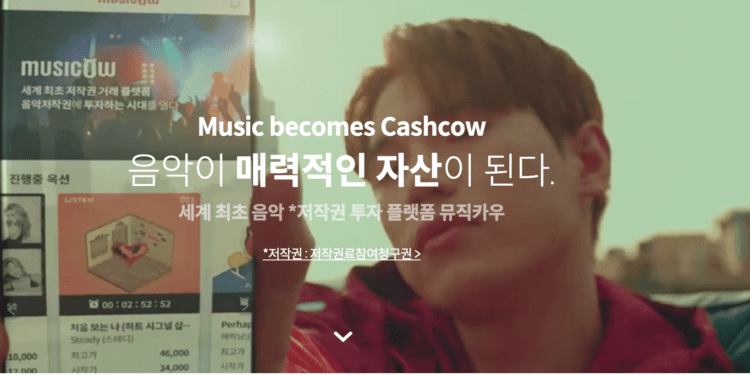

K-Pop copyright trading platform Musicow attracts investment of 100 billion won ($79 million) through a private equity fund (PEF) operated by Stic Investment. Musicow allows investors to buy or sell stakes in copyrights to K-Pop songs in a public auction or an online marketplace. Musicow shares copyrights of more than 900 K-Pop songs on its platform. Investors at Musicow receive monthly copyright royalties and profit from increasing the copyright price.

With the new funds, Musicow plans to speed up the preparation of a base for strengthening investor protection. It wants to work on business reorganization as per the incorporation of the Capital Market Act, do organizational reinforcement such as recruitment of experts, and advancement of security systems and IT infrastructure. Musicow and Stic Investment also decided to join hands for ecosystem innovation that broadens the basis of the copyright market through the creation of a music fund.

Both companies to create music copyright fund

Stic Investment and Music Cow are also discussing the creation of the Korea’s largest music copyright fund. It plans to create a virtuous cycle environment where artists and producers can focus on creative activities by securing more music copyrights through forming a music copyright fund. An official of the fund managed by Stic Investment said, “Musicow, which has a new business model of music copyright trading for the first time in the world, has brought about a big change in the music industry. We will spare no effort to support it so that it can establish itself as an investment platform.”

The ‘music copyright fee participation claim’ traded in Musicow was announced as a security by the financial authorities on April 20 and incorporated into the system. Musicow plans to introduce additional measures to strengthen investor protection over the next six months. Meanwhile, Musicow is expected to develop an IPO in 2023 and has appointed Mirae Asset Securities to manage it.

Also Read,

- K-Pop commerce startup K-Town 4U to expand service to K-Drama with new investment

- Korean startup Hanteo Global gaining grounds as ‘K-Pop Big Data Company’

- Hash Purple brings in ‘KDOL’, a social platform for K-Pop fans worldwide

- Check out these Korean startups connecting K-Pop with the rest of the world