Korea’s startup economy rests on more than venture capital. A large share of early-stage firms rely on policy-backed loan guarantees to secure bank financing. When that safety net begins to absorb record losses, it sends a signal beyond individual defaults. It raises questions about the resilience of Korea’s credit-based startup financing model at a time of currency pressure and weak domestic demand.

KIBO Reports Record Loan Subrogation in 2025

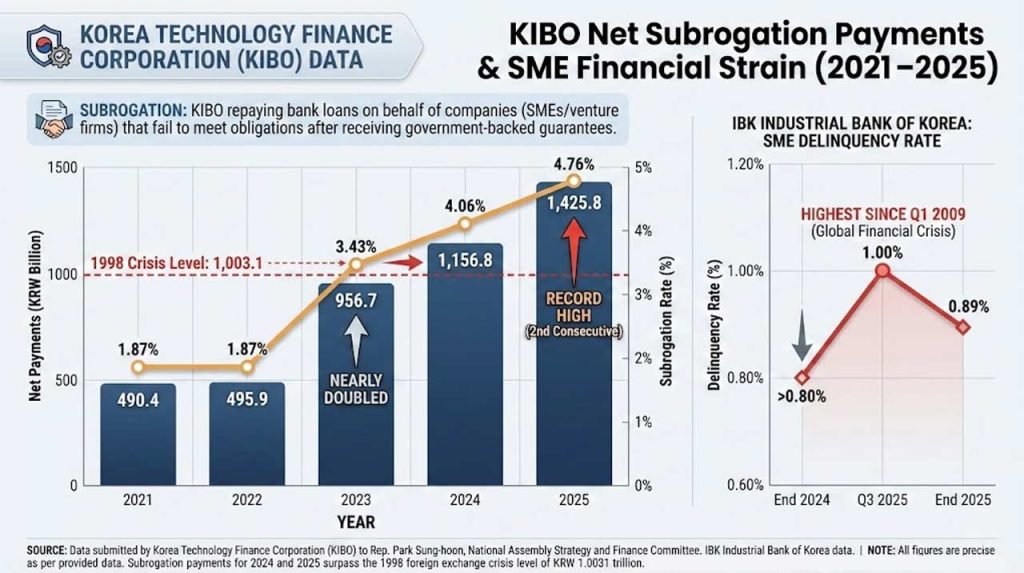

Data submitted by the Korea Technology Finance Corporation, commonly known as KIBO, to Rep. Park Sung-hoon of the National Assembly’s Strategy and Finance Committee show that net subrogation payments under general guarantees for SMEs and venture firms reached KRW 1.4258 trillion in 2025.

Subrogation refers to KIBO repaying bank loans on behalf of companies that fail to meet their obligations after receiving government-backed guarantees.

The net increase has risen sharply in recent years. It stood at KRW 490.4 billion in 2021 and KRW 495.9 billion in 2022 before nearly doubling to KRW 956.7 billion in 2023. In 2024, it reached KRW 1.1568 trillion, surpassing the KRW 1.0031 trillion recorded during the 1998 foreign exchange crisis. 2025 marked a second consecutive record high.

The subrogation rate also climbed steadily, from 1.87 percent in 2021 and 2022 to 3.43 percent in 2023, 4.06 percent in 2024, and 4.76 percent in 2025.

At the same time, the delinquency rate at IBK Industrial Bank of Korea, a major lender to SMEs, reached 1.00 percent at the end of the third quarter of 2025, the highest level since the first quarter of 2009 during the global financial crisis. It eased slightly to 0.89 percent at year-end but remained above the 0.80 percent level a year earlier.

Why Startup Loan Guarantees Matter in Korea’s Financing Structure

In Korea, early-stage and growth-stage startups often combine equity investment with government-backed business loans. Institutions such as KIBO provide guarantees that enable companies with limited collateral to access bank financing.

This structure has supported startup formation and expansion over the past decade. It has also created a system in which credit conditions at policy institutions directly affect startup liquidity.

A rising KIBO loan subrogation figure does not only reflect company-level distress. It also indicates that a larger share of guaranteed loans has turned non-performing, increasing the financial burden on the guarantee fund itself.

Lawmaker Warns of Structural Pressure on SMEs

Rep. Park Sung-hoon stated,

“SMEs are being hit directly by the strong exchange rate and weak domestic demand.

Rather than remaining at the level of repaying or writing off debt, the government must establish fundamental and sustainable measures that encompass industrial competitiveness and domestic market revitalization.”

His remarks place the data within a broader macroeconomic context rather than framing it solely as a financial issue.

Rising Credit Risk and Startup Financing Conditions

KIBO’s rising subrogation payments for SMEs will potentially result in practical implications for Korea’s startup ecosystem.

A higher subrogation rate means a greater portion of guaranteed loans is defaulting. If this trend continues, screening standards at guarantee institutions and banks may tighten. Startups that rely on government-backed business loans could face stricter eligibility criteria or increased scrutiny of cash flow.

This does not signal a collapse of the Korea venture capital hub. Equity funding operates under different dynamics. However, many early-stage companies use policy-backed debt to extend the runway between funding rounds. Stress in the credit pipeline can therefore amplify Korea startup financing risk, particularly for firms exposed to domestic demand.

The regional data underline that the issue is not confined to a single cluster. Gyeonggi Province and Seoul account for the largest net increases in subrogation, reflecting the concentration of SMEs and startups in those areas. Meanwhile, higher subrogation rates in regions such as Jeju and North Jeolla indicate localized vulnerability.

For international investors and cross-border partners assessing Korea’s startup environment, the message is measured. The policy support system remains active, but the cost of default within that system is rising. Credit-backed growth may become more selective.

A Test of Korea’s Policy-Backed Startup Model

Korea’s startup ecosystem has long combined venture capital with structured public guarantees. That model has lowered entry barriers and expanded access to financing.

Record KIBO subrogation does not dismantle that system. It does, however, test its sustainability under macroeconomic pressure.

If delinquency and subrogation rates stabilize, the episode may be seen as a cyclical adjustment. If they continue to climb, institutions may be forced to recalibrate risk thresholds.

Therefore, for founders, the immediate implication is clear: stronger revenue visibility and disciplined cost management will matter more in securing both loans and follow-on investment.

Key Takeaway on KIBO’s Record Debt Repayment for SMEs

- KIBO’s net loan subrogation reached KRW 1.4258 trillion in 2025, a record high.

- The subrogation rate rose to 4.76 percent, up sharply from 1.87 percent in 2021.

- IBK’s SME loan delinquency rate peaked at 1.00 percent in Q3, the highest since 2009.

- Rising Korean SME loan defaults increase pressure on startup loan guarantees Korea relies on.

- Tightening credit conditions could reshape Korea startup financing risk for early-stage firms.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.