Korea’s startup policy has long promised to empower the next generation of entrepreneurs. But as the economy tightens and risk aversion deepens, the country’s youth founders are discovering that even the government’s safety nets have started to pull away. The latest data from the Fund of Funds shows not just a budget cut—it shows a shift in who Korea is betting its future on.

Youth Investment Declines as Korea’s Fund of Funds Favors Safer Bets

According to data released by the Ministry of SMEs and Startups (MSS), the Fund of Funds’ Youth Account formation dropped to KRW 66.8 billion (USD 50 million) as of November 2025, down from KRW 85.1 billion a year earlier.

The decline comes as investors—and increasingly, public programs—concentrate on high-growth sectors such as artificial intelligence (AI) and semiconductors, where returns appear more predictable and politically secure.

The Youth Account, designed to invest at least 60% of committed capital in startups led by founders aged 39 or younger, was originally created to fill the capital void in early-stage, high-risk ventures. But the fund’s ability to perform that role is fading as policy allocations continue to shrink.

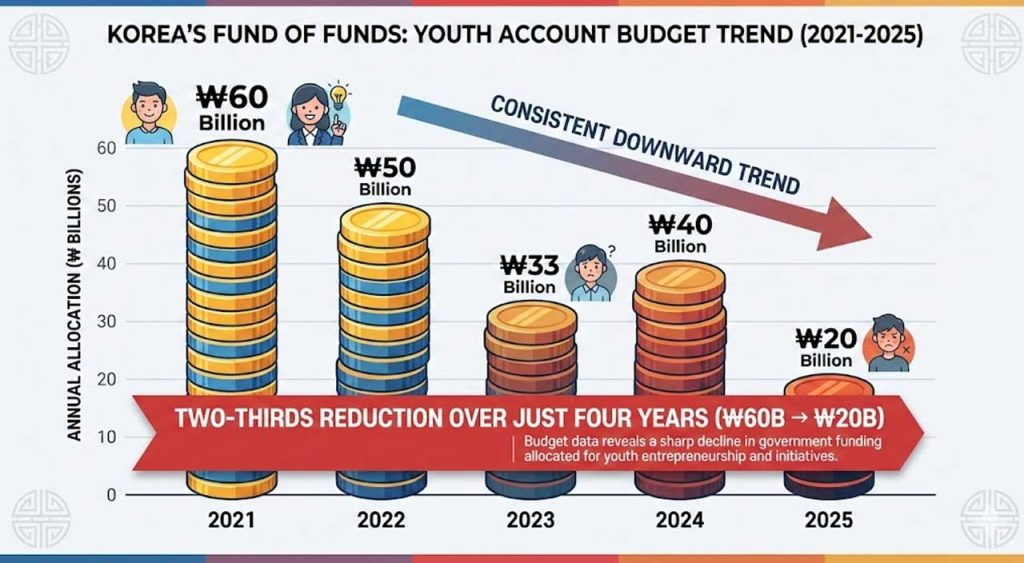

The government’s annual budget for the Youth Account has fallen sharply from KRW 60 billion in 2021 to just KRW 20 billion in 2025—a two-thirds reduction over four years.

Korea’s Youth Startup Crisis Deepens as Capital Flees Early-Stage Risk

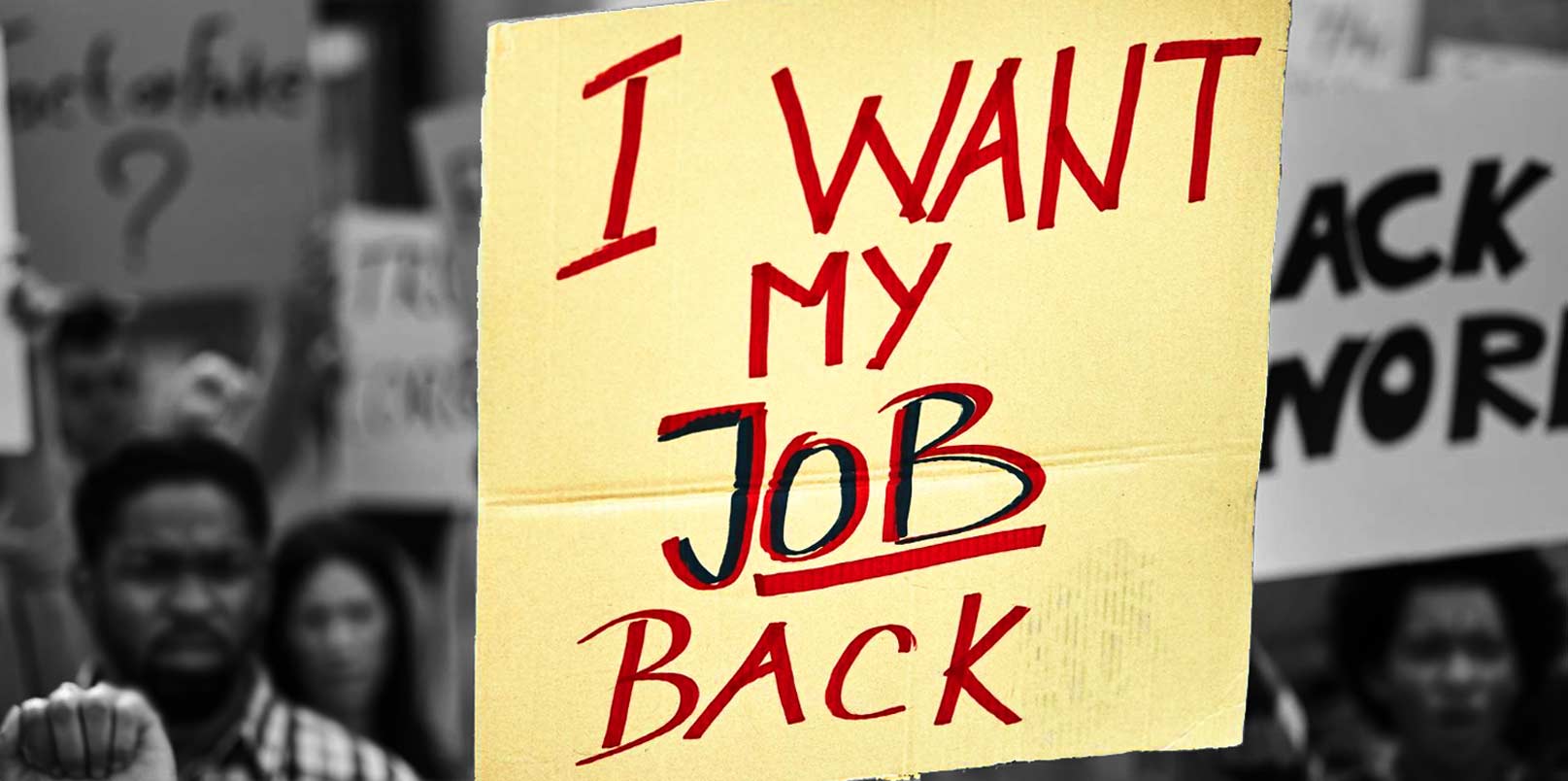

This funding retreat arrives at a fragile moment for Korea’s youth economy. The country is witnessing a sharp rise in what policymakers call “resting youth” (쉬었음 청년)—young adults who are neither working nor studying. The number surpassed 500,000 in late 2025, reflecting a widening gap between policy rhetoric and actual opportunity.

Meanwhile, the youth employment rate fell for the 19th consecutive month in November, dropping to 44.3%, with 177,000 fewer young people employed than a year earlier.

At the same time, Korea’s small and medium-sized enterprise (SME) landscape is aging rapidly. Government surveys show that seven out of ten SME owners are now over 50, and one-third are over 60.

The combination of aging leadership and shrinking youth participation signals a deeper structural risk: Korea’s entrepreneurial engine is losing its next generation.

The Friction: Policy Finance Retreats When It’s Needed Most

The paradox is striking. Korea’s Fund of Funds was designed to fill the gap private investors avoid, particularly in early-stage innovation. Yet as market uncertainty rises, policy capital itself is withdrawing—precisely when it was meant to step forward.

Experts say that as high interest rates and market volatility persist, both private and public capital are gravitating toward sectors with proven returns and lower failure risk, leaving youth-led startups—typically pre-profit and untested—without access to crucial seed investment.

This shift also reveals a cultural tension inside Korea’s innovation policy: while the nation celebrates startup success stories in AI or chips, it is simultaneously undercutting the financial mechanisms that help young entrepreneurs reach that stage in the first place.

Policy Dialogue Meets Ground Reality

Last year, the Ministry of SMEs and Startups (MSS) held a roundtable with Millennial and Gen Z founders during Youth Week, reviewing a year’s worth of initiatives and collecting recommendations for future youth policies.

At that meeting, Vice Minister Noh Yong-Seok emphasized that “listening to the voices of the younger generation is the starting point and the most important task of government policy innovation.” He added that the ministry would work to design policies that “young people can genuinely feel.”

The intention was clear. But the data now paints a harder truth.

Despite repeated pledges to strengthen youth entrepreneurship, the Fund of Funds’ Youth Account keeps shrinking, and fewer private venture capital firms are willing to participate.

The contraction reflects both a smaller public budget and a loss of private appetite. While the government’s Youth Account allocation has been halved over the past five years, the remaining policy capital has struggled to attract venture firms willing to match and deploy it. The result is a capital vacuum at the very stage where Korea’s next generation of founders is expected to emerge.

This structural imbalance exposes a deeper contradiction. Innovation, by nature, depends on risk — yet policy capital now mirrors private caution instead of counterbalancing it.

AI and Deep Tech Gain Ground While Youth Ventures Lose Support

The concentration of capital in deep tech and AI may strengthen Korea’s industrial competitiveness, but it risks widening the equity gap across the startup landscape. Startups that operate outside major technology clusters—consumer services, sustainability, local tech—are now struggling to secure even early validation funding.

By retreating from early-stage risk, Korea’s public funds are reinforcing a “winner-takes-all” ecosystem that favors scale-ready ventures over learning-stage innovators.

While such reallocation may appear fiscally prudent, it leaves the country’s startup pipeline shallower and more homogenous, undermining diversity in innovation.

A venture capital official noted,

“The Youth Account exists to fill the vacuum private money refuses to enter. If policy finance retreats, the entire growth ladder breaks—because youth entrepreneurship is the first rung.”

Global Investors See Policy Recalibration in Korea’s Venture Landscape

Global investors are beginning to interpret Korea’s latest funding shift as a policy recalibration — one that may sharpen capital efficiency in the near term while quietly eroding the long-term resilience of its startup ecosystem.

Many overseas venture funds still regard Korea as a model of well-coordinated public–private innovation. Yet the steady contraction of early-stage policy finance now raises concerns about the country’s ability to nurture the next generation of globally competitive founders once its current wave of AI and semiconductor ventures reaches maturity.

Multinational partners and cross-border accelerators are also reassessing entry strategies. Korea continues to stand out as a powerhouse in advanced technology, but early collaboration may increasingly depend on private capital as public funds grow more selective.

Betting on Certainty at the Cost of Renewal

Korea’s innovation system has long been built on a simple promise—that policy would do what the market cannot. Yet the decline of youth-targeted funding reveals how even institutional ambition bends to financial gravity.

If young founders continue to face closed doors from both investors and policy funds, Korea risks an innovation deficit that no amount of AI or semiconductor breakthroughs can offset.

Real renewal will depend not just on funding what works—but on protecting those still learning how to make it work.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.