Korea’s medical AI story has usually been told as a promise: strong science, impressive demos, long timelines, thin margins. This week’s numbers force a different conversation. Revenue is rising fast across several listed firms, and one company has crossed a line Korea’s market had not seen before in this category. The catch is that one profitable year does not equal a stable sector. It does, however, change what investors can reasonably demand next.

Korea Medical AI Revenues Hit Records as Seers Technology Turns First Annual Profit

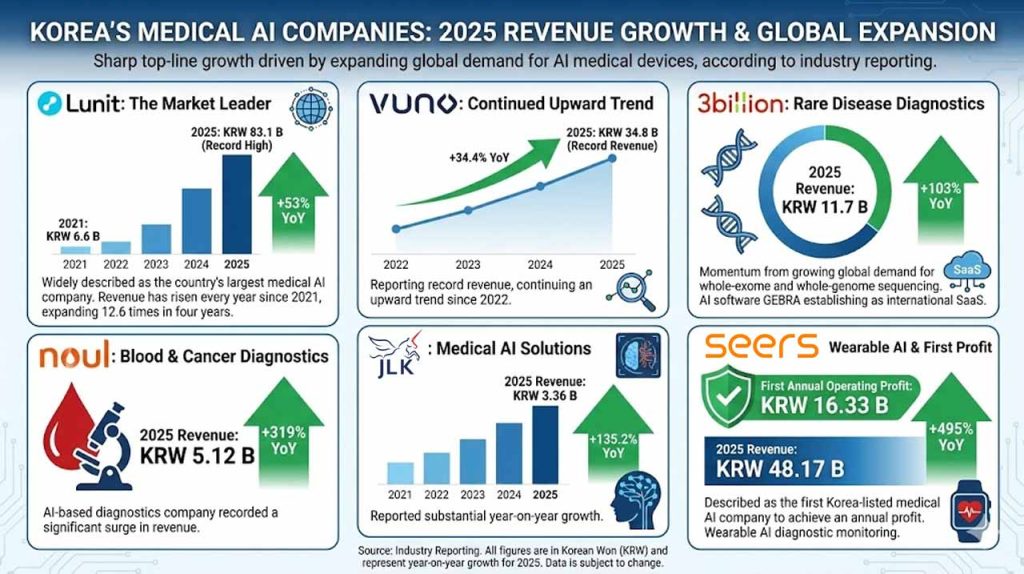

Korea’s medical AI companies reported sharp top-line growth in 2025 as global demand for AI medical devices expanded, according to industry reporting.

Lunit, widely described as the country’s largest medical AI company, posted consolidated revenue of KRW 83.1 billion, up 53% from KRW 54.2 billion a year earlier, setting a record high. Its revenue has risen every year since 2021, when it was KRW 6.6 billion, expanding 12.6 times over four years.

VUNO also reported record revenue of KRW 34.8 billion, a 34.4% year-on-year increase, continuing an upward trend since 2022.

Rare disease diagnostics firm 3billion posted KRW 11.7 billion in revenue, up 103% year on year. The company attributed momentum to growing global demand for whole-exome and whole-genome sequencing-based diagnostics, and said its AI genetic variant interpretation software GEBRA has begun to establish itself internationally as a SaaS product.

Noul, an AI-based blood and cancer diagnostics company, recorded revenue of KRW 5.12 billion, up 319% year on year, and JLK reported KRW 3.36 billion, up 135.2%.

Seers Technology, a wearable AI diagnostic monitoring company, reported operating profit of KRW 16.33 billion, marking its first move into the black. Industry observers described Seers as the first Korea-listed medical AI company to achieve an annual profit. Its revenue rose 495% to KRW 48.17 billion.

A Profit Milestone Resets How Investors Evaluate Korean Digital Health

Korea’s digital health ecosystem has struggled with a credibility gap that is hard to solve with technology alone. Revenue, margin, and cash discipline carry more weight in public markets than product potential. That is why the Seers profit milestone matters more than a single company’s success story. It provides a reference point that the category can actually produce operating profit, not only growth.

Additionally, Korea’s medical AI growth also reflects a broader pattern. Multiple firms are showing large year-on-year revenue gains in the same period, and analysts tie that to global demand for AI medical devices rather than a one-off domestic event. For venture investors and strategic partners, that shifts the conversation. It becomes less about “Can Korea build medical AI?” and more about “Which firms can convert demand into repeatable business?”

This does not override earlier policy and regulatory debates in digital health. It simply introduces a parallel reality: parts of the sector are now being perceived by execution metrics that capital markets recognize.

Growth Is Broad, Profitability Is Rare Across Listed Medical AI Firms

The uncomfortable truth is that record revenue does not automatically translate into a stable ecosystem.

First, the sector is still highly exposed to operating discipline. Profitability is reportedly described as an exception, not the norm. The milestone is important precisely because it has been rare.

Second, the drivers behind growth vary by company and can be uneven. 3billion points to expanding global demand for sequencing-based diagnostics and to software adoption under a SaaS model. Noul highlights geographic diversification and supply deals that improved pricing and gross margins. These are credible mechanisms, but they also show that “medical AI” is not a single market. It is a bundle of business models that will mature at different speeds.

Third, several firms are still in transition. VUNO’s operating loss narrowed to KRW 4.9 billion, and it is described as approaching a possible break-even point. Lunit states it is targeting EBITDA profitability by year-end through revenue growth and cost reductions, including workforce reduction and efficiency measures. Those plans signal pressure to prove operational leverage, not just demand.

In other words, the sector has momentum, but it still has to earn trust quarter after quarter.

Commercial Demand Is Rising, but Financial Durability Remains Unproven

This wave of results enables one clear shift: Korea’s medical AI category can now be discussed with at least one proven example of annual operating profit among listed players, alongside multiple cases of rapid revenue expansion.

That will likely change how founders pitch and how investors evaluate risk. If one listed firm can do it, the market will ask why others cannot. That is both an opportunity and a burden.

What it does not enable yet is a broad claim that Korea’s medical AI sector has reached sustainable maturity. The development does not show that profitability is widespread. It does not show that margins are stable across the category. It does not show that near-term break-even targets will be met. Those remain open questions.

The key shift is not certainty. It is accountability.

What Korea’s Medical AI Numbers Mean for Global Capital and Partnerships

That’s why these results underline a practical point for global founders watching South Korea. Korean medical AI has moved beyond an R&D into a commercialization story. And it is driven by demand outside Korea as well as company-level operational moves, including channel diversification and SaaS positioning.

Yet, it also becomes a conflicting milestone for international investors. Because while Korea’s medical AI is no longer purely speculative, the dispersion between leaders and laggards is likely to widen. Capital will reward companies that can translate demand into repeatable economics, not those that only show growth.

At the same time, it sends concrete signals to cross-border partners that companies are expanding across regions, working with overseas distributors, and positioning products for global markets.

This will then create partnership openings in distribution, validation, and commercialization. And it also raises the bar for diligence: the key question becomes unit economics and repeatability, not only technological novelty.

The Sector Has Moved Past Promise. Now It Must Deliver Consistency

Korea’s medical AI sector is starting to be perceived like a business. That sounds obvious, but it is a real transition for a category that has long lived on potential.

The first annual operating profit among listed peers will not solve the ecosystem’s structural debates. It will, however, remove excuses. The next phase is not about proving AI works in medicine. It is about proving that companies can keep working as “real” and profitable business.

Key Takeaway for Korea’s Medical AI Market

- Korea’s medical AI firms reported sharp revenue growth last year, with Lunit at KRW 83.1B (+53%), VUNO at KRW 34.8B (+34.4%), and 3billion at KRW 11.7B (+103%).

- Seers Technology reported KRW 16.33B in operating profit, described as the first annual profit among Korea-listed medical AI companies, with revenue at KRW 48.17B (+495%).

- Medical AI growth is attributed to the expansion of global demand for AI medical devices and to company-specific commercialization moves such as SaaS positioning and overseas channel diversification.

- The milestone changes the market conversation from pure potential to operational accountability, but it does not prove sector-wide profitability or maturity.

- For global stakeholders, the key signal is commercialization traction paired with widening performance gaps, making execution quality the deciding factor for capital and partnerships.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.