A KRW stablecoin story usually gets filed under regulation, then forgotten. But this one is different. Wemade is trying to solve a narrower, harder problem: how to build a blockchain that can survive Korea’s compliance expectations without forcing financial users to put every transaction in public view. That design choice comes with a cost, and the trade-off is the point.

Wemade StableNet: KRW Stablecoin Infrastructure for Korean Compliance

On January 30, Wemade said it opened the testnet for StableNet, its KRW stablecoin-focused network, describing it as an infrastructure layer optimized for stablecoin issuance and operations rather than a general-purpose public chain.

Reports from Yonhap and Newsis describe several technical claims attached to the testnet launch:

- No separate gas token: transaction fees are designed to be paid using the KRW stablecoin itself, targeting accounting simplicity and operational predictability for business and financial partners.

- Fast finality and throughput: StableNet uses an in-house consensus approach described as WBFT, with claims of sub-second transaction finality and capacity up to 3,000 transactions per second.

- Privacy with audit-readiness: a “secret account” implementation based on ERC-5564 is presented as a way to keep sensitive transaction details private while still supporting audit responses when required.

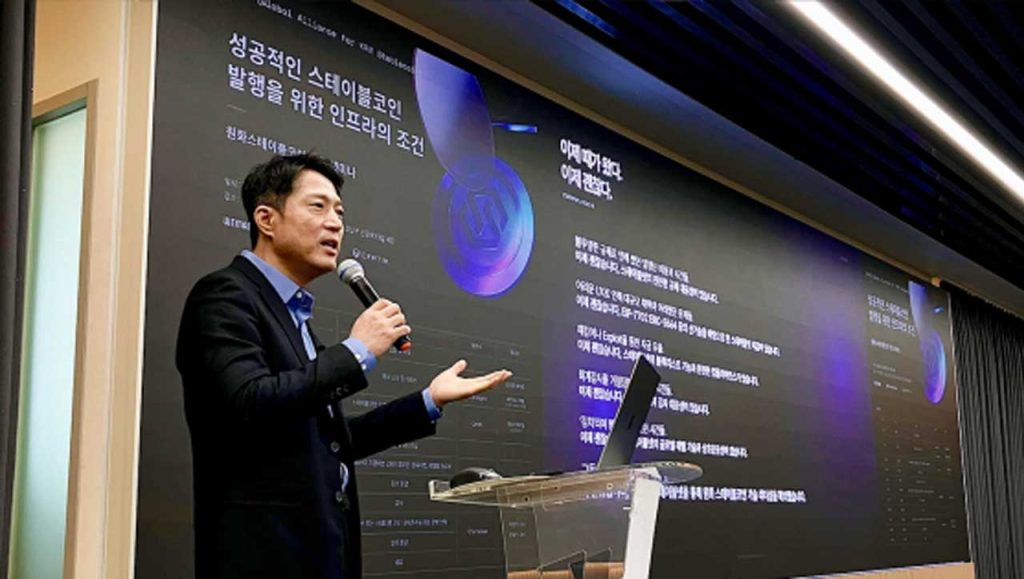

At a Seoul seminar on January 29, Kim Seok-hwan, a vice president at Wemade, framed the core goal bluntly: StableNet is designed so that “the Bank of Korea can feel at ease,” emphasizing that the network was built on the premise of complying with Korean financial rules and adapting to future requirements.

Korean Stablecoin Chain: Why It Matters Now for On-Chain Finance

The more important signal is not “another testnet.” It is the argument behind it.

Across Newsis and Bizwatch’s coverage, the company’s logic lies in the fact that if stablecoins are meant to be used by institutions, the infrastructure must behave like financial rails, not like a retail crypto network that tolerates probabilistic settlement, volatile fee assets, and ambiguous accountability.

Kim’s critique centers on a familiar public-chain edge case that traditional finance hates: chain reorganization, where blocks that looked final can be replaced by a longer chain. He further explained that this is a built-in characteristic of many public blockchains rather than “someone’s fault,” yet it can still invalidate transactions in a way financial operators cannot accept.

Kim Seok-hwan illustrated,

“Imagine a bank or card company using blockchain to process stablecoin payments. If a chain reorganization occurs within a minute, all payment records could be canceled.”

So StableNet is being positioned as a “K-finance” infrastructure play: compliance-first design, predictable fees, and a privacy feature that still allows oversight responses,

“Most public blockchains are not designed for financial institutions that require transactional finality and reliability. That’s why we’re building a dedicated mainnet specialized for on-chain finance.”

The Friction is Trust Not Code

A chain can claim compliance, but it still must earn trust from the institutions it wants to serve.

StableNet’s pitch runs into a structural tension without fully stating: financial-grade auditability and user privacy pull in opposite directions. If you make privacy strong enough to protect commercial confidentiality, regulators and auditors demand stronger controls and clearer disclosure pathways. If you make audit controls too heavy, users start to ask if it is meaningfully different from conventional finance databases.

Wemade’s answer is “selective privacy” through secret accounts plus audit readiness. While that may sound neat on paper, the real test is operational: who is allowed to reveal what, under which process, and how disputes get handled.

There is also an adoption friction baked into the thesis itself. By arguing that “generic public chains” are a poor fit for institutional on-chain finance, Wemade is implicitly saying partners must join a new ecosystem with its own standards, tooling, and governance expectations.

That is a high bar even when the tech works.

What StableNet Enables — and the Boundaries It Can’t Yet Cross

StableNet’s early rollout signals what a compliance-first blockchain might practically achieve inside Korea’s financial system — and what still lies out of reach.

The platform’s biggest functional leap is simplicity. By letting users pay transaction fees directly with a KRW stablecoin instead of a separate gas token, it removes one of the biggest frictions for enterprises that must report every micro-transaction in local currency. For corporate treasurers and auditors, that change matters more than marketing speed claims.

Speed is another claim Wemade is betting on. The company says its WBFT consensus finalizes transactions in under a second and handles roughly 3,000 transactions per second. If these numbers hold once banks and fintech partners begin testing, StableNet could close the performance gap that has kept public chains from serving regulated finance.

And yet, StableNet remains an experiment under scrutiny. It is not regulatory approval — only a design built for compliance. Korea’s central bank has not endorsed any private stablecoin network, and even the best-engineered system still needs legal clarity before large institutions will settle real-money transfers on it.

There is also the testnet caveat. Every metric unveiled so far — speed, privacy, interoperability — exists in a controlled environment. Scaling to production, where latency, audits, and liquidity collide, is a different test entirely.

Most fundamentally, StableNet is still infrastructure, not an active currency. It provides the rails, but adoption will depend on which licensed entities choose to issue and distribute a KRW-backed stablecoin through it.

Until that happens, StableNet represents a technical foundation — not yet a functioning market.

StableNet vs Typical Public-Chain Assumptions

| Topic | Stablenet Positioning | Typical Public-Chain Pain Point |

| Transaction fees | Fees paid using KRW stablecoin; no separate gas token | Fees often paid using volatile tokens, complicating accounting |

| Transaction finality | Claimed near-instant finality via WBFT | Settlement finality can be slower or probabilistic |

| Reversals / reorg risk | Built to avoid finance-disrupting reversals | Chain reorg risk framed as unacceptable for finance use |

| Privacy and audit | Secret accounts plus audit readiness. | Transactions and counterparties often fully visible on-chain |

What global stakeholders should watch if Korea moves toward KRW stablecoin issuance

For global investors and builders, the practical takeaway is not “Wemade enters crypto.” It is that Korean actors are increasingly framing stablecoin infrastructure as regulated financial plumbing, not as an extension of open crypto culture.

Three watchpoints surfaced:

- Institutional partner pull: StableNet’s “priority accounts” and audit-ready privacy features are aimed at corporates and financial institutions. The first credible signal will be named pilots and usage patterns, not marketing language.

- Privacy posture under compliance: “secret transfers” inside a system that still supports audit responses is a delicate middle ground. If it works, it becomes a template others will copy. If it fails, the market snaps back to fully transparent rails for safety.

- Interoperability expectations: the reports mention external tokens and practical app-like UX goals. Global readers should watch how the ecosystem handles real-world integration, not just chain performance.

StableNet: Betting on Governance Expectations, Not Just Faster Blocks

StableNet reads like an infrastructure team responding to a specific institutional fear: finance cannot run on rails that may “technically be fine” but behave unpredictably at the worst moment.

Wemade is betting that Korea’s stablecoin future, if it arrives, will reward systems built for compliance workflows and auditability, even if that makes the ecosystem less open and more demanding to join.

If that bet is right, the next stablecoin advantage in Korea may come from who can satisfy regulators and partners without humiliating users’ privacy, not who can ship the flashiest token.

Key Takeaway on StableNet by Wemade

- Verified development: Wemade opened the StableNet testnet on January 30, positioning it as KRW stablecoin-focused infrastructure, not a general public chain.

- Clear facts: fees paid in KRW stablecoin (no gas token), WBFT-based near-instant finality claims, and “secret account” privacy built for audit readiness.

- Core tension: privacy that protects sensitive transactions has to coexist with audit and compliance expectations that demand controllability.

- Practical limit: “compliance-ready design” does not equal regulatory approval, and a testnet is not proof of institutional adoption.

- Global relevance: Korea’s stablecoin infrastructure conversation is moving toward “regulated financial rails,” with design choices shaped by institutional settlement and oversight demands.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.