The prominent Korean startup growth analysis platform, ‘Innovation Forest’, unveiled its much-anticipated ‘2023 Investment Settlement Report’ on January 31. This comprehensive report delves into the core aspects of last year’s startup investment landscape in South Korea, offering invaluable insights derived from Innovation Forest’s extensive data repository.

The report encompasses a thorough analysis of various facets including 2023 startup investment trends in Korea, preference categories among investors, performance evaluations of key players, and notable cases of investment recovery. According to financial disclosures by Innovation Forest, the report indicates a notable shift in investment patterns compared to the previous year.

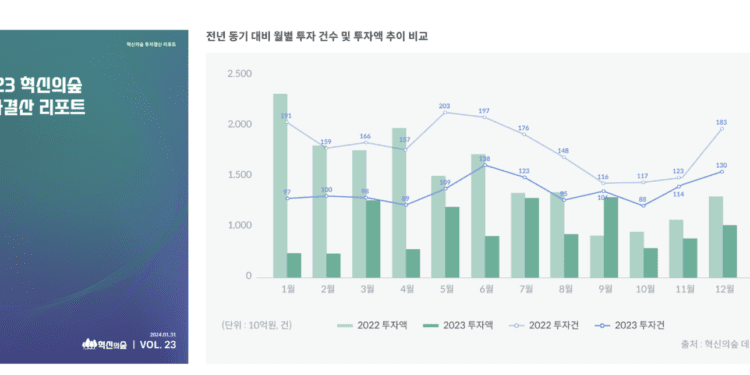

In 2023, the total number of startup investments in Korea stood at 1,287, amounting to approximately 7.275 trillion won ($5.3 billion). This figure reflects a significant decrease of 34.5% in the number of investments and a remarkable 51.5% decline in investment capital compared to the figures recorded in 2022, which tallied 1,966 investments totaling around 15 trillion won ($11.3 billion). The report attributes this decline in investment partly to the lingering impact of the cooling investment climate that emerged in the latter half of 2022.

However, it also notes a stabilization and reduction in volatility over certain periods. Moreover, investor interest remains robust in emerging technologies such as artificial intelligence, big data, robotics, and electric vehicles, indicating enduring market enthusiasm amid the challenging environment.

Innovation Forest categorizes startups into 24 distinct categories based on their business characteristics. Among these, the ‘Blockchain/Deep Tech/AI’ and ‘Manufacturing/Hardware’ categories emerged as prominent focal points, attracting substantial investments both in terms of frequency and capital infusion.

▼ Top 10 categories in terms of number of investments in Innovation Forest

1 | Big Data/Blockchain/AI | 13.7%

2 | Semiconductor/Display | 12.0%

3 | Healthcare/Bio | 11.9%

4 | Games | 7.8%

5 | Content/Entertainment | 6.3%

6 | Insurtech/Financial Technology | 5.6%

7 | Education/Edutech | 5.3%

8 | Food/Beverage | 4.2%

9 | Mobility/Transport | 4.0%

10 | Agriculture/Fishery/Forestry | 3.7%

Hong Gyeong-pyo, CEO of Mark & Company, the operator of Innovation Forest, emphasized the importance of leveraging past investment data to navigate future market dynamics effectively. “Starting in 2024, the business environment is in a time of uncertainty and opportunity, and in this situation, we hope that both entrepreneurs and investors can achieve their goals by considering complex and diverse factors,” he said.

The ‘2023 Innovation Forest Investment Settlement Report’ is now available for public access on the official website of Innovation Forest, offering stakeholders an invaluable resource for informed decision-making and strategic planning.

Also Read,

- South Korea’s Ministry of SMEs and Startups to Pump Record $684 Million to Revive Venture Investment in 1st Quarter

- K-Digital Wave: Korean Startups and Tech Giants Ready to Amaze at CES 2024

- Hashed Invests 36.8 Billion Won ($28. 4 Million) in Challenging Year, Signals Promise for Blockchain Startups

- Top Accelerators in South Korea Shaping Startup Success

- SparkLabs Injects $75k Boost: Four Startups Secured for 22nd Accelerator Program with Substantial Initial Investment

Keep tab on latest news in the Korean startup ecosystem & follow us on LinkedIN, Facebook, and Twitter for more exciting updates and insights.