Korea’s venture market staged a sharp rebound this year, but the real story is not the scale of investment. It is the shift in who is supplying the capital and what that shift signals about Korea’s next phase of innovation. Pension funds, corporates, and private VCs are now setting the pace, reshaping the balance between state-driven and market-driven growth. This new capital structure hints at deeper economic transitions that matter for founders and investors preparing for 2026.

Venture Investment Surges Back to ₩9.8T as Private Capital Takes Command

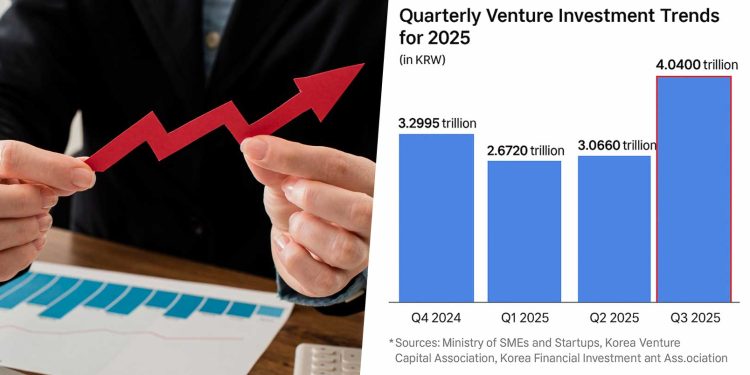

According to the Ministry of SMEs and Startups (MSS), new venture investments reached KRW 9.78 trillion (~ USD 7.1 billion) during the first three quarters of 2025, up 13.1 percent from the previous year.

Third-quarter investment exceeded KRW 4 trillion, marking the first quarterly recovery to this level since late 2021. The momentum extended across growth stages:

- Startups under seven years old: KRW 4.52 trillion (+13%)

- Later-stage firms: KRW 5.25 trillion (+13%)

- Startups under three years old: KRW 1.71 trillion (+9%)

Although the number of investees declined to 3,136 firms, the average investment per company increased 24 percent to KRW 3.12 billion. This concentration points to investors prioritizing resilience, technological depth, and clearer business fundamentals.

Fund Formation Rebounds After Three Years, Driven by Private and Institutional Capital

Venture fund formation reached KRW 9.71 trillion (~ USD 7.47 billion) in the same period, a 17.3 percent increase after three consecutive years of decline. The shift in the composition of fund sources is the most important development.

Private-sector capital accounted for 83 percent of commitments. Among these, pension funds and mutual aid associations contributed KRW 837 billion, up 131 percent year-on-year — the highest level ever recorded.

Policy-based funds, including the Mother Fund and Korea Growth Finance, contributed KRW 1.6 trillion as part of a more balanced approach rather than primary leadership.

The data shows that Korea’s venture market is moving toward a model where private and institutional capital set the rhythm, with government roles shifting toward catalytic support rather than dominance.

Laying Groundwork for Korea’s Next Venture Strategy

MSS Minister Han Seong-sook stated that double-digit growth across both investment and fund formation reflects solid market fundamentals.

“It is encouraging that venture investment and fund formation both recorded double-digit growth. We will prepare the Venture Top Four Nation plan within the year to support the creation of a KRW 40 trillion venture investment market.”

Her remarks point to a policy environment that recognizes the growing influence of private capital and seeks to channel that momentum rather than replace it. The government is aligning its role around scaling national innovation rather than driving every investment cycle.

What the Investment Patterns Reveal About Korea’s Evolving Ecosystem

1. Regional Capital Flow Is Slowly Decentralizing

Among companies that attracted more than KRW 10 billion each, 13 were located outside the Seoul metropolitan area. Examples include Cellark Bio, TRIOAR, Sovargen (bio sector) and Raion Robotics, Nexsensor (robotics and industrial tech).

This reflects gradual geographic diversification driven by stronger technical capabilities in local ecosystems. It also signals early progress toward balanced regional development, a long-standing national objective.

2. The Sector Mix Suggests a Shift Toward Deep, Capital-Intensive Innovation

Gaming investments rose by 82 percent, while video, performance, and entertainment recorded 59 percent growth. Bio and medical followed with a 25 percent increase. ICT services, on the other hand, saw a slight decline.

Together, these shifts suggest investors are gravitating toward areas with stronger defensibility and deeper technical foundations rather than fast-scaling consumer software.

3. Institutional Investors Are Signaling Long-Horizon Confidence

Record pension fund commitments suggest confidence in Korea’s innovation economy as a long-term asset class, not a short-term cycle. This shift could influence how startups pursue scale, governance, and long-term value creation.

Korea Moves Toward a More Market-Driven Innovation Economy

The rebound is important, but the deeper message lies in the structural changes underneath it.

Korea’s venture ecosystem is becoming less dependent on government initiative and increasingly shaped by private risk capital. This indicates rising market maturity and the beginning of a new phase where institutional investors influence strategic direction, sector priorities, and capital standards.

The coming Top Four Global Venture Powerhouse strategy will determine how Korea aligns its policies with this new capital landscape. It means that investors may set higher expectations on traction and technology strength from founders. But for global investors, it signals an ecosystem stepping closer to international standards in financing behavior, sector focus, and investment discipline.

In the end, Korea’s venture rebound is not just a return to growth. It is also a recalibration of how innovation is funded — and a preview of a more globally competitive deep-tech and knowledge-intensive economy.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.