South Korea’s long-awaited Digital Asset Basic Act has reached a crucial tipping point. After nine years of banning local coin issuances, the government is now set to legalize them under one of the world’s most comprehensive digital asset frameworks. But as regulators craft the final bill, a heated debate has emerged: should stablecoins—the backbone of the next-generation financial internet—be tightly controlled by banks, or should fintech companies be allowed to drive innovation?

Korea’s Digital Asset Act to Redefine Crypto Governance

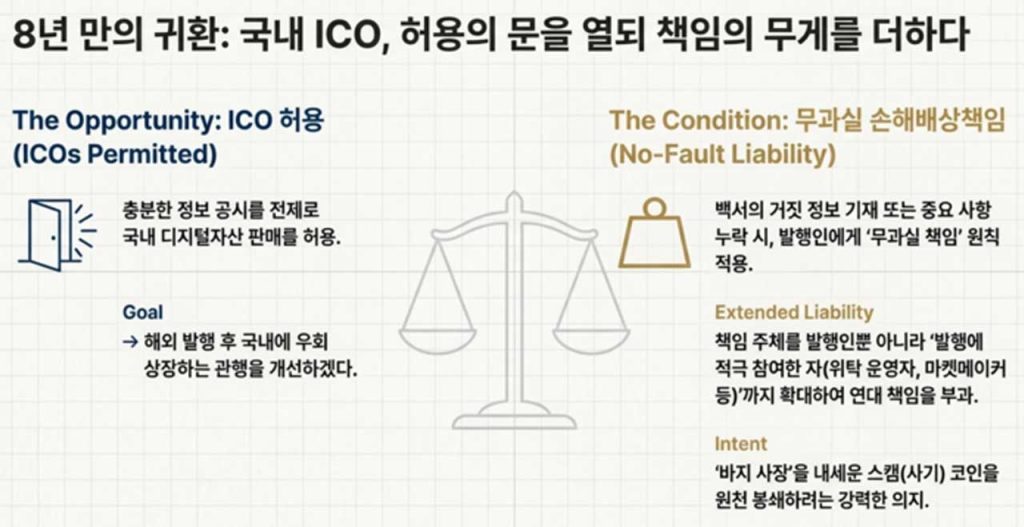

The Digital Asset Basic Act is expected to be finalized between late 2025 and early 2026. It will officially replace the term virtual assets with digital assets and introduce a unified rulebook for coin issuance, trading, and consumer protection.

At its core, the law will reauthorize domestic Initial Coin Offerings (ICOs) for the first time since 2017, provided companies disclose all material information in white papers. False or misleading statements will trigger strict liability not only for issuers but also for active participants such as delegated operators and market makers.

The Financial Services Commission (FSC) is also defining a clear legal status for stablecoins, requiring all issuers to maintain full (100%) reserves in bank deposits or government securities and to separate customer funds from company assets. Paying interest to coin holders will be strictly prohibited.

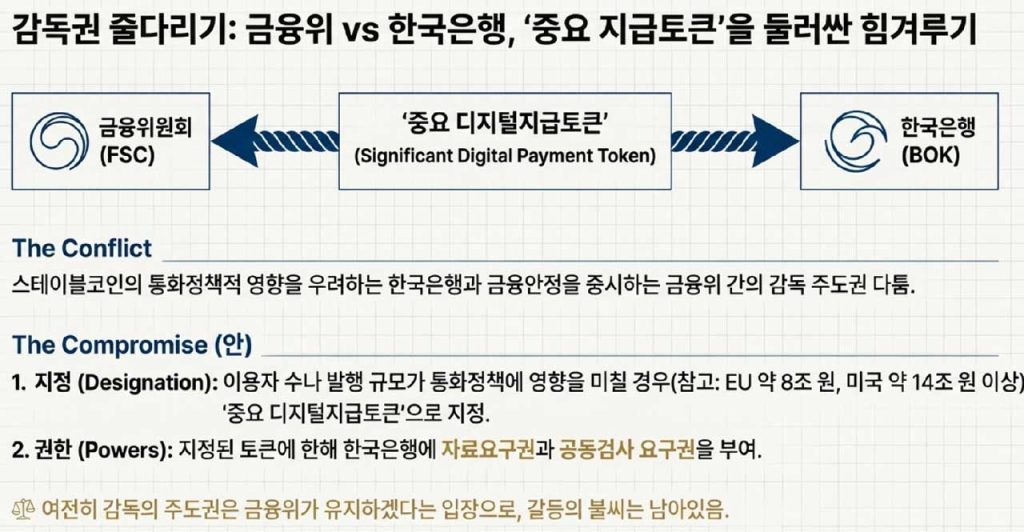

The Central Conflict: Who Gets to Issue Stablecoins?

The sharpest disagreement centers on who should have the legal authority to issue KRW-based stablecoins.

The Bank of Korea (BOK) argues that only bank-led consortiums with majority (51%) ownership should be allowed to issue stablecoins. It insists that banks, already subject to stringent solvency and anti-money-laundering requirements, are the only entities capable of ensuring stability and protecting the financial system.

The FSC takes a more flexible view. While acknowledging the need for stability, it warns that a rigid “51% rule” could suppress competition and block entry by fintech firms with the technical expertise to build scalable blockchain infrastructure. The FSC cites the EU’s MiCA regulation, where 14 out of 15 licensed stablecoin issuers are electronic money institutions rather than banks, and Japan’s fintech-led yen stablecoin projects as global examples of innovation within regulatory boundaries.

Industry experts who attended the Democratic Party’s December policy consultations largely agreed that the “bank consortium model” risks creating an overly closed ecosystem that benefits incumbents while discouraging innovation.

TF Secretary General Ahn Do-geol commented,

“With this governance model, it will be difficult to achieve the network effects and technological breakthroughs that stablecoins can deliver.”

Regulatory Focus on Foreign Stablecoins

The new law also targets foreign-issued stablecoins like Tether (USDT) and Circle’s USDC, which dominate Korea’s crypto trading volume. Under the proposed framework, these coins may only circulate if their issuers establish a domestic branch and comply with Korean supervision standards.

Without a Korean office, global stablecoin issuers will be barred from offering payment, redemption, or remittance services. Trading on domestic exchanges may still be allowed under a “brokered transaction” model, similar to Hong Kong’s approach, but direct use as a payment medium would be restricted.

This requirement aligns Korea with global regulatory convergence—Hong Kong and Japan also require local entities or partnerships for stablecoin distribution. However, critics argue the rule could make Korea less competitive if global issuers hesitate to set up domestic operations.

Big Tech and Banks Race to Lead the Market

Even before the law passes, major corporations are moving fast to secure early positions.

Kakao Group has announced plans to build a Korean-won stablecoin ecosystem, connecting KakaoPay, KakaoBank, and KakaoTalk into a unified digital wallet. The company envisions a wallet-to-wallet (W2W) system that enables direct peer-to-peer payments without intermediaries.

Naver Financial, in partnership with Dunamu (Upbit), is developing a blockchain-AI hybrid platform that links search, payments, and digital assets. BC Card has completed pilot testing for QR-based stablecoin payments by converting foreign coins into digital prepaid cards.

Korean banks are also repositioning themselves:

- KB Financial and Shinhan Bank are running stablecoin settlement pilots tied to the Bank of Korea’s central bank digital currency (CBDC) project.

- Hana Bank has signed MOUs with Circle and Dunamu to explore cross-border remittance infrastructure.

- Woori Bank, leveraging its partnership with blockchain startup BIDEX, is testing B2B and tokenized securities settlement using KRW-backed coins.

Meanwhile, foreign issuers are already laying groundwork. Circle and Tether have filed trademarks such as USDC, EURC, KRWT, and WON TETHER in Korea and are building partnerships with local banks and Web3 firms in anticipation of market entry once regulations stabilize.

A Web3 company representative commented,

“Filing trademarks doesn’t mean Circle or Tether will immediately launch here, but once regulations clarify, they’ll likely accelerate partnerships for issuance, payment, and remittance.

While the Korean government is still cautious, global players with established dominance are already speeding ahead.”

Policy Divide: Control for Stability or Openness for Innovation?

The stablecoin debate reveals a deeper philosophical divide within Korea’s financial policy. The Bank of Korea prioritizes financial safety, warning that unregulated stablecoins could undermine monetary control. The FSC and much of the private sector argue that overregulation could drive innovators offshore and slow Korea’s transition into a Web3-driven economy.

For global investors and startups, the outcome will determine how open Korea’s fintech ecosystem remains in 2026 and beyond. If the final law leans toward flexibility, Korea could emerge as a model for responsible but innovation-friendly regulation in Asia. If it leans toward banking exclusivity, fintech entrants may pivot to friendlier markets like Singapore or Hong Kong.

2026: The Defining Year for Korea’s Stablecoin Future

The coming months will decide Korea’s stablecoin future. The Digital Asset Basic Act could either establish Korea as a regional fintech powerhouse or confine it within traditional financial boundaries.

Yet the window for action is narrowing. The global cryptocurrency and digital asset markets are advancing at a pace that traditional policy cycles struggle to match. If Korea hesitates while others move ahead with clearer rules and incentives, it risks losing both capital and talent to faster-moving ecosystems. Timely reform will be crucial if the nation aims to position itself as a top-tier global venture powerhouse.

As digital currencies reshape global finance, Korea’s ability to balance trust and innovation will define its competitiveness in the Web3 era. The world will be watching to see if the nation that pioneered mobile finance can now lead the next evolution—digitally stable money built on both security and creativity.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.