ruled that additional taxation was unlawful. The court ordered KCS to refund the overpaid duties, criticizing the agency’s handling of scientific classification and procedural accuracy.

When Trade Bureaucracy Outpaces Innovation

The controversy highlights a structural issue in Korea’s trade administration.

FTA classification relies on precise species identification, yet the KCS reportedly misinterpreted Indonesia’s official correspondence from the Ministry of Environment and Forestry.

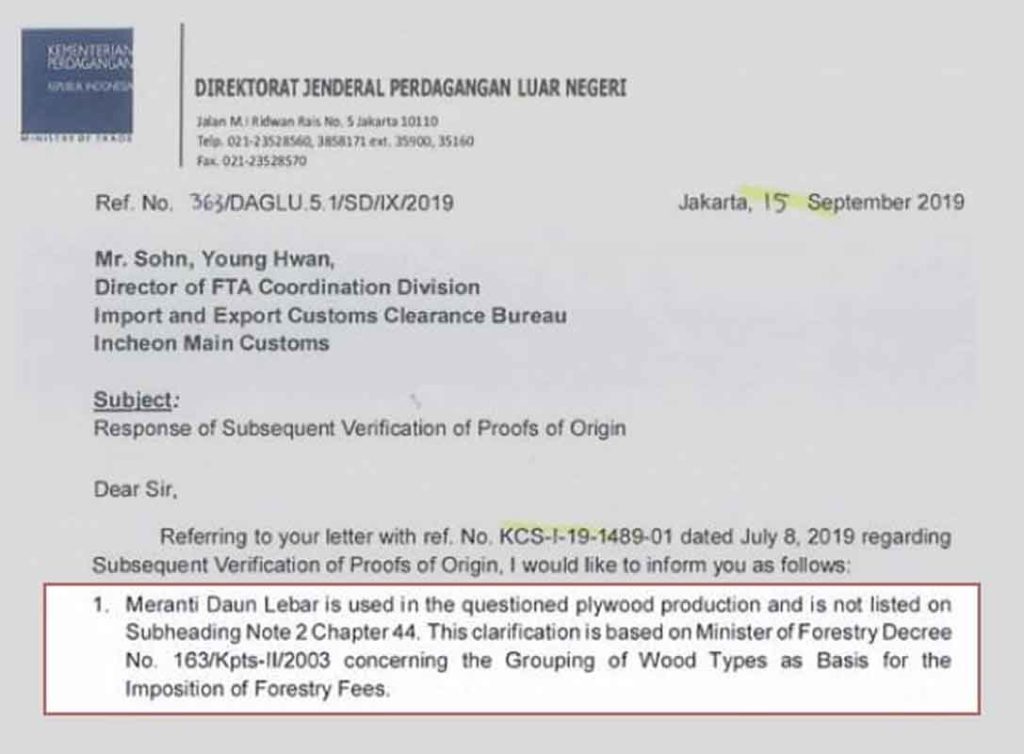

The Indonesian side clarified that Meranti Daun Lebar and Meranti Bakau are not identical species and that only laboratory analysis could confirm equivalence. This warning was completely ignored.

Despite a 2019 letter from Indonesia’s Ministry of Trade confirming that the wood was not part of the 88 restricted tropical species, the KCS enforced the higher tariff. SMEs then faced heavy, unexpected financial strain, with one firm described,

“Because of one official letter from the Customs Service, our company’s cash flow froze. This kind of administrative error pushes small manufacturers to the edge of collapse.”

Legal and Industry Reaction on the Customs Misclassification Case

The Korea Customs Service has denied deliberate wrongdoing, stating that all taxation followed “legal procedure and established customs law.” However, the court’s verdict directly challenged that view, describing the taxation as administratively improper.

SME representatives argued that the case shows how technical misjudgments in government processes can lead to massive financial consequences.

A representative from an affected firm stated,

“The Customs Service knew the additional tax was groundless but proceeded anyway. Treating refunds as a remedy without accountability damages business trust.”

Industry experts also noted that this misclassification occurred despite clear foreign correspondence — signaling a gap between Korea’s bureaucratic systems and the demands of global trade governance.

A Wake-Up Call for Korea’s Startups and SMEs Institutional Support

The ruling for this FTA customs misclassification carries implications far beyond the flooring industry.

Korea’s SME and startup sectors rely heavily on efficient trade compliance to expand globally under FTAs. This incident exposes how outdated verification and documentation systems can undermine competitiveness, particularly among SMEs that lack the resources to contest administrative errors.

That is why for investors and trade partners, the case raises a critical question: how resilient is Korea’s institutional support framework for innovation-driven exporters?

Analysts argue that Korea must accelerate its digital customs modernization, integrating AI-based species classification, real-time FTA verification, and transparent inter-ministerial coordination. Such upgrades align with broader government objectives to strengthen trade integrity and reduce policy friction for SME-led exports.

Restoring Trust and Global Credibility

The verdict is prompting calls for systemic governance reform. Trade law experts emphasize that origin verification under FTAs is directly linked to national credibility — a single misinterpretation can damage Korea’s reliability as a trading partner and affect the investment climate for its startup ecosystem.

As the Ministry of SMEs and Startups (MSS) and related agencies continue to digitize trade and innovation support frameworks, the case serves as a cautionary benchmark. Ensuring that technology, policy, and administration move at the same pace will be essential for Korea to maintain its position as a trusted innovation hub in the Asia-Pacific region.

Crucial Reform for Korea’s Journey to Global Competitiveness

The customs misclassification dispute is more than a legal victory for affected SMEs — it is a reminder that Korea’s journey toward global competitiveness depends on transparent, data-driven, and responsive governance.

Building trust in trade systems through digital reform and cross-agency accountability will determine how effectively Korea’s SMEs and startups can navigate global markets in the next decade.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.