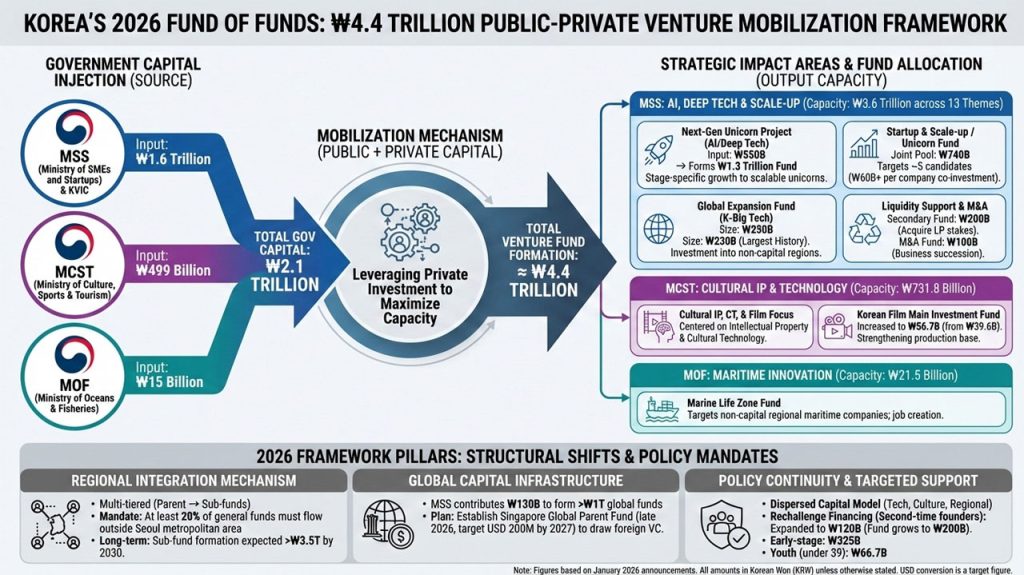

Korea has moved from blueprint to execution in its 2026 venture capital roadmap. The government officially launched a KRW 4.4 trillion Fund of Funds program that merges AI and deep tech investment with cultural IP and regional innovation. The inter-ministerial initiative signals a decisive transition from policy design to full-scale capital deployment—reshaping Korea’s venture finance architecture for both domestic and global investors.

Korea Launches ₩4.4 Trillion Fund of Funds for 2026

On January 23, the Ministry of SMEs and Startups (MSS) announced the execution of the “2026 First Regular Fund of Funds Investment Plan,” jointly established with the Ministry of Culture, Sports and Tourism (MCST) and the Ministry of Oceans and Fisheries (MOF).

The three ministries, in cooperation with Korea Venture Investment Corp. (KVIC), will invest KRW 2.1 trillion in government capital, mobilizing approximately KRW 4.4 trillion in total venture fund formation.

This marks one of the largest coordinated public–private venture mobilizations in Korea’s history, encompassing AI, deep tech, cultural content, and regional growth.

Under the MSS framework, KRW 1.6 trillion will be invested across 13 thematic areas, resulting in KRW 3.6 trillion in venture capital capacity.

Among these, the KRW 550 billion “Next-Generation Unicorn Development Project” anchors the initiative, forming a KRW 1.3 trillion fund dedicated to AI and deep tech ventures. The program provides stage-specific growth financing to help early ventures evolve into scalable unicorns.

A KRW 740 billion Startup and Scale-up Fund and a new “Unicorn Fund” will jointly deploy more than KRW 60 billion per company in public–private co-investments, targeting around five high-potential unicorn candidates.

In parallel, the KRW 250 billion Global Expansion Fund will support startups seeking cross-border growth in K-Big Tech, while the KRW 230 billion Regional Growth Fund—the largest in its history—will channel investment into non-capital regions.

To strengthen liquidity, the MSS will also form a KRW 200 billion Secondary Fund to acquire LP stakes and existing venture equity and maintain a KRW 100 billion M&A Fund for business succession.

Cultural IP and Maritime Innovation Join Korea’s Venture Capital Map

The Ministry of Culture, Sports and Tourism will invest KRW 499 billion to create KRW 731.8 billion in venture funds centered on intellectual property (IP), cultural technology (CT), and film.

Among them, the Korean Film Main Investment Fund rises from KRW 39.6 billion to KRW 56.7 billion, reflecting policy focus on strengthening the nation’s film production base and IP commercialization pipeline.

The Ministry of Oceans and Fisheries will contribute KRW 15 billion to launch a KRW 21.5 billion “Marine Life Zone Fund.” Its investment mandate targets non-capital regional maritime companies, promoting corporate growth and regional job creation.

Regional and Global Capital Integration Drive the 2026 Framework

The 2026 Fund of Funds (also known as Mother Fund) introduces a multi-tiered regional investment mechanism linking parent and sub-funds. Each year, approximately four regions will receive KRW 4 trillion in parent funds and KRW 7 trillion in sub-funds, with total sub-fund formation expected to exceed KRW 3.5 trillion by 2030.

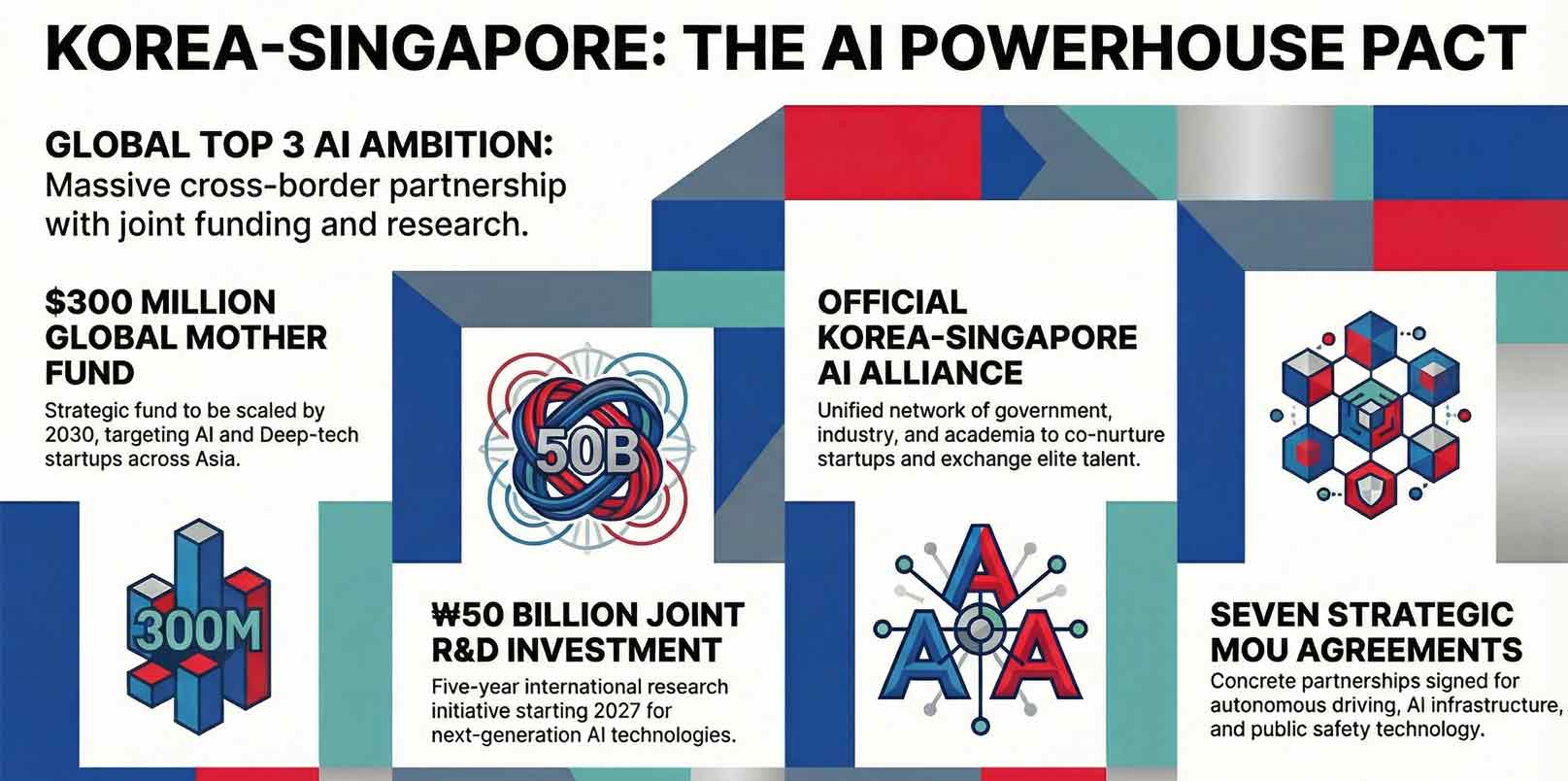

On the global front, the MSS will contribute KRW 130 billion to form over KRW 1 trillion in global funds. A new rolling investment program will collaborate with major domestic and international investors. By late 2026, the ministry plans to establish a global parent fund in Singapore with an operational target of USD 200 million by 2027.

This approach aims to draw foreign venture capital into Korean startups, transforming the Fund of Funds into a platform for global investment inflow.

Korea’s 2026 Venture Capital Framework: Policy Continuity and Funding Shift

The KRW 4.4 trillion program formalizes what was outlined in MSS’s earlier KRW 1.6 trillion Fund of Funds blueprint revealed earlier in January 2026. That earlier strategy defined the structural direction—emphasizing AI, regional innovation, and responsible scale—while this launch delivers financial execution across ministries.

Unlike past cycles where funding concentrated in policy-driven sectors, the 2026 model disperses capital across strategic technology, cultural industries, and regional ecosystems. It also institutionalizes regional investment mandates, requiring at least 20% of capital from general funds to flow outside the Seoul metropolitan area.

In addition, rechallenge financing for second-time founders expands from KRW 30 billion to KRW 120 billion, with the dedicated fund growing to KRW 200 billion. Early-stage and youth entrepreneurship also receive separate allocations: KRW 325 billion for early startups and KRW 66.7 billion for founders under 39.

Government Ministries Outline Cross-Sector Investment Strategy

According to the MSS, this year’s inter-ministerial expansion builds upon the Fund of Funds’ 20-year role as the cornerstone of Korea’s venture capital market. Officials explained that the program’s design reflects “a unified effort to connect policy capital with private investment efficiency and global competitiveness.”

The MCST emphasized its goal to strengthen “investment capabilities that extend from initial IP development to commercialization,” enabling Korea’s creative industries to scale globally.

The MOF highlighted that regional marine investment is part of “a broader strategy to link local industrial growth with high-quality employment in maritime economies.”

Implications for Korea’s Startup Ecosystem and Global Venture Capital Flows

The 2026 Fund of Funds reflects a governance shift in how Korea deploys state-backed venture capital. The inclusion of cultural and maritime sectors diversifies investment away from technology alone, signaling a whole-of-economy approach to venture scaling.

For global investors, the establishment of a Singapore-based parent fund underlines Korea’s intention to internationalize its venture pipeline, connecting with sovereign wealth and institutional partners across Asia and beyond.

Regionally, the expanded investment mandate reinforces Korea’s non-capital startup corridors, creating localized financial ecosystems that complement existing hubs like Pangyo and Seoul.

The quadrupled funding for early and rechallenge ventures also introduces a safety net for experimentation, countering the risk-averse capital climate that previously sidelined early founders.

Closing Perspective: Korea’s Next Venture Capital Phase

With the KRW 4.4 trillion Fund of Funds now active, Korea is entering a new phase of execution-led venture governance. The integration of AI and deep tech with cultural and regional equity mechanisms positions Korea’s venture ecosystem for a more balanced, globally connected growth trajectory.

How effectively the program channels funds into scalable outcomes—particularly outside the capital region—will define its long-term credibility among both domestic and global limited partners.

As 2026 unfolds, the Fund of Funds stands as both a financial and governance benchmark, testing how well Korea can align industrial ambition with investment discipline.

2026 ₩4.4T Fund of Funds Key Takeaway

- Program Overview: Korea officially launches a ₩4.4 trillion Fund of Funds (2026) through a joint initiative by MSS, MCST, and MOF, combining public and private venture capital.

- Core Sectors: Investment focuses on AI, deep tech, cultural IP, and regional growth, marking a shift toward integrated cross-sector venture governance.

- AI & Deep Tech: ₩1.3 trillion allocated to the Next-Generation Unicorn Development Project supporting scalable AI and deep tech startups.

- Cultural IP & Film: ₩731.8 billion under the Ministry of Culture, Sports and Tourism, including IP, cultural technology (CT), and Korean film investment.

- Maritime Innovation: ₩21.5 billion Marine Life Zone Fund led by the Ministry of Oceans and Fisheries, targeting non-capital regional maritime companies.

- Regional Growth: ₩230 billion invested in Regional Growth Funds, expanding local startup ecosystems beyond Seoul and Pangyo.

- Liquidity & M&A: ₩200 billion Secondary Fund for LP share liquidity and a ₩100 billion M&A Fund to support SME succession.

- Global Integration: Launch of a Singapore-based Global Fund (US$200M target by 2027) to attract foreign venture capital into Korean startups.

- Policy Mechanism: Institutionalized 20% regional investment mandate and multi-tiered sub-fund structure linking public finance with private capital efficiency.

- Strategic Impact: Positions Korea as a globally connected venture capital hub, advancing innovation governance, regional balance, and cross-border capital alignment.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.