The Korean startup ecosystem is one of the fastest-growing in the world. The country saw a slowdown in the last two years owing to the pandemic, but in 2022 it expects to get back on track of growth. As the world limps back to normalcy post-COVID-19 restrictions, the Korean economy is also showing promising signs. Korean startups are gearing up for a better year of innovation, funding and unicorns.

Investments

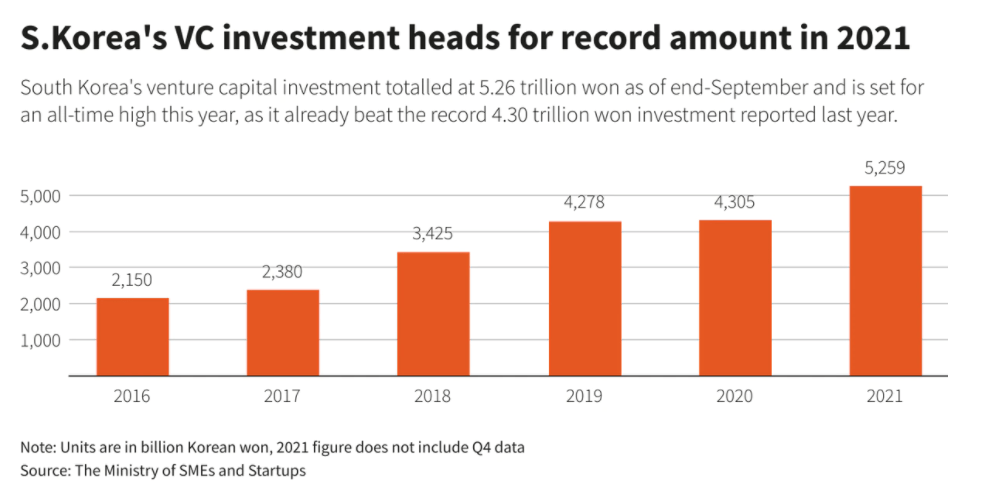

South Korean startups attracted record levels of funding in 2021 from private investors. Startups’ total venture capital investment is a record 5.26 trillion won in 2021, eclipsing the previous high of 4.30 trillion in 2020. The investments are expected to continue apace in 2022.

Unicorns

In 2021, South Korea got 15 official unicorn startups, with three new companies joining the billion-dollar club list — Zigbang, Dunamu, and Market Kurly. With more investments flowing in and the Korean government’s push to have 20 unicorns in 2022, more startups will get the $1 billion market valuation.

Check out the Korean startups that have achieved the ‘Unicorn’ status

IPOs

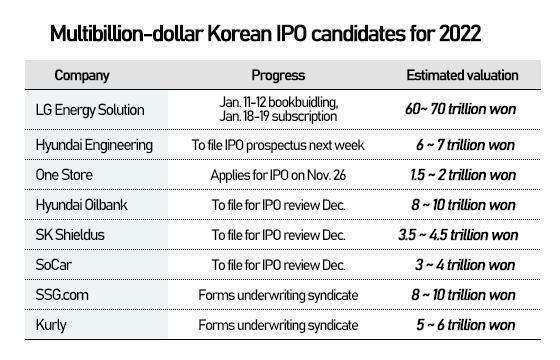

2021 saw record IPOs at the Korean bourses, with many startups debuting at the market. Also, the most dazzling IPO debut was by Korean e-commerce startup Coupang at the New York Stock Exchange in the first quarter of 2021.

For 2022, Market Kurly, the delivery unicorn startup, PUBG creator Krafton, and many other startups have already filed for an IPO at the Korean exchanges. Investment banks project that 2022 IPO turnover could exceed 25 trillion won/$21 billion.

Another hot IPO year in 2022 at Seoul with big and intriguing lineup

Source: Pulse

Economic Growth

Korean finance ministry projected the 2022 growth outlook for the country’s economy to 3.1 percent. ). The International Monetary Fund expects the South Korean economy to grow 3.3 percent. Asia’s fourth-largest economy is on a recovery path on the back of robust exports of chips and autos. Domestic demand and private spending are likely to gain ground despite pandemic uncertainties.

S. Korea ups 2022 economic growth outlook to 3.1%

Source: Korea Herald

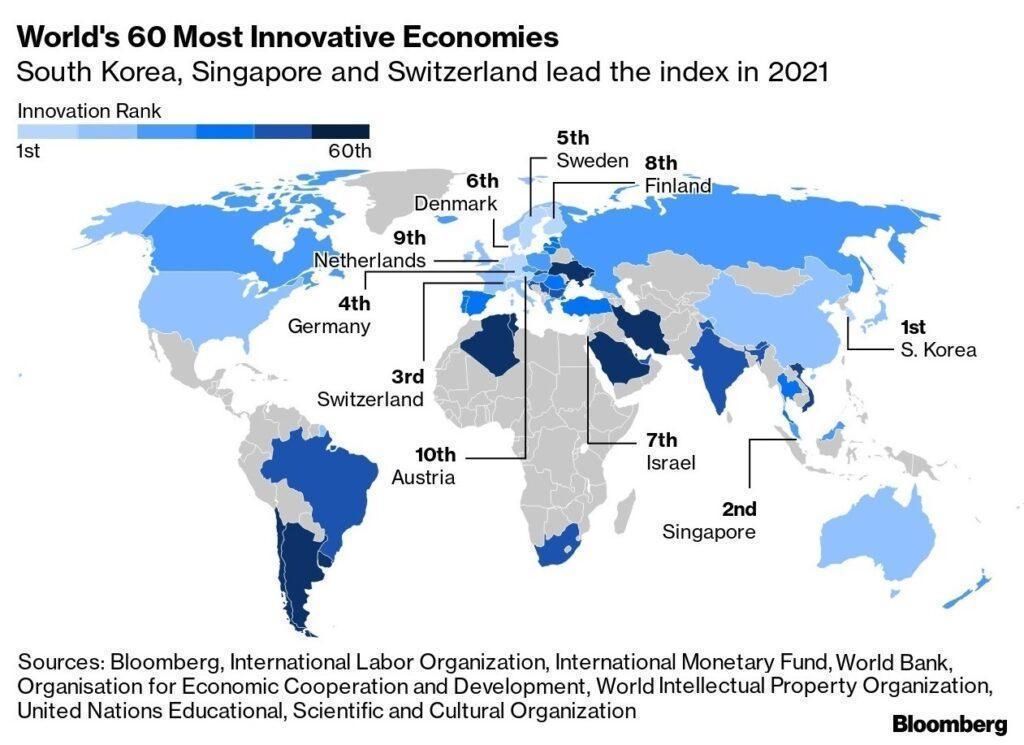

Technological Innovation

South Korea has been crowned as the most innovative country in the world. According to the Bloomberg Innovation Index, South Korea was labeled as the world’s most innovative country in 2021. It has been the sixth consecutive year for the country to claim the top spot. Driving its innovation are the entrepreneurial aspirations of the startup founders and unprecedented support for startups from the government and private sector. So definitely in 2022, expect more innovation in several technology areas – metaverse, sustainable & green tech, edutech, content, fintech, robotics, automation, AI, VR, gaming, etc.