Korea’s beauty sector has long set global trends through products. Now, it is rewriting the rules of talent. New recruitment data shows that K-Beauty firms—once focused on brand and product—are systematically acquiring professionals who can scale operations, build channels abroad, and turn global demand into sustainable export power.

Hiring Trends Signal a Structural Shift in K-Beauty’s Growth Model

A new analysis by Remember & Company, operator of the professional recruitment platform Remember, reveals that K-Beauty companies dominated Korea’s career hiring landscape throughout 2025.

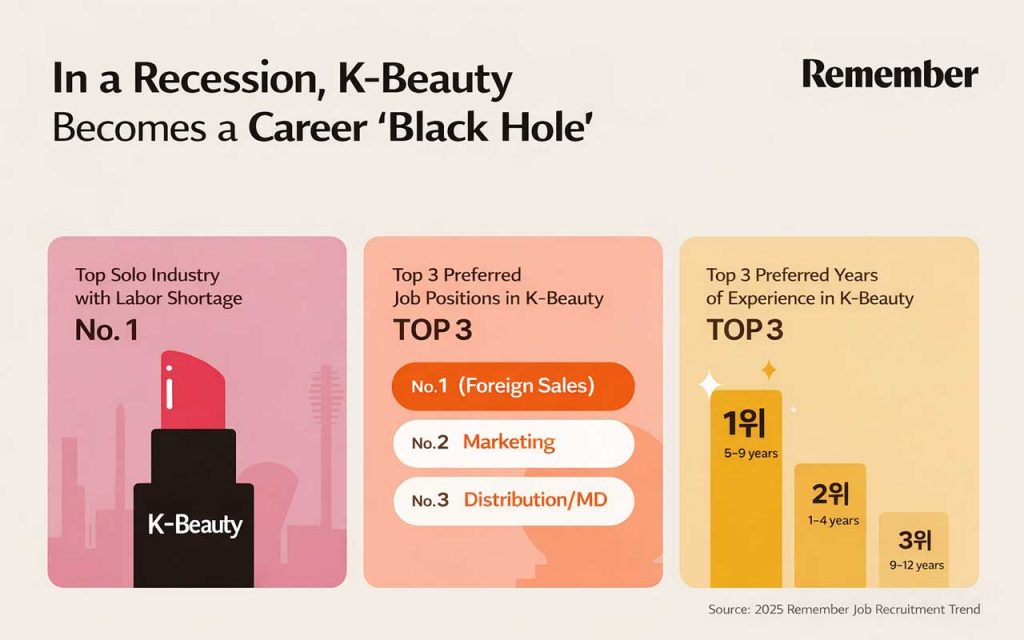

Based on corporate scouting data from the platform’s top 10% of professionals—those receiving the highest number of direct recruitment offers—the beauty sector accounted for 16% of all scouting activity, a remarkable share for a single industry.

The surge places beauty alongside information technology and consumer goods as one of Korea’s top three target industries for mid-career recruitment. While other sectors slowed hiring amid economic headwinds, beauty brands intensified their talent acquisition, focusing on roles directly tied to global market expansion.

Among all job categories, sales led with 30%, followed by marketing (27%) and distribution or merchandising (13%). These functions point to companies prioritizing execution capacity over experimentation, as firms seek to solidify their overseas presence in regions such as North America, Europe, and Southeast Asia.

Why This Matters for Korea’s Broader Industry Landscape

K-Beauty’s hiring push is more than a sign of recovery—it reflects a shift toward qualitative growth. For years, the sector relied on product innovation and influencer-driven marketing. Now, as global competition tightens, firms are investing in organizational capabilities that support scalability, compliance, and market localization.

The report also shows a marked preference for experienced, operationally ready professionals. Mid-level talent with five to eight years of experience—typically those capable of managing export logistics, retail partnerships, or regional branding campaigns—received over half (52%) of all offers. Another 30% targeted junior professionals who can adapt quickly to changing consumer trends.

In essence, beauty firms are staffing for agility and execution, not hierarchy. The trend mirrors how Korea’s broader innovation economy is maturing—where workforce strategy now determines how global potential translates into measurable growth.

Expert Insights: Recruitment as a Proxy for Industrial Strategy

Jeon Min-seok, head of the Data Intelligence Team at Remember, said:

“Scouting data is an early indicator that captures industrial change faster than conventional hiring records. What we’re seeing is structural adjustment that K-Beauty companies are transitioning from volume-based growth to qualitative expansion, preparing for deeper global market penetration.”

The company’s headhunting division further confirmed the trend. Beauty firms ranked among the top three industries using executive search services, focusing on sales and marketing professionals with international experience.

A large portion of mandates involved overseas sales—a sign that companies are strengthening their export operations through proven talent rather than entry-level hires.

What This Signals for Korea’s Startup and Employment Ecosystem

The K-Beauty hiring wave illustrates how traditional consumer industries are adopting startup-like strategies—using recruitment as a tool for transformation. For policymakers and investors, this shift carries important signals: when legacy industries begin sourcing agile talent, it often precedes the next wave of ecosystem diversification.

Beauty’s transformation also connects to Korea’s broader export resilience. While tech startups faced tightened funding cycles in 2025, beauty brands leveraged existing cash flow and brand equity to expand globally. This allowed them to act as employment stabilizers, absorbing skilled professionals and sustaining high-value job creation even amid macroeconomic uncertainty.

For younger companies in beauty tech, AI formulation, or digital commerce, this trend provides both opportunity and challenge—competing for talent with established players now building global pipelines.

Yet the next test for Korea’s beauty sector will unfold beyond its current global expansion cycle. As trade relations with China begin to normalize, the question is not whether K-Beauty can return—it’s how it will compete in a redefined market where C-beauty brands began to dominate cross-border digital commerce.

For Korean companies, sustaining global momentum now depends on converting their talent-driven transformation into adaptive, cross-border strategies that match this new reality.

The Human Layer Behind Korea’s Next Export Engine

K-Beauty’s ascent in recruitment data tells a deeper story: industries that globalize through people, not just products, endure longer cycles of growth. By investing in sales professionals, marketers, and cross-border operators, the sector is building the human infrastructure needed for Korea’s next phase of export competitiveness.

As the nation looks beyond manufacturing-led recovery, K-Beauty offers a blueprint—one where strategic hiring becomes industrial policy by other means.

Key Takeaway on K-Beauty’s Global-Stage Strategy

- K-Beauty accounted for 16% of all scouting offers to Korea’s top 10% of professionals in 2025, a record share for a single sector.

- Mid-career professionals (5–8 years) are the most sought-after, reflecting the need for execution-ready talent.

- Sales, marketing, and distribution roles dominate, signaling a focus on global expansion rather than domestic maintenance.

- Headhunting demand for overseas sales professionals places K-Beauty among Korea’s top three recruitment industries.

- The data confirms that K-Beauty’s next growth stage is not just brand-driven but human-capital-driven, redefining how Korea’s export sectors scale globally.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.