Korea’s bio sector has emerged as the lone bright spot in an otherwise subdued venture market. Private investors are pouring capital into biotech and health startups betting on long-term innovation, yet government policy support remains sluggish. Now, as the investment gap widens, questions are growing over whether Korea can sustain its bio momentum without structural reform.

Bio and Health Startups Drive Venture Funding in Sluggish Market

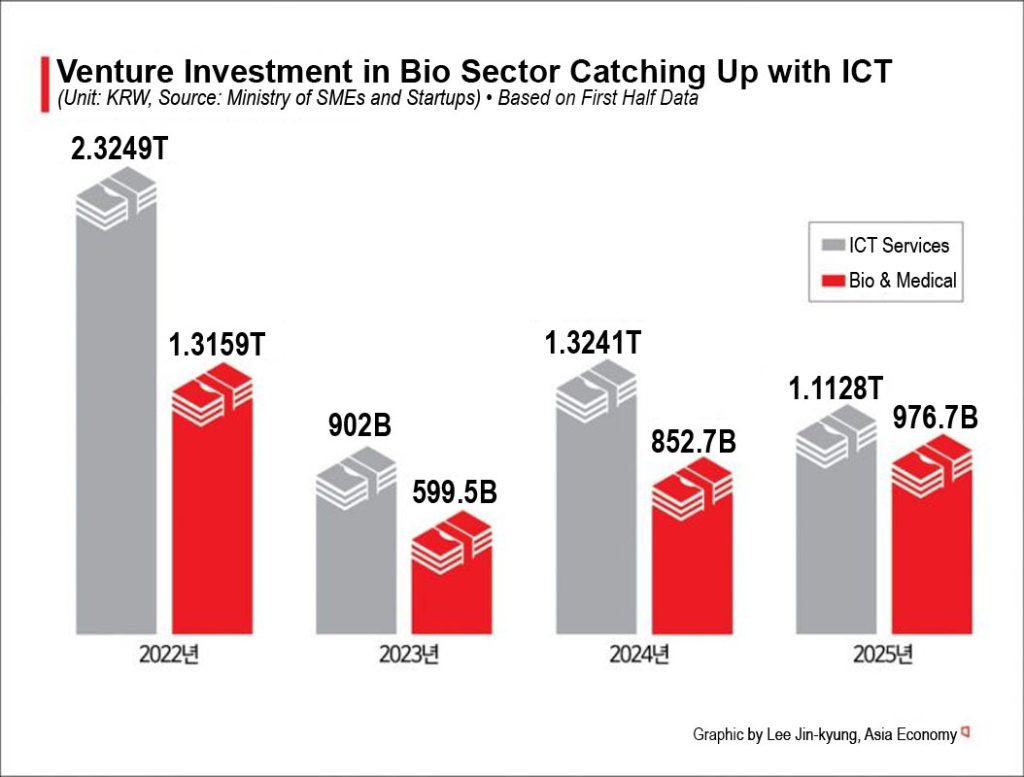

Even as Korea’s broader venture investment market remains subdued, bio and medical startups have emerged as the country’s strongest growth driver. The sector’s resilience contrasts sharply with continued stagnation across ICT and service industries, underscoring investor confidence in Korea’s biotechnology and HealthTech capabilities.

According to data from the Korea Venture Capital Association (KVCA), bio and medical ventures attracted KRW 735.2 billion (USD 530 million) in new investment between January and August 2025. And this is an 8% year-on-year noteworthy increase. Not only that but their share of total venture capital also rose to 18%, up from 16.6% a year earlier.

In September alone, bio-health startups secured KRW 100.6 billion (~ USD 71.4 million), accounting for more than a quarter of the KRW 380.7 billion (~ USD 270.4 million) invested in startups that month.

This surge stands in stark contrast to the ICT service sector, where investment volumes fell by over KRW 200 billion year-on-year to KRW 1.10 trillion during the same period. And that is why analysts describe the current landscape as one where “bio is holding firm while others falter.”

Government Task Force on Bio Innovation Stalls After Six Months

Still, despite the private sector’s renewed enthusiasm, government action has failed to keep pace.

The Ministry of SMEs and Startups (MSS) established a Pharmaceutical and Bio Venture Task Force and an expert advisory panel in May 2025, following the January announcement of the “Pharmaceutical and Bio Venture Innovation Ecosystem Plan.”

The plan promised to support technology commercialization, open innovation, and investment environment reform, but no follow-up meetings have taken place since the TF’s launch. Administrative transitions and budgetary adjustments have further delayed implementation.

To date, the only visible progress has been a new KRW 11.8 billion (USD 8.6 million) R&D program for pharmaceutical and bio ventures included in next year’s budget. Previously, the MSS had provided limited assistance through general R&D programs without dedicated bio-sector funding.

Private Capital Leads, Policy Lagging Behind

While private investors continue to bet on long-term biotech growth, many in the industry warn that the policy infrastructure remains inadequate to sustain momentum.

A representative from a pharmaceutical startup commented:

“Other ministries are setting up funds, but supporting startups is the MSS’s responsibility. The bio sector needs practical and scalable programs that can help early-stage companies survive.”

Experts add that government inaction risks widening the gap between private market enthusiasm and institutional capability. Without systemic reforms, even promising startups could fail to cross the ‘death valley’ between research and commercialization. Lengthy clinical trials, regulatory procedures, and high compliance costs remain major bottlenecks that delay market entry and erode competitiveness.

Calls are growing for policies that facilitate global partnerships, including collaboration platforms linking startups with major pharmaceutical companies, CMOs, and overseas investors.

Policy Inertia Threatens a Strategic Growth Engine

Korea’s bio and HealthTech sectors have long been viewed as strategic engines for the country’s innovation-driven economy. Yet the government’s current policy gap threatens to undermine the momentum generated by private capital.

Global investors increasingly view Korea as an emerging hub for biotech manufacturing, regenerative medicine, and AI-based diagnostics, but the absence of clear policy coordination risks limiting the country’s competitiveness against peers like Singapore, Israel, and the U.S.

Sustained growth will require a coherent, cross-ministerial approach that links R&D support, clinical trial infrastructure, and venture funding pipelines. Without such coordination, Korea’s bio boom may remain confined to isolated investment successes rather than evolving into a scalable innovation ecosystem.

Private Market Optimism Needs Policy Backbone

The surge of capital into bio and health startups reflects strong market belief in Korea’s innovation capacity, but without a functioning policy framework, that confidence may not last.

As global biotech competition intensifies, policy inertia has become the biggest risk to Korea’s ambition of building a self-sustaining innovation ecosystem. The next phase of growth will depend not only on how much money flows into bio startups, but on whether the government can translate momentum into long-term institutional support, predictable regulation, and global partnerships that position Korea as a serious player in the international biotech economy.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.