Korea’s startup ecosystem is redefining what capital means. At the 2026 Startup Investor Summit in Busan, industry leaders, investors, and policymakers gathered to discuss how early-stage investment can mature beyond financial dependency — into a trust-based, private-led ecosystem where experience, collaboration, and innovation drive long-term sustainability.

Startup Investor Summit 2026 Brings Together Korea’s Public and Private Leaders

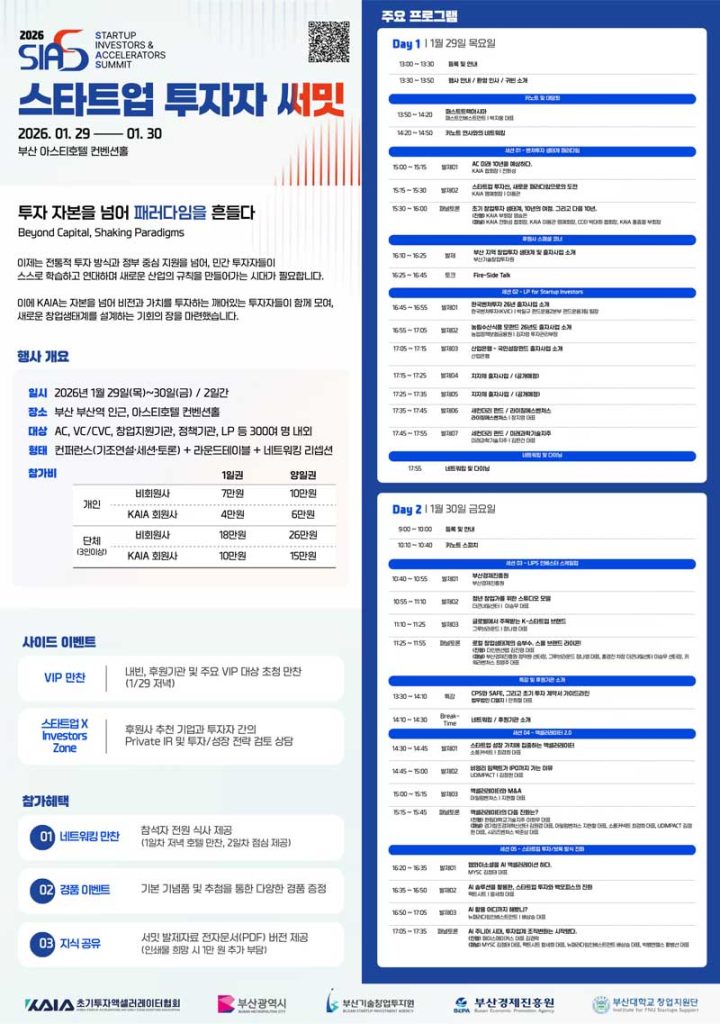

The Korea Association of Initial Investment Accelerators (KAIA) will be hosting the 2026 Startup Investor Summit in Busan from January 29 to 30, under the theme “Beyond Capital, Shaking Paradigms.”

The event will be jointly organized with Busan Metropolitan City and the Busan Technopark Investment Institute.

Participants include accelerators, venture capital firms (VCs), limited partners (LPs), and regional innovation organizations. Together, they will explore the evolution of Korea’s early-stage investment landscape — from government-supported capital to a mature, private-driven venture ecosystem.

Keynote and Main Sessions: Redefining Early-Stage Investment

In the keynote session, Jiwoong Park, CEO of Fast Track Asia, is offering a panoramic view of the changing global and domestic startup investment environment, emphasizing the strategic role of early investors in shaping ecosystem sustainability.

The main discussion features:

- Hwaseong Jeon, Chairman of KAIA

- Yongkwan Lee, CEO of Bluepoint Partners

- Daehee Park, Head of Daejeon Center for Creative Economy and Innovation

- Jongchul Hong, CEO of Infobank iAccel

- Seungeun Myung, CEO of VentureSquare

They examine “A Decade of Early-Stage Startup Investment and Paradigm Shifts in Korea’s Venture Industry,” tracing how accelerators have evolved from funding intermediaries to ecosystem architects.

Five Core Agendas Shaping Korea’s Next Investment Decade

The summit’s discussions will be structured around five key themes:

1. 2026 Local Government and Fund of Funds (Mother Fund) Investment Directions

Local governments, Korea Venture Investment Corp. (KVIC), and the Agricultural Policy Insurance and Finance Service (APFS) are introducing funding initiatives and co-investment goals for 2026.

2. LICON (Local and Lifestyle Innovation Companies) Investor Scale-Up

Busan Economic Promotion Agency, The Invention Lab, The Bigger Tomorrow Center, and GrooveRound will be sharing strategies connecting local startups and small businesses to global investment networks.

3. Accelerator Business 2.0

Sopoong Connect, UD Impact, Ylem Ventures, SERIES Ventures, and Hallym University Holdings to discuss sustainable accelerator models, exploring how early investors can create value through mentorship, data transparency, and long-term partnerships.

4. AI-Driven Investment and Growth Technologies

MYSC, FactSheet, New Paradigm Investment, BigBang Angels, and Pacemakers will present real-world applications of AI in deal sourcing, evaluation, and portfolio management, showing how data-driven insights can enhance investor efficiency.

5. Regional Capital Decentralization and Innovation Synergy

By holding the summit in Busan, KAIA and its partners are reinforcing the importance of decentralizing Korea’s innovation economy, positioning Busan as a bridge between regional startups and global venture capital flows.

Stakeholder Statements Reflect Industry’s Turning Point

A KAIA representative emphasized that accelerators are no longer defined by capital supply alone, stating:

“The accelerator model has evolved beyond simply supplying money. Knowledge, experience, networks, and trust are now the core assets that determine long-term sustainability.”

This sentiment reflects a growing consensus across the Korean venture ecosystem — that financial capital must now coexist with intellectual and relational capital to sustain innovation.

Policy and Legal Insights: Preparing for Regulatory Shifts

On the summit’s second day, the Ministry of SMEs and Startups (MSS) will outline the upcoming policies supporting small business and startup development within Korea’s broader innovation agenda.

Additionally, DLG Law Firm, a legal advisory specializing in venture and startup investment, are also conducting a session titled “The Amendment to the Venture Investment Promotion Act and Startup Investment Guidelines,” offering participants guidance on how to adapt investment practices under the new legislative framework.

Ecosystem Significance: A Defining Moment for Private-Led Growth

The 2026 Startup Investor Summit represents more than an annual gathering. It marks a symbolic transition — the private sector’s readiness to lead through collaboration, accountability, and shared expertise.

The discussions align closely with Korea’s broader shift toward a post-policy innovation model, where accelerators, LPs, and founders co-develop standards of transparency and sustainable growth.

As Busan strengthens its identity as a regional innovation hub, the city’s growing venture network signals a decentralization of startup capital once concentrated in Seoul — paving the way for a more inclusive national innovation ecosystem.

Closing Insight: A Maturing Startup Economy

The Busan summit is capturing the pulse of a maturing startup economy that understands: capital alone cannot sustain innovation.

Korea’s early-stage ecosystem now stands at a critical juncture — evolving from policy dependence toward self-regulating, knowledge-driven growth. The real paradigm shift lies in how investors, accelerators, and founders choose to collaborate across trust, data, and long-term vision.

Key Takeaways on Korea Startup Investor Summit 2026

- Event: Startup Investor & Accelerator Summit 2026, held January 29–30 in Busan.

- Organizer: Korea Association of Initial Investment Accelerators (KAIA).

- Theme: “Beyond Capital, Shaking Paradigms.”

- Focus: Private-led venture ecosystem, sustainable accelerator models, AI-driven investment tools.

- Key Participants: KAIA, Fast Track Asia, Bluepoint Partners, Infobank iAccel, VentureSquare, Busan Metropolitan City, MSS.

- Key Policy Discussion: Venture Investment Promotion Act amendment and startup investment guidelines by DLG Law Firm.

- Significance: Marks Korea’s transition from policy-driven funding toward private-sector leadership in early-stage investment.

- Location Insight: Busan positioned as a cross-border and regional innovation hub.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.