South Korea’s startup policy is shifting from mass funding to precision acceleration. The newly launched Unicorn Bridge Program, a two-year fast-track designed by the Ministry of SMEs and Startups (MSS), represents the government’s clearest attempt yet to convert high-potential startups into globally competitive unicorns.

Unicorn Bridge Program: A Two-Year, Milestone-Based Push Toward Global Scale

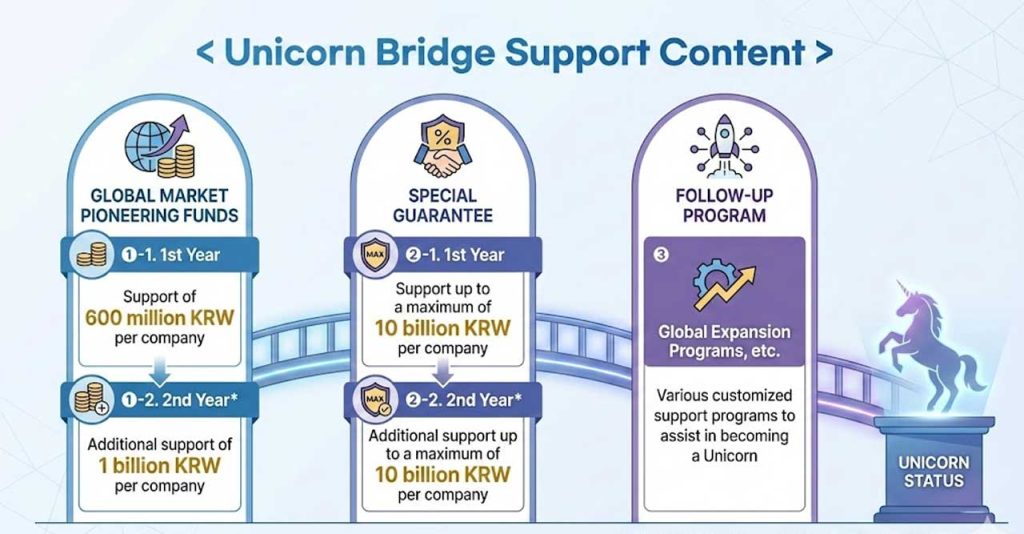

According to the MSS January 30 press release, and coverage by Yonhap, Money Today, and ChosunBiz, the 2026 Unicorn Bridge Program provides selected startup up to KRW 1.6 billion (~ USD 1.2 million) in government grants and special guarantees of up to KRW 100 billion (~ USD 75 million) per year — a total maximum of KRW 200 billion over two years (~ USD 150 million).

Fifty companies will be chosen in the first year to receive KRW 600 million in funding and up to KRW 10 billion in special guarantees for overseas market expansion. In the second year, the top twenty among them will qualify for an additional KRW 1 billion and up to KRW 10 billion in new guarantees.

Eligibility criteria target unlisted startups that have raised at least KRW 5 billion in cumulative investments within five years and meet one of two thresholds — a corporate valuation of at least KRW 100 billion or completion of TIPS R&D or the Super-Gap Startup Project. Deep-tech, AI, semiconductor, and bio companies receive preferential scoring. Applicants must be startups founded within seven years (ten years for new-industry sectors); KONEX-listed companies are also eligible.

Minister Han Seong-sook emphasized that unicorns “are the new engines of national growth through innovation and job creation” and that this initiative aims to “link promising potential unicorns to global investment opportunities.”

Applications are open from January 30 to February 20, 2026, with final selections scheduled for April.

A Pivotal Shift in Korea’s Startup Funding Architecture

The program formalizes what policymakers began shaping through last year’s Mother Fund and NEXT Unicorn Project. While those initiatives expanded total venture capital reserves, Unicorn Bridge focuses on execution — how to transform capital access into measurable scale.

By conditioning funding on milestone achievement, the scheme moves beyond traditional grant allocation. It introduces performance-based public financing, where startups are evaluated on investment traction, R&D progress, and market expansion. Failure to meet annual milestones can lead to partial or full recovery of state funding, a mechanism rarely enforced in Korea’s prior startup subsidies.

The policy’s timing matters: Korea’s unicorn creation rate has slowed since 2022, even as record government budgets were deployed. Unicorn Bridge is a structured answer to that slowdown — not more money, but sharper incentives.

Where Ambition Meets Friction: Milestones and Reality

Behind the scale and ambition lies a demanding compliance structure. According to the MSS press release, participating startups must secure at least KRW 10 billion in follow-on investment in the first year and KRW 20 billion in the second to achieve a “success” rating.

Companies that fall short of their milestones face partial claw-back of funding — KRW 4.2 billion for sincere failure and KRW 6 billion for non-sincere failure in the first year, KRW 7 billion or KRW 10 billion respectively in the second. The ministry allows a one-year grace period before final “success” judgment to account for startup funding cycles

For many founders, this transforms the program from an accelerator into a performance pressure cooker. While policymakers describe it as a “growth ladder,” the required investment milestones exceed what most mid-stage Korean startups have historically achieved within a similar time frame.

Industry experts note that even firms supported under Pre-Unicorn programs or TIPS Scale-Up rarely attract over KRW 20 billion annually without cross-border syndication. Unless private capital partners engage early, the milestone clause could narrow participation to already well-funded ventures rather than expanding opportunity.

Enabling Deep-Tech Scale, But with Limits

The program’s design clearly favors deep-tech sectors — artificial intelligence, system semiconductors, biotechnology, and health tech sectors — where Korea seeks global competitiveness. It leverages the same evaluation ecosystem built around KIBO (Korea Technology Finance Corporation), which guarantees credit access for innovation-heavy firms.

However, the grant ceiling of KRW 1.6 billion, while generous by domestic standards, covers only a fraction of deep-tech commercialization costs. Many AI and semiconductor ventures burn that amount in a single quarter. The policy may therefore serve more as signal capital — validation for private investors — than direct scale-up financing.

For early-stage founders, the high eligibility bar and milestone-linked clawbacks may limit accessibility, concentrating benefits among startups already backed by major venture funds or corporate investors.

Global Relevance: Policy Signaling for Cross-Border Capital

To international investors, the Unicorn Bridge acts as a state certification layer — a signal that selected companies have cleared Korea’s highest technical and fiscal thresholds. It could accelerate partnerships with global venture funds, particularly in Singapore, the U.S., and the Middle East, where Korean AI and semiconductor startups are increasingly active.

By aligning with similar deep-tech initiatives such as Japan’s J-Startup Next and Singapore’s Startup SG Equity, Korea is positioning itself as a co-investment destination for strategic capital. Yet unlike those programs, Unicorn Bridge embeds fiscal discipline through return obligations — including a “success return fee”, under which successful participants must repay KRW 5 billion of their KRW 10 billion second-year grant back to the government.

That mechanism converts government support from subsidy to reciprocal investment, principle global investors recognize and often demand.

A Bridge Built on Pressure and Promise

The Unicorn Bridge embodies the duality of Korea’s startup strategy in 2026 — generous funding anchored by tough accountability. It signals a maturation of public venture policy: less about creating unicorns by number, more about building the scaffolding for globally defensible ones.

Still, the program’s success will depend on private capital’s willingness to co-invest and on policymakers’ flexibility to adjust milestones when market conditions tighten. Korea has learned that no startup becomes a unicorn by decree — it requires both structure and freedom to grow.

Key Takeaways on Korea’s Unicorn Bridge Program

- Program Overview: The Unicorn Bridge Program offers up to KRW 1.6B in grants and KRW 20B in guarantees over two years, with milestone-linked funding recovery.

- Eligibility: Targets unlisted firms with ≥KRW 5B in investment and ≥KRW 100B valuation or completion of TIPS/Super-Gap projects.

- Execution Pressure: Startups must raise KRW 10B in Year 1 and KRW 20B in Year 2 to retain support.

- Policy Shift: Marks Korea’s move from broad subsidy to performance-based public financing.

- Sector Focus: Prioritizes AI, semiconductor, and biotech — key deep-tech areas for global competitiveness.

- Global Implication: Creates a transparent certification channel for foreign investors evaluating Korean startups.

- Strategic Tension: Balances government ambition with realistic founder capacity; success depends on private market engagement.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.