Korea’s token securities (STO) market — once a showcase of regulatory innovation — now faces a credibility test. The dispute between fintech startup LucentBlock and NexTrade (NXT), Korea’s first alternative trading platform, has raised critical questions about fairness and startup protection when public or quasi-public institutions compete directly with private innovators. That is why the outcome of this dispute could later shape investor confidence in Korea’s next phase of digital finance.

LucentBlock – NXT Dispute Brings Startup Governance Under Spotlight

A confidential partnership gone wrong has put Korea’s STO ecosystem under scrutiny.

An exclusive report from ChosunBiz revealed that LucentBlock, the first fintech startup to commercialize fractional investment in tokenized securities, accuses NexTrade (NXT) of using its proprietary information to launch a competing STO consortium.

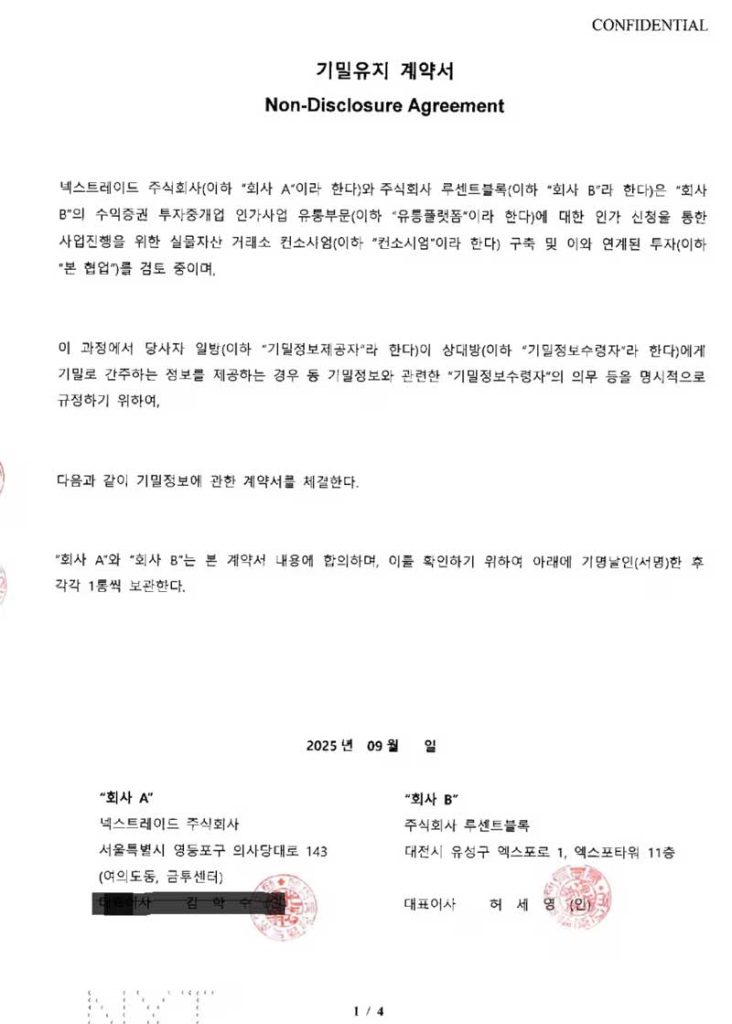

And it happened despite a signed non-disclosure agreement (NDA) and prior assurances that NXT would not enter the market directly.

According to multiple documents and parliamentary records, LucentBlock provided internal business plans, financial data, and technical materials to NXT in September under NDA terms.

Then, weeks later, NXT reportedly contacted securities firms to form its own STO consortium and pursue an independent license application — a move the startup community sees as a breach of trust and a warning sign for innovation policy.

NXT maintains its actions were lawful, stating that “the materials shared were general corporate documents, not sensitive trade data,” and that the company “has explored STO expansion since its founding in 2022.”

Korea’s Regulatory Sandbox and STO Market Evolution

LucentBlock entered Korea’s financial innovation sandbox in 2018 under the Special Act on Financial Innovation Support, investing nearly four years in regulatory trials, licensing procedures, and platform development. It has since grown to over 500,000 users and completed more than KRW 30 billion (USD 22 million) in public offerings.

The company’s success helped validate the market potential of fractional investment platforms, prompting regulators to formalize STO operations earlier this year.

However, the same legal framework that enabled LucentBlock’s growth now exposes the limitations of Korea’s startup protection system — especially when state-linked entities like KRX (Korea Exchange) and NXT pursue overlapping business models.

NXT, partially backed by major securities firms, operates as an alternative trading system (ATS) under the Korea Exchange’s oversight. Its quasi-public role gives it both regulatory privileges and market influence, creating a gray area where commercial expansion may conflict with its institutional position.

Policy Reckoning: Lawmakers Question Ethics in Korea’s STO Market

The dispute between LucentBlock and NexTrade (NXT) escalated into a controversy during the National Assembly’s Financial Services Commission audit on October 20, 2025.

Lawmaker Park Beom-gye criticized NXT’s move, saying

“LucentBlock and NexTrade signed a confidentiality agreement to form a consortium. NexTrade breached that contract, built another consortium, and applied for off-exchange trading approval. That’s not only a legal issue but a violation of business ethics.”

He also pointed out that “an alternative trading platform owned by securities firms cannot ethically compete against the very startups it regulates or collaborates with,” and compared KRX’s and NXT’s dual roles to “a coach deciding to play as a competing athlete in the same game.”

Lawmaker Park Beom-gye then urged regulators to review the case and enforce strict measures, especially when South Korea is on its way to build its Third Venture Boom.

“The Lee Jae-myung administration has pledged to support Korea’s third venture boom. Undermining a startup’s innovation and effort in this way goes against that national agenda.

The FSC must scrutinize this case for ethical and structural conflicts between public power and private innovation. So this requires strong action in line with the public accountability principles of the current administration.”

In response, FSC Vice Chairman Lee Eo-gwon acknowledged the issue’s sensitivity but noted that “no official application has been submitted yet.” He reaffirmed that sandbox participants would receive “additional evaluation points” during licensing to protect early innovators.

“No official application has been submitted yet, so it’s premature to judge outcomes.

However, we have stated that consortiums including sandbox operators will receive additional evaluation points.”

LucentBlock CEO Heo Se-young described the incident as “a betrayal of public trust,” adding that public-interest institutions should not use their position to suppress startups that pioneered new markets under government supervision.

“Given that the exchange holds regulatory and disciplinary authority, its entry into the same market amounts to undue pressure.

When a public-power entity competes directly with startups, innovation dies.”

Startup Trust at Stake: How Korea’s Public–Private Divide Shapes Future Innovation

The LucentBlock – NXT dispute underscores a recurring tension in Korea’s innovation policy — balancing state-led regulation with private-sector innovation.

Not only that, but the case also reflects a deeper structural challenge: once startups prove a business model’s market viability, larger public or financial institutions often replicate it, leveraging influence to dominate the newly legalized sector.

This pattern risks discouraging early-stage innovation in fintech, AI finance, and digital asset infrastructure, sectors critical to Korea’s next wave of startup growth. It also calls into question the effectiveness of Korea’s exclusive-operation provisions, which were designed to give sandbox pioneers temporary protection after regulatory approval.

If quasi-public platforms can sidestep these protections through institutional privilege or policy influence, it risks weakening both startup confidence and foreign investor trust in Korea’s innovation governance.

After all, the question now extends beyond just one case and company: when innovators prove a market’s viability, what safeguards exist to prevent public or regulatory entities from stepping in to dominate the system they were meant to nurture?

LucentBlock – NXT Dispute: A Defining Test for Korea’s Innovation Credibility

Finally, the LucentBlock – NXT controversy now stands as more than a corporate dispute.

It is a litmus test for Korea’s ability to protect innovation ecosystems from institutional dominance while promoting fair digital finance development.

Regulators are expected to clarify conflict-of-interest boundaries and strengthen mechanisms that ensure startups pioneering within regulatory sandboxes are not disadvantaged by the very institutions meant to supervise them.

The final resolution of this case will later determine whether Korea’s vision of inclusive, innovation-driven finance can retain the trust of entrepreneurs and global investors alike.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.