Artificial intelligence (AI) is redrawing the map of global venture capital. While U.S. and Chinese investors concentrate almost exclusively on their domestic markets, Europe leans outward with cross-border bets. Korean VCs, meanwhile, still direct two-thirds of their AI investments to domestic AI firms. Experts caution that unless Korea diversifies abroad, its venture ecosystem risks narrowing returns and missing global opportunities.

U.S. and China Prioritize Domestic AI Investment

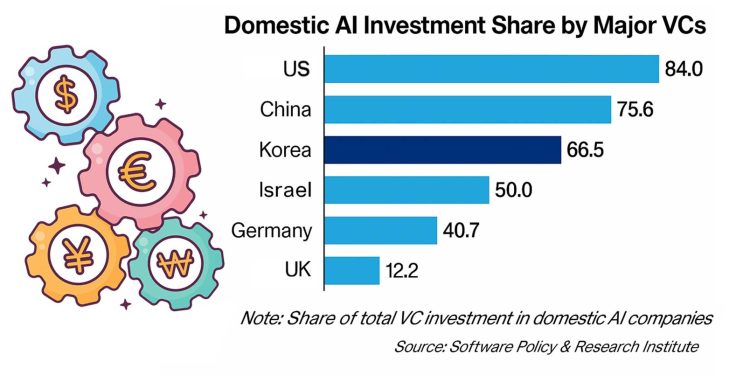

Korean news outlet Hankyung highlighted a recent analysis by the Software Policy Research Institute. The report shows that U.S. venture capital firms allocated 84% of their AI investments to domestic AI startups, with only small portions flowing to the UK (2.0%), China (1.3%), and Israel (1.2%).

Chinese VCs also favored their own market, channeling 75.6% of AI investment into Chinese companies. U.S. firms received just 4.1%, while Korean startups captured only 0.2%.

Cross-border activity between the two largest markets has also shrunk sharply. Chinese VC investment in the U.S. dropped from USD 2.478 billion in 2021 to USD 685 million in 2023, underscoring the growing fragmentation of global capital flows.

Europe Bets on Cross-Border Growth

In contrast, European VCs are taking a more global approach.

UK-based investors directed 53.1% of their AI capital into U.S. companies, while just 12.2% stayed at home. At the same time, German VCs allocated 40.7% domestically, with the rest spread across foreign markets. France also invested 43.1% locally and 17.7% in U.S. startups.

This outward strategy reflects Europe’s recognition that accessing leading ecosystems is as important as nurturing domestic innovation.

Expert Warnings on Korea’s Domestic AI Investment Pattern

Meanwhile in South Korea, most VC firms committed 66.5% of AI capital to domestic AI startups and 22.3% to U.S. companies, while China again received only 0.2%. This home-market concentration is partly shaped by the state-run Fund of Funds (Mother Fund), which steers much venture activity toward Korean companies.

An industry insider stated,

“Korea’s venture capital ecosystem is heavily reliant on the Fund of Funds (Mother Fund), which naturally drives investment into domestic AI startups. But for long-term profitability and ecosystem development, it will be important to expand into promising overseas AI startups.”

Jang Jin-chul, Senior Researcher at the Software Policy Research Institute, added,

“As U.S.–China technological competition intensifies, the inward focus of investment has become even more pronounced.”

Implications for Korea’s Startup Ecosystem and Global Investors

Korea’s reliance on domestic AI ventures keeps investment aligned with policy priorities but also narrows exposure to the global innovation frontier. Unlike Europe’s outward-facing approach, the strategy risks boxing the market into a smaller scale unless capital begins moving more actively into cross-border opportunities.

From the perspective of international investors, Korea’s position presents both a challenge and an opening. Domestic concentration can limit diversification, yet Korean funds that step abroad could emerge as important bridges linking Asia’s local ecosystems with global AI hubs.

A Test for Korea’s Cross-Border Investment

Ultimately, the data underscores a strategic crossroads. Korea’s AI ecosystem has momentum, but without stronger cross-border investment, long-term growth may be constrained.

Therefore, policymakers and fund managers will need to balance domestic support with outward expansion to ensure Korean startups stay competitive in the AI-driven global economy.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.