Korea has officially activated the 2026 TIPS (Tech Incubator Program for Startups) R&D phase, signaling the first operational step in its nationwide startup policy overhaul. The initiative raises R&D funding limits, embeds ESG evaluation standards, and mandates regional equity, positioning the country’s startup ecosystem for a new era of sustainable and globally competitive innovation.

Government Launches Expanded 2026 TIPS R&D Framework

The Ministry of SMEs and Startups (MSS) announced the 2026 TIPS Startup Support Plan on January 25, formalizing the largest-ever expansion of the country’s public–private startup support system.

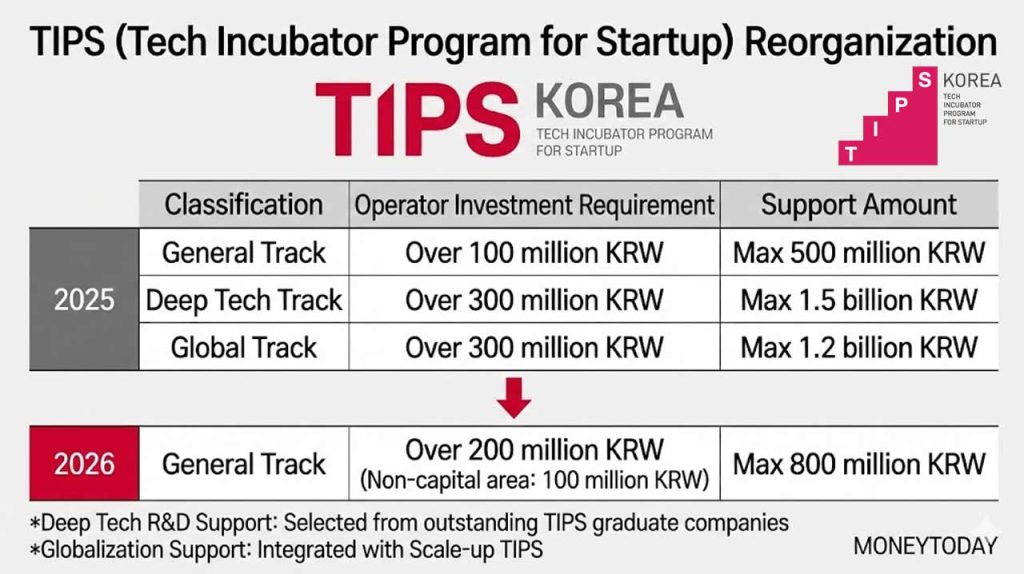

Under the revised framework, the R&D funding ceiling per company rises from KRW 500 million to KRW 800 million over two years—the first increase in 13 years since TIPS began in 2013. The ministry will support 800 startups under the R&D category, up by 100 from 2025, while maintaining 650 companies for commercialization assistance.

TIPS operators—private investment firms certified to identify and incubate promising startups—must now invest at least KRW 200 million in each participating company, double the previous threshold. This change aims to attract stronger private capital participation and heighten due diligence standards in the selection process.

Regional and ESG Priorities Now Structural to TIPS

A structural shift accompanies the funding expansion. Half of all general-track R&D slots will be allocated to startups based outside the Seoul metropolitan area, reflecting the ministry’s goal to reduce regional imbalance and stimulate local innovation capacity.

To level the playing field, non-capital startups face a lower investment requirement of KRW 100 million, compared to KRW 200 million in Seoul. This marks the first formalization of regional quota enforcement within the TIPS framework.

The evaluation process now incorporates social value creation metrics. 10% of general-track R&D slots will be reserved for ESG-oriented companies, including climate-tech and social venture startups. The adoption of corporate retirement pension systems has also been introduced as an evaluation element—counting as a bonus factor in the general track and a mandatory requirement for deep-tech applicants.

Deep-Tech Support: A Graduated Model for High-Impact Innovation

The Deep-Tech Track has been restructured to create a graduated pathway for high-performing startups. Only those that complete General Track are now eligible for Deep-Tech TIPS, which provides follow-up R&D funding of up to KRW 1.5 billion over three years.

This new structure replaces the previous multi-track format (General, Deep-Tech, Global) with a single-track entry model and post-graduation advancement, reducing administrative overlap and funding redundancy.

The ministry clarified that deep-tech support will prioritize AI, semiconductor, robotics, and advanced manufacturing ventures that have demonstrated measurable progress under TIPS’ initial phase.

To reduce the administrative load, the number of in-person evaluations in the Deep-Tech Track has been cut from two to one, while non-R&D evaluations now rely solely on document review.

Stakeholder Perspectives and Policy Intent

Jo Kyung-won, Director of Startup Policy at MSS, emphasized the policy’s intent to connect innovation with scale:

“As AI and deep-tech technologies reshape the global economic paradigm, the potential of innovative startups is more important than ever. This plan reinforces Korea’s growth support system for startups driving technological transformation.”

The Ministry of SMEs and Startups added that the unified model is designed to enhance “funding clarity, follow-on continuity, and private-led efficiency,” while addressing long-standing issues of bureaucratic fragmentation that limited the program’s impact.

Ecosystem Significance: A Turning Point for Korea’s Startup Policy

The 2026 TIPS revision represents a structural pivot in Korea’s startup policy—from entry-heavy support toward growth-oriented, capital-anchored development.

By embedding regional and ESG priorities, Korea is broadening its innovation definition beyond technology output to include sustainability and inclusiveness. This approach aligns with emerging global frameworks linking climate technology and impact investment with national innovation policy.

The increase in R&D ceilings and mandatory operator investment aligns TIPS more closely with OECD-standard venture funding norms, enabling better leverage of private capital. For deep-tech founders, the stepwise model provides a tangible growth ladder—from prototype to scale-up—under one integrated policy system.

Moreover, by simplifying evaluation processes and rewarding corporate welfare practices, the program signals Korea’s shift toward startup governance maturity, where innovation and responsibility advance together.

Future Outlook: A Measured Start to Korea’s Next Startup Chapter

The 2026 TIPS activation marks not only the beginning of the fiscal cycle but the first stage of Korea’s broader startup policy transformation. By linking regional balance, ESG values, and private-led funding mechanisms, the government is recalibrating the country’s innovation economy to be more inclusive and globally attuned.

The effectiveness of this expansion will depend on execution discipline—whether operator quality, evaluation transparency, and follow-up support remain aligned with the program’s long-term goals. For now, Korea’s startup ecosystem stands at the threshold of a new, more globally competitive phase.

Key Takeaways on Korea’s TIPS R&D Program 2026

- R&D funding limit raised from ₩500M → ₩800M over two years — first increase in 13 years.

- TIPS operators’ investment requirement doubled from ₩100M → ₩200M (₩100M for non-capital regions).

- 800 startups to receive R&D support in 2026; 650 startups for commercialization.

- 50% of slots allocated to non-capital region startups; 10% reserved for ESG-focused companies.

- Deep-Tech Track restructured for graduates of General TIPS; follow-up R&D up to ₩1.5B over 3 years.

- Evaluation reforms: simplified to one in-person review; retirement pension adoption added to scoring.

- Policy direction: emphasizes regional equity, ESG inclusion, private-led investment, and sustainable innovation.

- Strategic goal: build a unified, growth-oriented support model connecting early innovation to global scalability.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.