South Korea’s startup sector, once a magnet for ambitious young talent, is facing its sharpest employment downturn in recent memory. In just three years, the number of successful startup hires has been cut in half. These figures underscore how the investment winter is reshaping Korea’s venture ecosystem, raising questions about sustainability, global competitiveness, and future talent pipelines in the Korean startup job market.

Korean Startup Job Market Falls Dramatically Amid Investment Slowdowns

Data from recruitment platforms and industry analysis show a clear downward trend. In May 2022, during Korea’s startup boom, information technology and platform companies posted 8,498 new job openings, resulting in 1,596 successful hires. By June 2025, postings had dropped to 4,872, with only 773 hires.

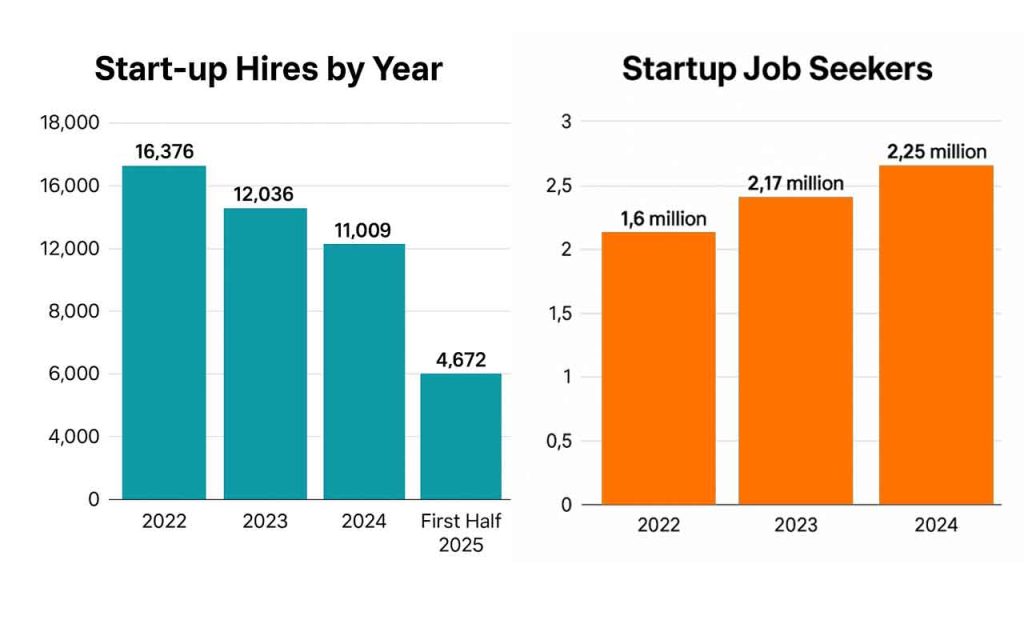

Annual figures also confirm the slide: 16,376 hires in 2022 fell to 12,036 in 2023 and 11,009 in 2024. In the first half of 2025 alone, only 4,672 hires were recorded — nearly half of the 8,544 hires reported in the same period of 2022. The contraction is directly tied to reduced venture investment.

Rising Applicants, Shrinking Opportunities in the Korean Startup Job Market

While job availability shrinks, interest in startups remains high.

In 2022, about 1.6 million applicants pursued startup positions. By 2024, that number had surged to 2.25 million, with a sharp rise already visible in 2023 when applicants exceeded 2.17 million.

The imbalance between demand and supply has intensified competition, leaving many jobseekers struggling to secure roles even as enthusiasm for startup careers persists.

Layoffs Through Large-Scale Restructuring

Amid investment pressures, startups have even been forced into mass layoffs. An analysis by Seoul Economic Daily and The VC found that 112 venture-backed startups cut over 30% of their workforce in 2025 alone. Nearly half of these firms had received government support through TIPS (Tech Incubator Program for Startups) or the Unicorn Project. In some cases, companies reduced more than 50% of staff.

This wave of restructuring highlights how fragile startup operating models have become under financial strain. Even government-backed ventures, often perceived as relatively stable, are not immune to the downturn.

Falling Job Satisfaction Signals Startups Losing Talent to Conglomerates

Startups were once considered an attractive career path, especially for graduates in their 20s. A 2023 survey by JobKorea and Albamon showed that 82% of 405 respondents expressed interest in joining a startup, citing opportunities for diverse experience and fast growth.

Yet, job satisfaction has since declined. A 2024 survey by Startup Alliance reported that only 41.5% of startup workers said they were “happy”, down from 49.2% in 2022.

Meanwhile, satisfaction at large corporations rose sharply, from 50.4% in 2022 to 65% in 2024. The widening gap suggests that startups are losing ground in the competition for young talent.

Automation and Restructuring: How Startup Roles Are Rapidly Disappearing

A recruitment platform representative noted.

“Just two or three years ago, it wasn’t uncommon to see graduates from top universities choosing startups for the flexibility and growth opportunities. But today, entire job categories are disappearing due to the spread of AI automation. Cases of startups offering high rewards like before have also become rare, so more jobseekers are avoiding startups altogether.”

Korean Startup Job Market Crisis: What It Means in Global Scale

This crisis in the Korean startup job market reveals deeper structural risks for the country’s startup ecosystem.

A shrinking job market not only discourages young talent but also erodes the sector’s ability to innovate and scale globally. For a country that relies on startups to diversify beyond its established conglomerates, the combination of reduced investment, shrinking headcounts, and falling worker satisfaction threatens long-term competitiveness.

Compared with other ecosystems, Korea’s downturn is especially stark. In the United States and China, venture firms continue to prioritize domestic startups, but hiring has not contracted as sharply.

And so, for South Korea, where global expansion is already a necessity due to limited domestic scale, sustaining a healthy talent pipeline is critical.

Can Korea’s Startup Ecosystem Rebuild Its Talent Pipeline?

The sharp contraction of Korea’s startup job market reflects more than a cyclical downturn. It signals structural pressures on an ecosystem that is still heavily reliant on venture funding.

Without strategies to stabilize investment flows, create resilient business models, and maintain talent attractiveness, Korea risks weakening its startup base at a time when global competition is intensifying.

And ultimately, this crisis in Korean startup job market reveals undisputable challenge for policymakers and investors. That without intervention, Korea’s “land of opportunity” for startups may continue to erode.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.