Sandbox Network, one of Korea’s largest creator platforms, is moving toward a 2026 KOSDAQ listing after nearly a decade of evolving its MCN business model toward IP and digital entertainment. Its IPO filing is not just a financial event — it reflects the structural evolution of Korea’s creator economy, where profitability now depends on IP ownership and platform independence rather than ad revenue alone.

Sandbox Network’s KOSDAQ Bid Gains Momentum

According to Seoul Economic Daily, Newsis, and Money Today, Sandbox Network officially appointed Korea Investment & Securities as its lead underwriter and will pursue a KOSDAQ IPO in 2026.

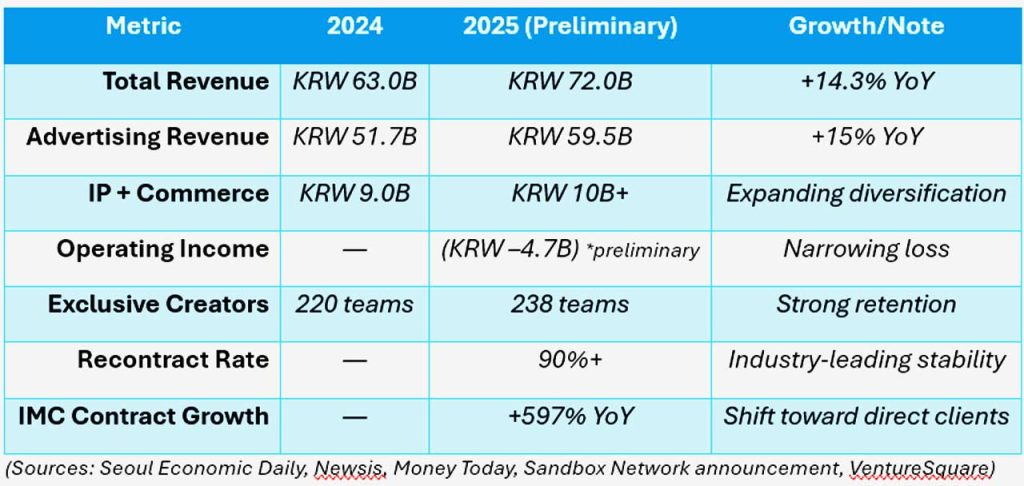

The company, co-founded by creator Na Hee-sun (Ddotty), posted KRW 72 billion (USD 54 million) in standalone revenue for 2025 — a 14% increase year-on-year.

Advertising remains its primary revenue stream at KRW 59.5 billion, up nearly 15%, while IP and commerce businesses together surpassed KRW 10 billion. Despite this growth, Sandbox recorded an operating loss of KRW 4.7 billion (2025 preliminary), highlighting the profitability challenge still facing Korea’s MCN (multi-channel network) sector.

The company supports 1,139 advertising creator channels and 238 exclusive creator teams, boasting an average six-year contract term and a renewal rate above 90%, data consistent across multiple local media reports.

Why This IPO Matters Beyond the Numbers

Sandbox’s IPO is not simply a capital-raising event. It symbolizes Korea’s attempt to prove that its creator economy can evolve from ad-driven management to intellectual property–based digital entertainment.

The pivot began in 2022 when CEO Lee Pil-seong reframed Sandbox as a digital entertainment company, emphasizing IP expansion over traditional MCN operations. In an interview with VentureSquare, he described the MCN industry as “entering its early maturity phase,” where survival depends on unique IP, sustainable creator models, and cross-media monetization.

In 2024, Sandbox consolidated leadership under a single-CEO structure led by Cha Byeong-gon, positioning itself for “transparent and efficient decision-making” ahead of the IPO, according to the company’s own statement.

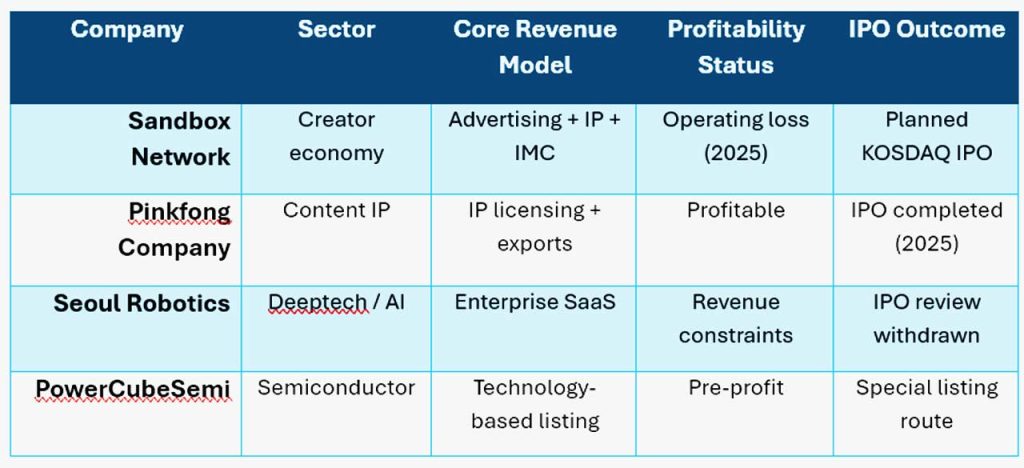

Sandbox’s IPO also aligns with a broader recalibration in Korea’s KOSDAQ market. In early 2026, Seoul Robotics withdrew its listing bid under tighter revenue criteria, while Pinkfong Company’s late-2025 IPO proved that IP-based content can meet profitability standards.

Together, they show that Sandbox now enters a more disciplined public market—one that rewards monetized creativity and penalizes unsustainable scale.

Inside Sandbox Network Korea’s Business Transformation

Sandbox’s growth drivers reveal a company consciously moving away from the low-margin MCN trap:

The company’s IMC (Integrated Marketing Communication) business achieved 597% growth in annual contract value, with direct deals rising to 69% of revenue. Major advertising clients now include Roborock, Epic Games, Nexon, and Amorepacific, according to reports from Money Today.

The IP arm also saw strong momentum: Sandbox’s publishing division surpassed 2.79 million cumulative copies sold, turning characters like Baek & A, Red Pajama Yako, and Ddushik into high-performing creative IPs. These IPs are monetized through publishing, merchandise, performances, licensing, and other derivative formats.

Sandbox Network Korea’s Corporate Direction

“Our customers are creators. Demonstrating trust and long-term partnership is our core business philosophy,”

— Lee Pil-seong, Sandbox Network CEO, VentureSquare (April 2025)

“We aim to evolve beyond MCN operations to lead as a digital creator IP platform,”

— Sandbox spokesperson, Seoul Economic Daily (Jan 2026)

Lee emphasized that IP-driven diversification is no longer optional:

“Advertising-based structures face clear limits. By rapidly shifting toward IP business, we expanded our scope effectively.”

Korea’s Creator Market at a Turning Point

According to a 2024 report from Korea’s Ministry of Science and ICT, the digital creator media industry reached KRW 5.31 trillion in 2023, up 28.9% year-on-year. Within that, the MCN and management segment accounted for KRW 753.1 billion, illustrating both the market’s expansion and its growing professionalization.

Yet traditional advertising revenue is tightening. The KDI Economic Information Center recorded a 7.4% decline in Korea’s broadcast advertising revenue in 2024. Industry analysts believed that this trend reinforces the shift toward diversified creator monetization through IP and commerce.

Sandbox’s pivot reflects this broader structural trend. While smaller MCNs struggle with platform dependency and volatile ad markets, Sandbox is building hybrid models across kids content, gaming subculture, and virtual IP ecosystems, tapping into resilient fan communities and multi-format licensing.

What Sandbox’s IPO Really Tests

Sandbox’s IPO is less a financial test than a proof of scalability for Korea’s post-MCN model. It must demonstrate that creator networks can evolve into IP ecosystems that sustain profitability even under declining ad CPMs and algorithmic volatility.

High creator retention and rapid IMC growth point to operational strength, but they also expose Sandbox’s core challenge: engagement scales faster than margin. Until IP-derived revenue consistently outpaces MCN management costs, profitability will remain structurally constrained.

Unlike PowerCubeSemi’s forthcoming technology-special listing or Pinkfong’s proven entertainment export model, Sandbox must convince investors that creator-economy IPs can be as scalable—and defensible—as industrial or cultural ones. The comparison underscores how Korea’s 2026 IPO pipeline now tests three value theses at once: technological credibility, cultural IP scalability, and digital-platform sustainability.

The KOSDAQ route, known for its flexibility toward growth-stage tech firms, is observed to give Sandbox room to price its listing based on growth potential rather than legacy earnings. However, the ultimate measure will be whether Sandbox can sustain consistent profitability — something CEO Lee himself identified as the 2025 milestone.

Analysis: Why Sandbox’s IPO Is a Stress Test for Korea’s Creator Economy

Sandbox’s planned listing is not just about capital access. It tests whether Korea’s creator platforms can escape the structural limits of MCN economics.

There are three unresolved questions define this IPO:

- Can IP offset MCN margin pressure fast enough?

Despite strong revenue growth, Sandbox remains loss-making. The key risk is whether IP and virtual goods can scale margins faster than creator management costs. - Is IMC growth structurally recurring or campaign-driven?

The 597% surge in IMC contracts reflects strong client demand, but investors will scrutinize how much of this growth is repeatable versus event-based. - Does creator IP offer defensibility comparable to traditional content IP?

Unlike animation or gaming IP, creator-led IP faces faster audience churn and platform dependence — a risk KOSDAQ investors are now being asked to price.

Sandbox’s IPO therefore represents a broader market test, whether Korea’s creator economy can mature from scale-driven growth into margin-driven sustainability.

Entering Capital Market Era — A Pivotal Milestone

Sandbox’s planned IPO marks a pivotal moment for Korea’s digital creator economy. If successful, it could potentially set a new precedent for MCN-to-IP transformation, signaling that Korea’s creator enterprises can move beyond algorithmic survival toward value-based scalability.

As ad CPMs compress and platform algorithms remain volatile, Sandbox’s IP strategy represents one of Korea’s first real attempts to price creator businesses as long-term assets rather than short-term traffic managers.

Key Takeaways on Sandbox Network KOSDAQ IPO 2026

- Sandbox Network targets a 2026 KOSDAQ IPO after posting KRW 72B in 2025 revenue (+14% YoY).

- The company’s preliminary operating loss of KRW 4.7B in 2025 underscores persistent MCN margin pressure.

- Transitioning from ad-driven MCN to IP-based digital entertainment, Sandbox now scales publishing, licensing, and virtual IP.

- IMC contracts grew 597%, with direct clients (69%) improving profitability.

- Korea’s creator media industry reached KRW 5.31T in 2023, while broadcast advertising fell 7.4%, accelerating structural shifts toward creator-led IP.

- Sandbox’s IPO will test whether creator-led IP can deliver defensible margins, not just audience scale, under KOSDAQ’s tightening profitability expectations

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.