South Korea’s startup sector has entered a phase of consolidation rather than acceleration. According to the latest government data, the country now counts 4.9 million startups—an all-time high—yet growth momentum is slowing amid tighter funding and global uncertainty. The findings mark a critical inflection point for a post-pandemic ecosystem learning to mature through efficiency rather than expansion.

Startup Growth Continues but Slows to 1.5% in 2023

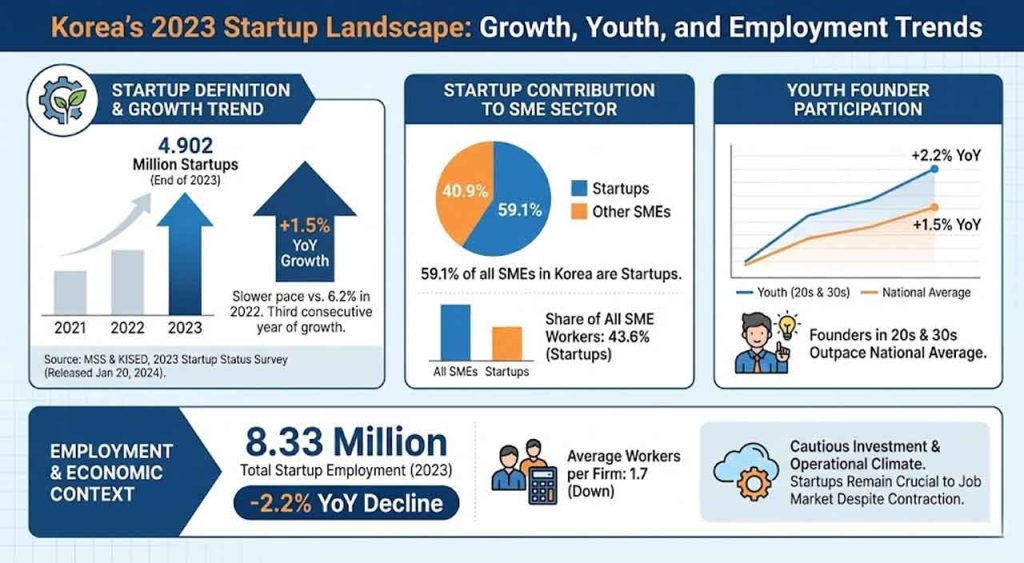

The Ministry of SMEs and Startups (MSS) and the Korea Institute of Startup and Entrepreneurship Development (KISED) released the 2023 Startup Status Survey on January 20, confirming that startups account for 59.1% of all small and medium-sized enterprises (SMEs) in Korea.

As of the end of 2023, Korea had 4.902 million startups, up 1.5% year-on-year, marking the third consecutive year of growth. However, this increase is significantly slower than the 6.2% expansion recorded in 2022, highlighting a more cautious investment and operational climate.

At the same time, youth participation remains a bright spot. Startups led by founders in their 20s and 30s rose 2.2%, outpacing the national average.

Still, despite the rise in new ventures, employment among startups dropped 2.2%, with 8.33 million people employed, averaging 1.7 workers per firm. Startups now employ 43.6% of all SME workers, underscoring their continued importance to Korea’s job market even amid contraction.

Background and Context: A Transitioning Post-Pandemic Economy

The survey defines startups as enterprises within seven years of establishment and is based on official business registry data supplemented by a sample survey of 8,000 companies.

Startups generated KRW 1,134.6 trillion in revenue in 2023, representing 34.4% of all SME sales, though this was a 4.3% decline year-on-year. Average per-company revenue reached KRW 230 million, down from prior levels, reflecting pressure from inflation, higher borrowing costs, and weaker consumption.

Within this landscape, technology-based industries accounted for 20% of all startups (978,847 companies) and 28% of total startup sales, underscoring their higher productivity relative to non-tech sectors.

The information and communications sector grew 12.5%, the fastest among all industries, followed by professional, scientific, and technical services (6%) and education (3.2%).

Non-technology sectors such as energy supply (+16.3%), wholesale and retail (+4.7%), and agriculture, forestry, and fisheries (+4.7%) also showed moderate increases.

While Korea’s startup base has expanded since the pandemic, officials acknowledge the macroeconomic headwinds that tempered 2023 performance. The ministry cited “domestic and global economic uncertainty” and post-pandemic adjustment pressures as primary reasons for the slowdown.

Government Response to the Slowdown

Cho Kyung-won, Director of Startup Policy at the Ministry of SMEs and Startups, stated:

“Although the entrepreneurial base expanded after the end of the pandemic, factors like high interest rates and economic uncertainty have made operations challenging. In 2026, we plan to invest KRW 3.5 trillion in cross-ministerial startup support to move beyond recovery and foster real growth.”

This upcoming KRW 3.5 trillion national startup support initiative will mark the largest such allocation in Korea’s history, signaling a government intent to transition from stimulus-based recovery to capability-based sustainability.

A Maturing Entrepreneurial Landscape for Korean Startups

Beyond growth figures, the survey highlights deep structural changes in Korea’s startup culture.

- Work experience remains the top driver of entrepreneurship — 83.2% of founders said they launched their ventures based on insights gained from prior employment.

- Economic motivation dominates — 64.8% cited higher income potential as their main reason for starting a business, followed by personal aptitude (41.8%) and career sustainability (19.1%).

- Barriers persist — Over 53.7% pointed to funding difficulties, while 45.9% mentioned fear of failure, and 36.7% cited lack of experience or knowledge as challenges.

- Capital remains self-funded — 95.2% of entrepreneurs rely primarily on personal resources, with smaller shares using loans (28.3%) or private borrowing (8.8%).

- Average startup cost — KRW 206 million, reinforcing how self-capitalized the early-stage ecosystem remains.

Meanwhile, 29% of startups were founded by serial entrepreneurs, averaging 2.2 business attempts, reflecting resilience and risk tolerance even amid volatility.

Startups reported an average operating margin of 5.7%, a net margin of 4.2%, and financial costs at 2.3%, illustrating the thin margins typical of early-stage operations.

Growth Quality Over Quantity in the Korea’s Startup Landscape

Korea’s startup landscape is shifting from expansion-driven growth toward structural depth.

The data shows that while the number of startups continues to rise, profitability, scalability, and investment intensity have weakened, signaling the need for ecosystem recalibration.

The increasing concentration of innovation in technology-driven sectors reflects a broader policy realignment: rather than maximizing startup counts, Korea is now emphasizing innovation capacity, sustainability, and international competitiveness.

This trend parallels shifts in venture investment behavior, where investors are prioritizing capital efficiency and domain expertise over sheer volume of deal flow.

Hence for global investors, it shows that Korea’s startup environment remains active but selective, rewarding founders who combine technical expertise with execution discipline.

As for foreign founders eyeing entry into Korea, the findings reinforce the country’s evolving identity as a knowledge-intensive, policy-backed innovation hub — one prioritizing substance over speed.

Looking Ahead to Korea’s Startup Ecosystem in 2026 and Beyond

Korea’s startup momentum is no longer defined by rapid expansion but by resilience and structural refinement.

The upcoming KRW 3.5 trillion national support framework—combining public and private capital—signals an inflection point for the ecosystem.

If 2023 revealed a slowdown, 2026 could mark the beginning of a new phase of consolidation and capability-building.

And the shift toward sustainable, globally relevant innovation suggests Korea’s startup economy is not cooling — it’s maturing.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.