South Korea’s ambition to rank among the world’s “Top Four Global Venture Nations” now hinges on startup financing reform. Industry leaders warn that without expansion of the Korea Fund of Funds (Mother Fund) and participation from pension and statutory public funds, the government’s ₩40 trillion (US$29.6 billion) venture investment target for 2030 could fall short.

Mother Fund Expansion Tops Venture Industry Demands

Leading venture associations, including the Korea Venture Business Association and the Korea Venture Capital Association, have urged the Ministry of SMEs and Startups to expand the Mother Fund’s annual budget to at least ₩5 trillion (US$3.7 billion).

The Mother Fund, managed by the Korea Venture Investment Corporation (KVIC), plays a pivotal role in Korea’s venture financing structure: government seed capital is deployed into VC-managed sub-funds, which then attract matching private investment. More public funding typically drives stronger inflows of private capital.

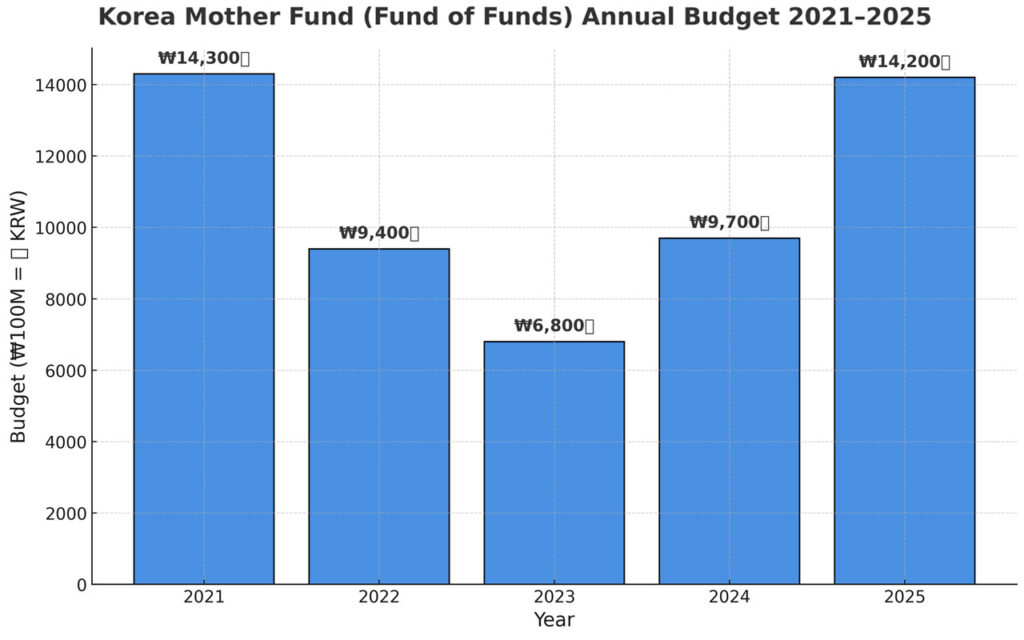

Budget trends highlight the challenge:

- 2021: ₩1.43 trillion (US$1.05 billion)

- 2022: ₩940 billion (US$693 million)

- 2023: ₩680 billion (US$503 million)

- 2024: ₩970 billion (US$716 million)

- 2025: ₩1.42 trillion (US$1.04 billion, projected)

While the figure has recovered from its 2023 low, industry leaders note that the level remains far below what is needed to sustain growth in a market increasingly reliant on public funding.

Venture Investment Gap Challenges 2030 Target

In 2024, Korea’s venture investment totaled about ₩12 trillion (US$8.9 billion) — just one-third of the government’s ₩40 trillion (US$29.6 billion) annual target for 2030.

- Policy-driven funds, including those seeded by the Mother Fund, accounted for roughly ₩2.4 trillion (US$1.78 billion) in sub-fund formation.

- This was an improvement from the previous year but still ₩5.7 trillion (US$4.2 billion) lower than the private sector’s contribution.

A Korea Venture Capital Association representative stressed,

“The Mother Fund budget has been stagnant for four consecutive years. Expansion is essential, because when the Mother Fund grows, private capital follows, and the entire market expands.”

Pension and Public Fund Reforms Under Debate

Beyond the Mother Fund, industry groups continue to call for new sources of venture financing. Key proposals include:

- Allowing pension funds to participate in venture capital investments.

- Revising the National Finance Act to require at least 5% of statutory public fund budgets be directed to startups and venture businesses.

Recent legislative developments:

- April 2025: Democratic Party lawmaker Lee Jae-gwan introduced an amendment to the Retirement Benefits Act to open pension fund participation.

- June 2025: Democratic Party lawmaker Park Jung submitted a National Finance Act amendment requiring statutory fund allocations.

- Representative Kim Tae-nyeon is preparing a similar bill, signaling growing momentum in parliamentary debate.

With Korea’s statutory public funds totaling nearly ₩1,400 trillion (US$1.04 trillion), even partial allocation could supply tens of trillions of won (tens of billions of dollars) annually in public risk capital.

Industry stakeholders also emphasize returns: statutory funds currently earn around 2% annually, while Mother Fund-backed sub-funds have averaged 20%. Advocates argue that, from a fiscal efficiency perspective, allocating a portion of public funds to venture capital is both rational and strategic.

Government Commitment and Policy Stakes

The Korean government has reiterated its commitment to venture capital expansion as a national agenda. At last week’s National Planning Committee public briefing, officials pledged to raise annual venture investment from ₩12 trillion (US$8.9 billion) today to ₩40 trillion (US$29.6 billion) by 2030.

Yet, insiders note the gap between ambition and resourcing. A senior venture industry official commented,

“The ₩40 trillion (US$29.6 billion) target ultimately depends on securing stable capital sources. If Mother Fund expansion and pension fund participation become reality, private capital will re-enter the market and the ecosystem will regain momentum.”

Implication for Korea’s Competitiveness on the Global Stage

The debate underscores a critical test for Korea’s Top Four Global Venture Nations strategy. Without reforms to financing, the country risks lagging behind in global competitiveness despite strong policy rhetoric.

For the startup ecosystem, the Mother Fund and pension fund venture capital investment represent more than budgetary tools; they are policy levers that could unlock sustainable growth, reduce overreliance on short-term public funds, and help revitalize Korea’s venture capital market.

Hence, the coming months will reveal whether the government is prepared to align its long-term vision with actionable financial reforms.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.