South Korea is recalibrating one of its most influential startup policy tools. In 2026, the government will significantly expand the TIPS program with larger R&D grants, structurally mandated regional priority, and a newly formalized Global TIPS track linked to overseas investment. The changes signal a shift away from entry-heavy support toward a more selective, growth-oriented model, as policymakers aim to connect early innovation with scale-up and overseas market access.

2026 TIPS Expansion Plan Unveiled at Inter-Ministerial Meeting

On December 18, 2025, the Ministry of SMEs and Startups announced a comprehensive expansion of the TIPS program at the second Inter-Ministerial Science and Technology Ministers’ Meeting. The policy update followed a performance review of TIPS, a public–private co-investment program launched in 2013 that has supported more than 4,400 startups and attracted over KRW 20 trillion in follow-on private investment.

The ministry confirmed that startup-stage TIPS R&D projects will increase from 700 to 800 in 2026. Growth-stage Scale-up TIPS projects will expand from 152 to 300. A new Global TIPS track will be introduced to support companies that secure overseas investment and pursue international market entry.

Why TIPS Matters in Korea’s Startup Policy Architecture

TIPS has become a central component of Korea’s startup support system. The program operates on a private-first model in which accredited investors identify and invest in startups before the government provides matched R&D and commercialization funding.

Since its launch, TIPS has become a key gateway for early-stage technology and deep-tech startups seeking both capital and institutional validation.

The 2026 expansion positions TIPS as a full life-cycle support mechanism. The ministry described the new structure as covering startup, growth, and global stages, replacing fragmented tracks with a clearer progression path. Existing startup-stage tracks will be consolidated, while deep-tech support will increasingly focus on follow-on R&D for companies that demonstrate performance in earlier phases.

What Changes in 2026: Funding, Structure, and Regional Allocation

Under the revised framework, general TIPS R&D funding will rise from KRW 500 million to KRW 800 million over two years. Companies completing the general track will become eligible for follow-up R&D support of up to KRW 1.5 billion over three years. Scale-up TIPS projects will offer R&D funding of up to KRW 3 billion, while Global TIPS projects may receive up to KRW 6 billion when overseas investment is secured in advance.

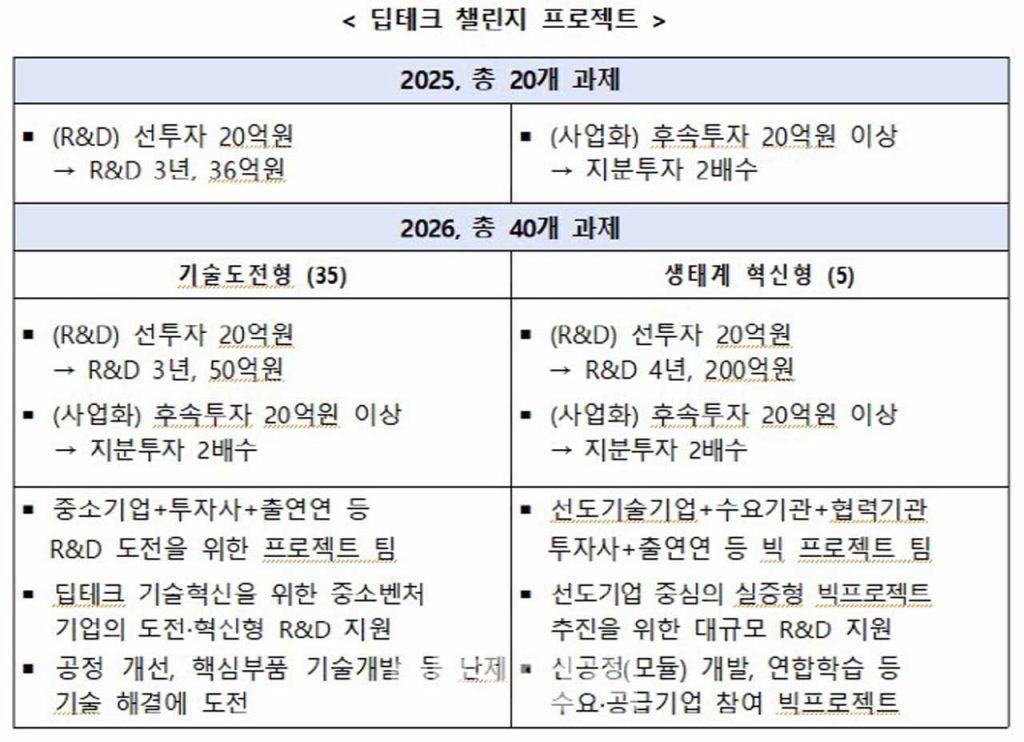

The ministry will also expand high-risk, high-impact funding instruments. Deep Tech Challenge projects will provide up to KRW 5 billion per task, while a pilot ecosystem innovation model involving multiple startups will offer support of up to KRW 20 billion per project.

Regional allocation will become a structural component of the program. At least 50 percent of General TIPS and Scale-up TIPS projects will be prioritized for non-capital region startups. Private investment requirements will be relaxed accordingly, with non-capital region companies facing a 50 percent lower threshold than firms based in the Seoul metropolitan area.

The ministry will also prioritize investors with regional presence as TIPS operators to strengthen local investment capacity. Region-dedicated venture funds linked to the Regional Growth Fund will be expanded through 2030, supported by regulatory changes that allow greater participation by local governments.

Government View on Selection and Risk

Minister of SMEs and Startups Han Seong-sook said the expansion addresses long-standing structural issues in early-stage support systems. She noted that previous evaluation mechanisms often penalized unconventional ideas and produced inconsistent outcomes depending on reviewers.

Han said expanding TIPS into a pan-ministerial policy platform would allow the program to support a broader range of technologies and industries while strengthening its role in mobilizing private capital.

“TIPS is one of the most important policies for building regional venture investment foundations, and its role is critical in stimulating private investment in regional innovative companies.”

2026 TIPS Expansion: Wider Shift in Korea’s Startup Policy

The 2026 TIPS expansion reflects a wider shift in Korea’s startup policy. Rather than maximizing the number of startups entering government programs, the ministry is placing greater emphasis on performance, scale potential, and capital efficiency. Larger R&D grants are paired with higher private investment requirements for operators, alongside differentiated thresholds for regional startups.

Domestic founders will face both greater opportunity and higher expectations. Access to expanded public R&D funding will depend more heavily on private investor validation and measurable progress. Regional startups stand to benefit from structural priority that reduces the long-standing capital concentration in Seoul.

Global founders and investors observing Korea will see a system increasingly aligned with international venture norms. The introduction of Global TIPS formalizes outbound expansion support and positions government-backed Korean startups more clearly within cross-border venture capital and innovation networks.

More Capital Is Not the End Goal

Korea’s 2026 expansion of the TIPS program goes beyond budget expansion. It represents an attempt to redesign how public capital, private investment, and startup growth connect across stages and regions.

While the program has clear scale in terms of funding and institutional backing, the decisive factor will be execution. If selection discipline, regional coordination, and follow-on support remain aligned, TIPS could function as a durable growth ladder rather than a crowded entry gate.

And so, the 2026 rollout will reveal whether Korea can translate policy ambition into startups capable of scaling and competing globally.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.