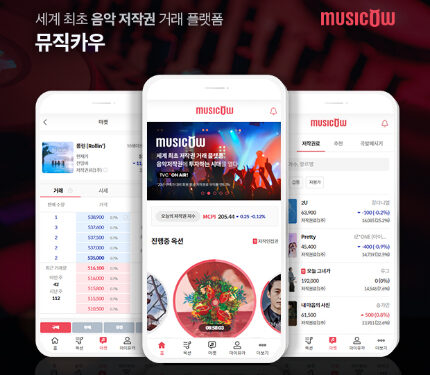

K-Pop music has become an enormous phenomenon worldwide with millions of fan following. For fans of K-Pop music Korea, startups are bringing innovations that can engage global fans and give them more to look forward to. Now K-Pop US fans can look forward to copyright trading.

K-Pop copyright trading platform Musicow has accelerated its advance into the United States market. Musicow announced in March that it would establish a US Corporation and target local markets.

Based on its experience in the platform business in Korea, Musicow will begin to construct a platform that allows individuals to trade music copyrights in the United States.

Musicow allows investors to buy or sell stakes in copyrights to K-Pop songs in a public auction or an online marketplace. Musicow shares copyrights of more than 900 K-Pop songs on its platform. Investors at Musicow receive monthly copyright royalties and profit from increasing the copyright price.

Ready with financial clearances

Musicow Korea is fully prepared to meet the requirements as it has been cleared by the Korean financial authorities and is subject to the Capital Market Act. The ‘music copyright fee participation claim’ traded in Musicow was announced as a security by the financial authorities on April 2022 and incorporated into the system.

It has also signed a comprehensive business agreement (MOU) with Kiwoom Securities to introduce an investor real-name account system and secure deposit storage and transaction stability.

In addition, various systems are being created, and the organization is expanding, such as restructuring to strengthen the protection of customer rights, the inauguration of a professional advisory committee, and large-scale recruitment of related experts.

A Musicow official said, “Since Musicow is the world’s first business model, we plan to apply the guidelines verified by the Korean financial authorities from the early stage of entry to reduce the possibility of failure in the local market thoroughly. In the end, it seems highly likely that this standard will become a global standard for music copyright platforms.”

Meanwhile, Musicow is expected to develop an IPO in 2023 and has appointed Mirae Asset Securities to manage it.

Also Read,

- K-Pop commerce startup K-Town 4U to expand service to K-Drama with new investment

- Korean startup Hanteo Global gaining grounds as ‘K-Pop Big Data Company’

- Hash Purple brings in ‘KDOL’, a social platform for K-Pop fans worldwide

- Gleam Media’s StarPlay app for K-Pop fans to follow their idols, share content & win rewards