Korea’s flagship early-stage startup program has succeeded in opening the door to entrepreneurship, but new data suggests many companies struggle to stay in the game. An analysis of the Pre-Startup Package shows that four out of ten supported firms shut down within five years. For founders, investors, and policymakers, the figures raise difficult questions about how early-stage risk is managed once public funding helps startups cross the starting line.

Survival Data Exposes Limits of Korea’s Pre-Startup Package

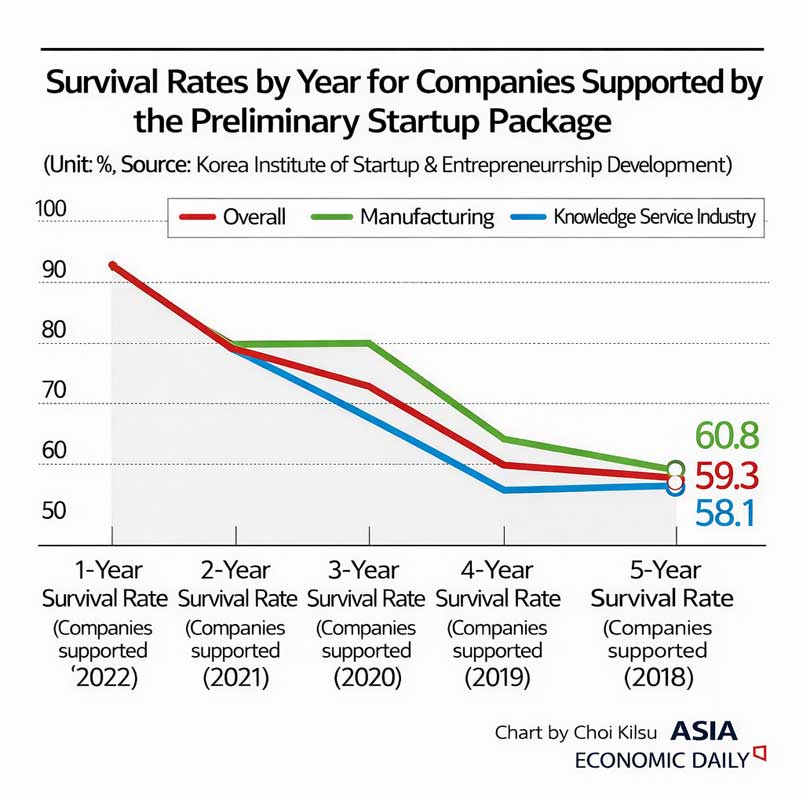

Data analyzed by Asia Economy from materials provided by the office of Democratic Party lawmaker Kim Won-i shows that the five-year survival rate of companies supported by the Pre-Startup Package (a.k.a the Preliminary Startup Package) stood at 59.3 percent as of 2023.

While the one-year survival rate was relatively high at 93.9 percent, the numbers drop sharply after year three. Survival falls to 75.1 percent in the third year, 60.3 percent in the fourth, and below 60 percent by year five. This contrasts with a 72.2 percent five-year survival rate among companies participating in government startup support programs overall.

The Pre-Startup Package began as a supplementary budget initiative in 2018 and was formalized in 2019. The program is now in its seventh year of operation.

Why Early Momentum Fades After Market Entry

The program targets aspiring founders before formal incorporation, providing up to KRW 100 million to support prototype development and market validation. Average support per company is around KRW 50 million, with roughly 890 firms selected each year.

This structure lowers entry barriers, but analysts argue it does not sufficiently address what happens after initial market entry. Many startups manage to launch but fail to secure stable customers or sustainable revenue, leaving them unable to cross the so-called “death valley” between early experimentation and commercial viability.

Industry data shows particularly weak outcomes in knowledge-based service sectors such as artificial intelligence and biotechnology. While first-year survival rates for manufacturing and knowledge services are similar, by the fourth year the gap widens to 65.0 percent for manufacturing versus 56.2 percent for knowledge services.

Structural Weaknesses of the Pre-Startup Package

Lee Il-han, a professor of business administration at Chung-Ang University, said knowledge service startups often face a delayed but sharper test. The professor explained,

“These sectors have lower upfront investment burdens, which makes entry easier. However, if stable demand is not secured, revenue foundations weaken, and many companies face a critical hurdle around the third or fourth year.”

Criticism has also focused on what experts describe as a “broad but shallow” support model. Compared with later-stage programs such as the Initial Startup Package or the Scale-Up Startup Package, funding per company is smaller while the number of beneficiaries is larger, diluting long-term impact.

Budget pressure has compounded the issue. The Pre-Startup Package budget fell to KRW 54.3 billion this year, down 63.6 percent from KRW 149 billion in 2020, as new initiatives such as startup-centered university programs drew resources into parallel tracks.

What the Data Signals for Korea’s Startup Ecosystem

For Korea’s startup ecosystem, the findings highlight a persistent tension between access and durability. Broad entry programs expand participation and experimentation, but survival data suggests that many firms stall once initial government support ends.

The pattern mirrors challenges seen in other innovation-driven economies, where early public funding improves formation rates but does not automatically translate into scalable businesses. In Korea’s case, the gap appears most pronounced in technology-driven service sectors that require time to build demand and reference customers.

The findings also intersect with Korea’s broader push to strengthen scale-up policy frameworks that link early funding to mid- and late-stage growth, including programs such as Scale-Up TIPS and global expansion tracks. While these initiatives aim to help startups accelerate once traction is established, the survival data suggests a structural gap earlier in the pipeline.

Many companies appear to stall before reaching the stage where scale-up support becomes accessible, raising questions about whether the preliminary funding layer is sufficiently selective and well-resourced to prepare startups for the transition.

Policy experts argue that without adjustments, the current structure risks normalizing short-lived startups rather than cultivating companies capable of attracting follow-on private investment. Overlapping programs and fragmented budgets may further weaken the ability to concentrate resources where long-term growth potential is strongest.

Rethinking Depth Over Breadth in Early-Stage Support

The Pre-Startup Package has played a clear role in lowering the barriers to entrepreneurship in Korea. Yet five-year survival data suggests that access alone is not enough.

For policymakers, the challenge now lies in deciding where public intervention adds the most value. A shift toward more selective, higher-density support could strengthen the ecosystem by helping fewer startups travel further. For founders and investors, the message is equally direct. Early funding opens doors, but the real test begins once public support runs out and market discipline takes over.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.