In 2026, Korea’s venture capital framework enters a defining transition. The government is no longer adjusting rules but is now rebuilding the system that connects public finance, private capital, and innovation. This venture investment reform signals a long-term shift in how Korea intends to fund its future industries, from AI and deeptech to regional startups, through a more agile, globally aligned investment structure.

2026 Venture Investment Reform: Reshaping Korea’s Venture Investment Landscape

South Korea has formally announced its most extensive venture investment reform to date, marking a turning point in how the nation mobilizes private capital for innovation. Centered on deregulation, tax expansion, and long-term sustainability, the new system aims to transform the country’s policy-driven venture environment into a globally competitive private-led ecosystem.

Unveiled by the Ministry of SMEs and Startups (MSS), the reform aligns with the government’s “Four Venture Powerhouses” strategy—a national agenda to elevate Korea into the world’s top four venture economies by deepening the country’s innovation capital base.

Venture Investment Obligations Eased to Boost Flexibility

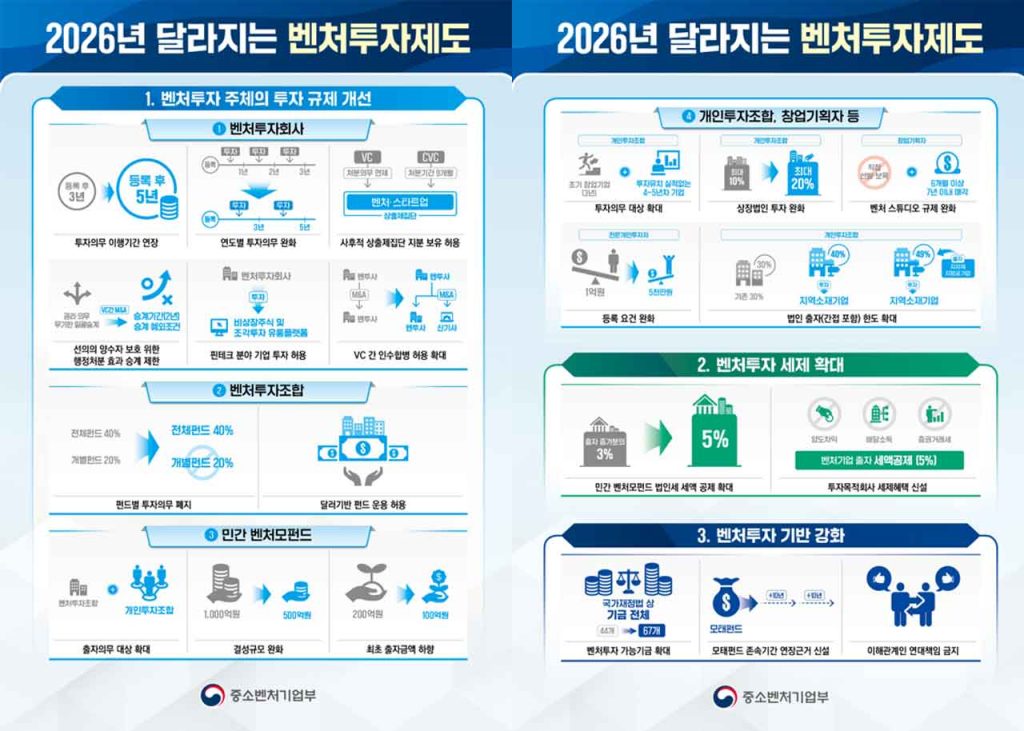

The 2026 policy reform extends the mandatory investment fulfillment period for venture investment companies from three years to five years, giving firms more time to deploy funds based on market conditions.

Previously, companies were required to make at least one investment each year for three consecutive years after registration. Now, they must complete one investment within three years and another by the fifth year, significantly reducing early operational pressure.

The government has also abolished the five-year mandatory divestment rule for cases in which invested startups later become part of large conglomerate groups, improving liquidity conditions for investors. Corporate Venture Capital (CVC) firms are granted a nine-month grace period to exit when portfolio companies are reclassified into the same business group.

The transfer period for administrative sanctions in mergers or acquisitions between venture capital firms has been shortened from indefinite to two years, providing protection for good-faith acquirers. Additionally, the permissible scope of investment now includes unlisted equity and fractional investment trading platforms, a change that broadens support for Korea’s fintech and innovation finance startups.

Regulatory Improvements for Venture Associations and Private Funds

For venture investment associations, the requirement that general partners (GPs) invest 20% in each individual fund has been removed. Instead, a 40% overall fund-level investment requirement now applies, allowing greater operational flexibility and strategic fund management.

To attract more foreign capital, non-Korean investors can now contribute directly using U.S. dollars without undergoing additional currency conversion procedures.

The government has also lowered the minimum formation size for private fund-of-funds from KRW 100 billion to KRW 50 billion and reduced the minimum initial contribution from KRW 20 billion to KRW 10 billion. These “private mother funds” can now invest not only in venture associations but also in individual investment associations, allowing more diverse private participation.

For individual investment associations led by accelerators, investment eligibility has been expanded to include four- to five-year-old firms without prior funding records, easing capital access for high-potential companies. Their investment limit in listed companies has also doubled from 10% to 20%.

In addition, the corporate contribution limit for accelerator-led funds has been raised from 30% to 40% when targeting regional startups, and up to 49% when local governments or public corporations contribute 20% or more of the fund. This adjustment aims to strengthen non-metropolitan venture ecosystems across Korea.

Tax Incentives and Institutional Support Strengthened

The 2026 reform introduces one of the most significant tax incentive expansions in the country’s venture history. The corporate tax deduction rate for additional contributions to private venture funds has increased from 3% to 5%, while maintaining a 5% deduction on total contributions.

Investments made through Special Purpose Companies (SPCs) will now enjoy the same tax benefits as direct investments, eliminating previous structural disadvantages for indirect funding models.

The range of statutory funds eligible for venture participation will expand to all funds under the National Finance Act, allowing national pension funds and public funds to invest directly in the venture ecosystem.

The Fund of Funds (Mother Fund)—a cornerstone of Korea’s venture policy—will now be able to extend its lifespan in 10-year increments beyond 2035. The government will begin this extension process in the second half of 2026, securing continuity for strategic investments in artificial intelligence (AI), deeptech, and export-driven innovation.

Minister’s Statement and Policy Direction

Minister Han Seong-sook emphasized that this reform represents a structural reorganization of Korea’s venture investment framework to better reflect evolving market realities. The minister stated,

“This reform comprehensively updates Korea’s venture investment system to ensure that investment becomes more flexible and sustainable. We will continue close communication with industry stakeholders and make every effort to reduce regulatory burdens as Korea advances toward becoming one of the world’s top four venture powerhouses.”

The Ministry expects the reforms to stimulate greater private-sector participation, enhance investor confidence, and establish long-term pathways for both institutional and cross-border venture investment.

Korea’s 2026 Venture Investment Reform: From Policy Finance to Private-Led Growth

The reform reflects a major policy transition: Korea’s venture ecosystem is evolving from policy-dependent capital to market-driven investment. By aligning tax relief, regulatory flexibility, and fund longevity, the government is positioning private investors—both domestic and global—as the primary engine of growth.

This approach also strengthens Korea’s appeal as a venture capital hub in Asia, complementing its broader innovation diplomacy efforts with the United States, Japan, and China. The expansion of foreign investor access and the inclusion of pension and public funds mark a clear signal of Korea’s intent to integrate its venture economy more deeply with global markets.

For startups, the relaxed investment obligations and broadened funding mechanisms could translate into more capital inflows at critical growth stages—particularly in sectors such as AI, robotics, deeptech, and clean energy.

Strategic Outlook: Building an Investment Ecosystem for the Next Decade

The 2026 venture investment reform is not a short-term stimulus but a structural redesign of Korea’s venture capital architecture. By combining deregulation with targeted incentives, the MSS seeks to transform policy finance into scalable infrastructure—bridging government resources, institutional funds, and private venture capital.

If successfully implemented, this framework could redefine Korea’s global position—not just as a startup-friendly nation but as an innovation financier in Asia, capable of channeling cross-border capital into emerging industries.

The coming years will test how effectively Korea balances public policy intent with private market execution. But the direction is clear: the country’s next venture growth phase will depend less on subsidy and more on strategy.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.