In a year defined by global uncertainty, Korea’s startup ecosystem is defying the odds. Investor sentiment is warming, capital flow is stabilizing, and founders are once again talking about growth instead of survival. Yet behind the optimism lies a harder question: can Korea transform this short-term rebound into a lasting recovery? And particularly one that cements its position as Asia’s next true venture powerhouse?

Korea’s Venture Economy Ends 2025 on a High

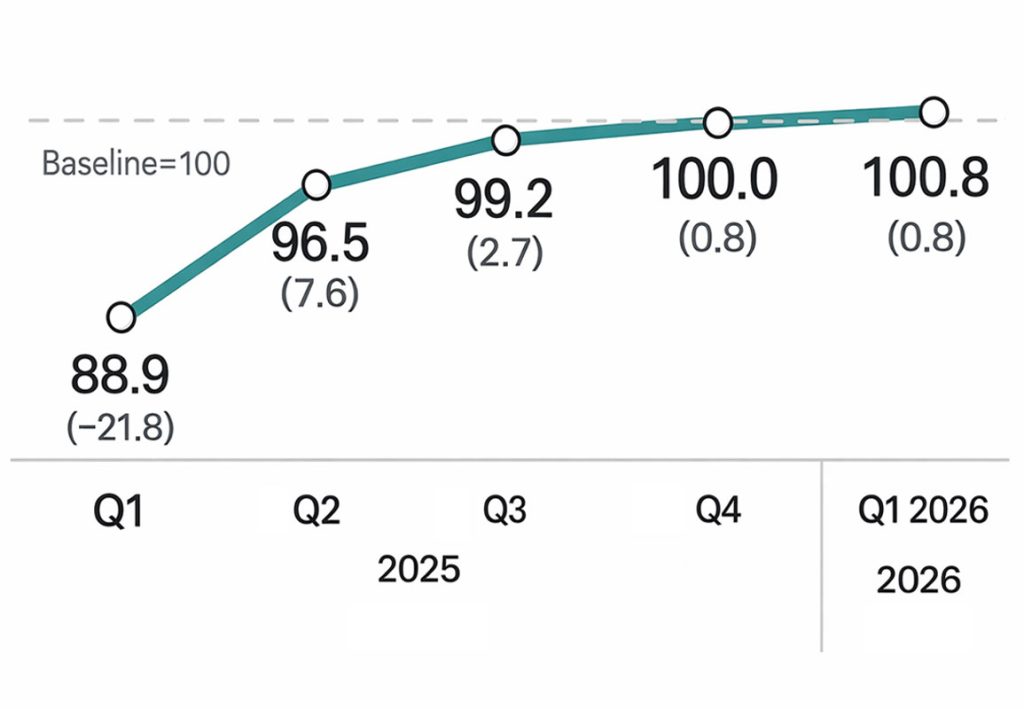

Korea’s startup and venture industry closed 2025 with record optimism. According to the Korea Venture Business Association (KOVA), the Venture Business Sentiment Index (BSI) for the fourth quarter rose to 95.3, the highest since the index was introduced in 2024.

The BSI measures how venture companies perceive current business performance and outlook. Scores above 100 indicate more companies see improvement than decline. This quarter’s results mark a strong rebound after hitting a low of 78.6 earlier in 2025 due to political uncertainty.

Firms credited the rebound to stronger domestic demand (85.5%) and improved financing conditions (25.5%), while those citing worsening conditions pointed to weak domestic sales (87.2%) and rising raw material prices (20.3%) caused by sustained exchange rate pressures.

The data shows a widening recovery across industries. Both manufacturing and services reported improvement, with the service sector BSI reaching 100.1, surpassing the baseline for the first time.

Signs of Financial and Sectoral Recovery

Breaking down the data, service-oriented startups led the surge. The software and IT-based service sector rose 12.5 points, while telecommunication and broadcasting equipment manufacturing jumped 20.8 points.

Manufacturing, traditionally more sensitive to costs, improved moderately, recording 91.2. Within this category, telecom and device producers saw the sharpest turnaround, reflecting the stronger performance in device and equipment manufacturing.

Sector leaders also cited easier access to capital and greater investor activity in late 2025 as major factors supporting the recovery. This aligns with reports that early-stage funding and bridge investments have increased since Q3, aligned with the government’s ongoing financial policy initiatives and renewed venture capital activity.

Industry Expectations Turn Upbeat for 2026

The good news is that this optimism extends into early 2026. The Q1 2026 outlook index rose to 100.8, crossing the baseline for the first time since the survey’s inception. Companies expecting improvement pointed to domestic sales recovery (81.7%), better funding conditions (35.5%), and stronger export performance (22.9%) as drivers.

However, businesses also voiced caution. A majority cited continued domestic sluggishness (86.6%) and financing challenges (32.4%) as risks, while concern over rising raw material costs (25.6%) nearly doubled from the previous quarter.

The manufacturing sector’s outlook dipped slightly to 97.0, while services rose to 105.1, led by software, IT-based platforms, and digital content companies. Financial indicators also reached milestones, with both management performance (105.1) and funding conditions (100.2) surpassing 100 for the first time since the BSI was launched.

Stakeholders Emphasize Recovery Momentum — and Policy Execution

KOVA Secretary-General Lee Jung-min described 2025 as “the year Korea’s venture confidence returned,” adding that “the fourth-quarter data reflects a tangible end to the stagnation phase.”

Lee Jung-min cautioned, however, that 2026 presents a more complex landscape, saying:

“Global uncertainty, geopolitical tensions, and domestic consumption weakness could limit the pace of recovery.”

He then emphasized that the government’s ‘Four Major Venture Powerhouse Strategy’—which includes capital expansion, policy-based investment, and ecosystem revitalization—must be implemented swiftly and without delay to ensure the rebound continues.

Turning a Domestic Rebound into Global Leverage

Now, this data underscores a broader shift, showing that Korea’s startup ecosystem is entering a post-survival phase after a prolonged period of investor caution amid broader economic tightening. The rebound in the service and digital innovation sectors suggests sentiment is returning toward technology-driven businesses rather than short-term financial plays.

If sustained, this recovery could help Korea solidify its position as a venture and innovation hub in Asia, particularly as global investors seek stable yet high-growth markets amid U.S. and Chinese economic uncertainty.

Still, challenges remain. Persistent inflationary pressure, high exchange rates, and slower global demand could dampen export-driven growth. Korea’s ability to balance financial support with regulatory flexibility will determine whether its startup momentum in 2025 becomes a long-term structural advantage.

The Real Test Begins in 2026

Korea’s venture economy is showing real signs of recovery, with confidence levels at their strongest since the BSI survey began in 2024. Yet the coming year will test whether that optimism can translate into sustainable, innovation-led growth.

And so, it becomes another task for policymakers to maintain capital flow, stabilize regulatory systems, and deliver on reform commitments before external volatility erodes the progress made in 2025. Meanwhile, for startups and investors, this is both a window of opportunity and a stress test for resilience in an uncertain global market.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.