A recent announcement by the Ministry of SMEs and Startups on the ‘2023 domestic venture investment and fund formation trends’ has ignited intense scrutiny over the accuracy of South Korea’s venture capital (VC) market statistics. While the government heralds remarkable growth and recovery, private research organizations paint a contrasting picture, sparking debates over the data collection methodology.

The Ministry’s report, unveiled on February 20, asserts that domestic venture investment surged to a historic KRW 10.9 trillion (USD 8.18 billion) in 2023, marking a 35% increase from the pre-COVID-19 peak of KRW 8.1 trillion (USD 6 billion) in 2020. Moreover, the data highlights a 22% uptick when converted to dollars, showcasing Korea’s robust recovery compared to global markets.

Private Sector Analysis Contradicts Government Figures

However, Startup Alliance, a prominent startup support organization, reports a staggering 52% decrease in venture investment, estimating the figure at KRW 5.3 trillion (USD 3.9 billion) for the same period. This stark contrast underscores the divergence in counting methodologies between government and private agencies.

Startup Alliance’s ‘2023 Startup Investment Report’, released on January 26, revealed a significant reduction in total investment from approximately KRW 11.1404 trillion (USD 8.36 billion) in 2022 to KRW 5.3388 trillion (USD 3.9 billion) in 2023. The organization’s statistics primarily rely on media reports and proprietary research, leading to disparities in reported figures.

Comparative Analysis of South Korea’s Venture Investment Landscape

| Aspect | Ministry of SMEs and Startups Report | Startup Alliance Report | THE VC Report |

| Venture Investment Figures | – KRW 10.9 trillion in 2023, 35% increase from 2020 | – KRW 5.3 trillion in 2023, 52% decrease from previous year | – Contraction in investment market compared to pre-pandemic period |

| Method | – Surveys with venture capitalists | – Reliance on media reports and proprietary research | – Not specified |

| Sector Focus | – Basic technology sectors (AI, semiconductors, robotics) | – Healthcare, Manufacturing, Content & Social | – Aerospace/military, electronics, Semiconductor/display |

| Investment Trends | – Surge in ICT Manufacturing and Electrical/Machinery | – Trend towards early-stage investments | – Increase in the number of investments in certain sectors |

| Data Collection Challenges | – Not specified | – Reliance on company announcements and media reports | – Not specified |

| Call to Action | – Comprehensive support for venture fund raising | – Need for greater transparency and standardization | – Not specified |

Government Report Highlights Surge in Venture Investment

In contrast, the Ministry of SMEs and Startups’ report highlights a clear recovery in South Korea’s venture investment sector compared to the global market. In 2023, domestic venture investment surged by 22% when converted to dollars, showcasing resilience amidst challenging global economic conditions. This growth trajectory contrasts with the United States and Europe, which experienced marginal fluctuations in venture investment levels.

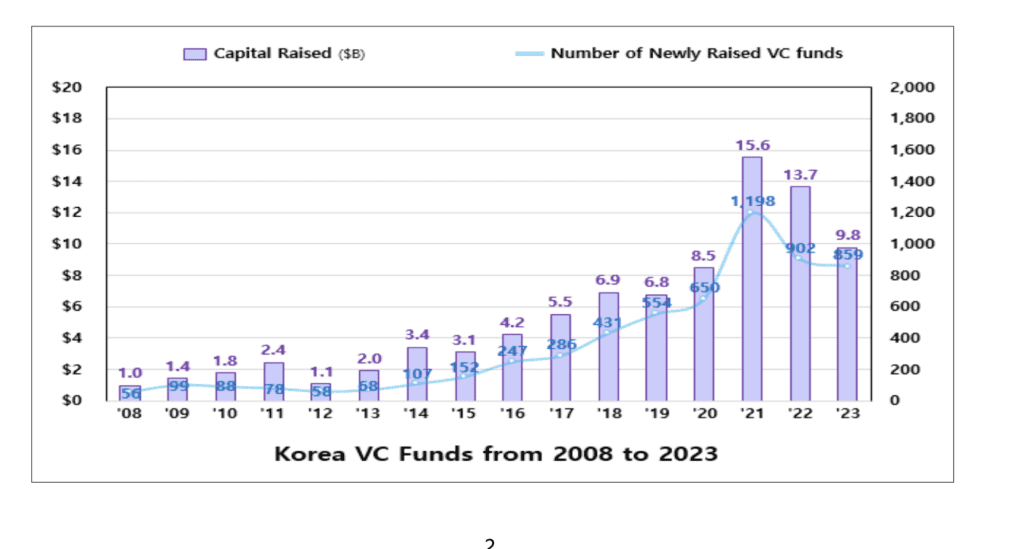

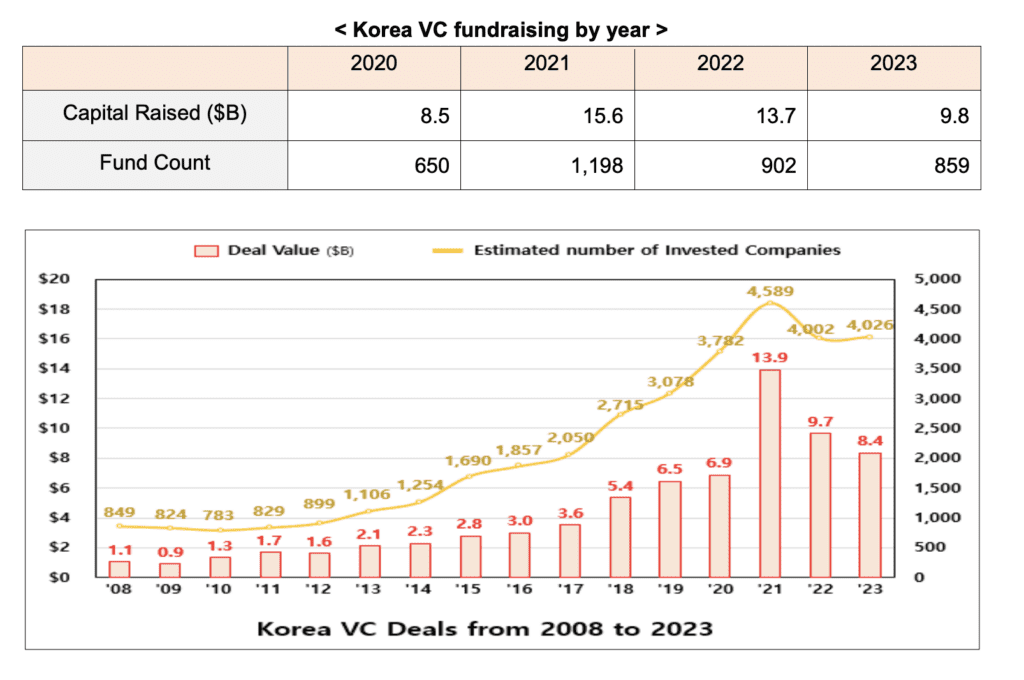

Notably, South Korea witnessed an unprecedented scale of domestic venture investment, reaching KRW 10.9 trillion (USD 8.18 billion). This figure, excluding the exceptional years of 2021-2022, demonstrates a sustained mid- to long-term growth trend, averaging a 16% annual increase since 2008. The year 2023 marked a 35% increase from the pre-COVID-19 peak in 2020, showcasing the sector’s resilience and adaptability.

Also, in the Ministry report a significant shift in investment trends emerged in 2023, with a notable focus on basic technology sectors such as artificial intelligence (AI), semiconductors, and robotics. This departure from COVID-19-related industries underscores investors’ growing confidence in emerging technologies and fundamental innovation.

Investment in ‘Information and Communication Technology (ICT) Manufacturing’ and ‘Electrical, Machinery and Equipment’ sectors surged by 63% and 40% respectively, reflecting a strategic realignment towards deep tech industries. Conversely, investment in ‘Information and Communication Technology (ICT) Service’ and ‘Distribution and Service’ experienced moderate declines, signaling changing investor preferences.

Government Initiatives to Bolster Venture Fund Formation

The formation of domestic venture funds in 2023 also witnessed notable growth and resilience. Despite global challenges, domestic funds experienced a 16% increase in size when converted to dollars, showcasing a solid trend compared to major countries. The annual fund formation amount reached KRW 12.8 trillion (USD 9.6 billion), an increase of 28% from pre-COVID-19 levels.

Continued recovery throughout 2023 is evident in the second-quarter performance, which increased by 82% compared to the first quarter. The Ministry underscores plans to provide comprehensive support for venture fund raising, including injecting policy finance, creating public-private joint funds, and expanding equity funds jointly managed with venture capital companies.

Minister Oh Young-joo said, “The domestic venture investment market in 2023 showed excellent recovery capabilities compared to major overseas countries,” and added, “The industry is also increasing its investment plan for 2024 compared to the previous year, and there is considerable field opinion that the market situation will improve further in the future, so there is a good atmosphere. We plan to mobilize all appropriate policy means to continue.”

Startup Alliance’s Perspective: Downturn in Venture Investment

The government’s announcement is very different from the figures from private research companies. However, the discrepancy between government and private agency statistics underscores challenges in accurately assessing South Korea’s venture investment landscape. Startup Alliance’s reliance on media reports and the Ministry’s survey of venture capitalists reveal fundamental differences in data collection approaches.

According to the Startup Alliance report, the startup investment market witnessed a downturn in 2023, leading to a significant decrease in large-scale investments. However, there was a notable trend towards early-stage investments, with investments under 1 billion won representing 63% (817 deals) of all investment transactions. The primary sectors attracting investments were Healthcare, Manufacturing, and Content & Social, indicating a strategic shift towards areas with potential long-term value, such as Healthcare and deep tech.

Among the sectors, Finance & Insurance, Content & Social, and Manufacturing received the highest investment amounts. Specifically, Finance & Insurance secured 733 billion won ($550 million), Content & Social received 645.8 billion won ($488 million), and Manufacturing attracted 626.8 billion won. Notably, the AI and semiconductor sectors gained significant attention in 2023, with notable investments in healthcare AI precision medicine services like ‘ImpriMed’ and brain disease AI imaging diagnosis solutions such as ‘NEUROPHET’. In the Manufacturing sector, companies like ‘MANGOBOOST’, focusing on DPUs (Data Processing Units), and ‘SEMIFIVE’, specializing in custom semiconductor designs, received substantial investments. In the Content sector, ‘Twelve Labs’ became the first Korean startup to receive investment from Nvidia.

Challenges in Data Collection and Methodology

Startup Alliance’s statistics are based on company announcements and media reports. If the investment amount was undisclosed, it was recorded as ‘0 won’. Of the 1,284 investments compiled by Startup Alliance, 57% (735 cases) were recorded with undisclosed investment amounts. On the other hand, the Ministry of SMEs and Startups conducted surveys with venture capitalists to assess the size of the venture investment market.

Meanwhile, the Korean startup investment database platform, ‘THE VC’, released its ‘2023 Korea Startup Investment Briefing’ on February 29. The report highlights a considerable contraction in the investment market compared to the pre-pandemic period, with noticeable shifts in sector preferences.

According to THE VC report, sectors experiencing an increase in the number of investments compared to the previous year include aerospace/military, electronics, and Semiconductor/display. This suggests a growing preference for manufacturing startups amid the investment downturn. However, only three out of 25 sectors saw an increase in investment amounts: Pet care, media/entertainment, and environment/energy.

The discrepancy between government and private agency statistics underscores challenges in accurately assessing South Korea’s venture investment landscape. As debates intensify over the accuracy of venture investment figures, stakeholders emphasize the need for greater transparency and standardization in data collection methods to provide a more accurate depiction of South Korea’s burgeoning startup ecosystem.

Also Read,

- South Korea’s Venture Investment Plummets by 42% in H1 2023, Amidst Global Caution

- Korean Government Announces $ 858 million Investment in 42 Venture Funds to Foster Innovation

- Korean Venture Market in Freefall: Government Scrambles to Salvage a Crumbling Investment Landscape

- South Korea’s Venture Landscape at Crossroads: Government’s Sweeping Reform Initiatives & Frozen Funds

- Startup Alliance’s Korean Startup Ecosystem Conference Explores Challenges & Opportunities in the Investment Market

Keep tab on latest news in the Korean startup ecosystem & follow us on LinkedIN, Facebook, and Twitter for more exciting updates and insights.