Korea’s National Pension Service (NPS), the largest institutional investor in the country, is now at a turning point. Pension reform will unlock tens of trillions of won in fresh capital annually, sparking debate over whether to channel more into overseas assets or into domestic venture capital. The outcome could reshape not only pension sustainability but also the trajectory of Korea’s startup ecosystem.

National Pension Service (NPS) Reform Sparks Investment Debate

The National Pension Service (NPS) of South Korea is entering a pivotal phase following major pension reforms that will raise contribution rates over the next eight years.

Beginning in 2026, premiums will increase by 0.5 percentage points annually, climbing from 9.5% to 13% by 2033. The reform is expected to generate KRW 65–71 trillion (USD 47–52 billion) in new investable assets each year between 2026 and 2029, even after benefit payouts.

While NPS has traditionally leaned toward overseas investments to secure higher long-term returns, internal discussions are emerging on whether more of this fresh capital should be redirected into domestic venture capital (VC) to fuel local economic growth.

Domestic vs. Global Capital: What NPS Choices Mean for Korean Startups

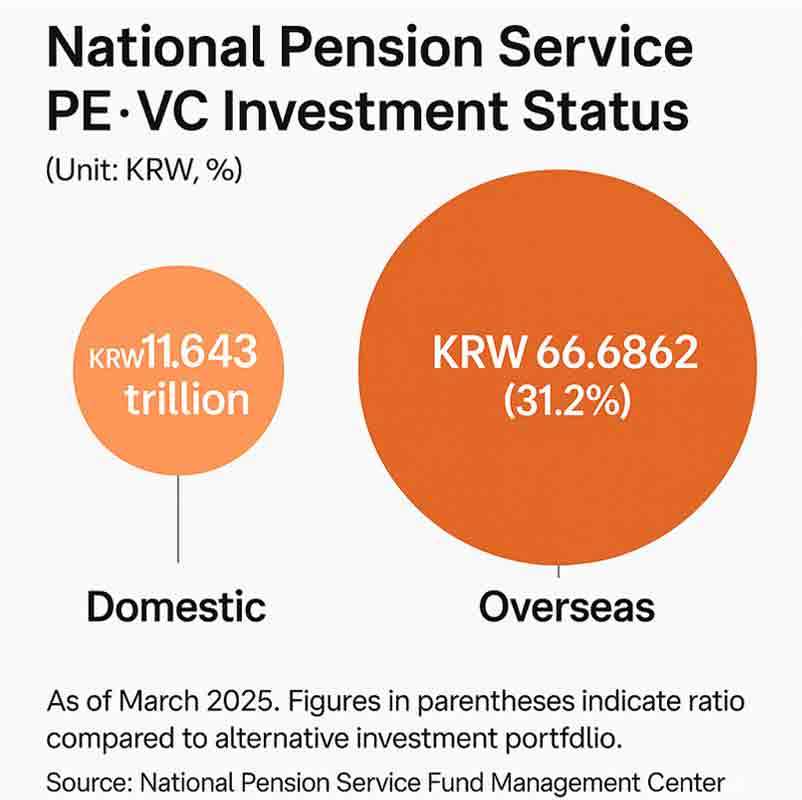

Historically, NPS has pursued a global-first portfolio strategy, expanding allocations to private equity (PE) and venture funds abroad. This approach was designed to secure higher returns and avoid destabilizing the domestic market when funds are eventually drawn down.

Critics, however, argue that the domestic share of VC investment remains disproportionately small.

As of March 2025, NPS managed KRW 213.6 trillion in assets, of which KRW 11.65 trillion went into domestic private equity. Yet the vast majority favored PE over VC. In 2024, NPS allocated KRW 1.55 trillion to domestic private investments — KRW 800 billion went to PE, while VC received only KRW 200 billion.

At the same time, Korea’s policy environment is shifting in favor of venture investment. The government has set a target to build a KRW 40 trillion annual venture market and foster more than 50 unicorns valued at over USD 1 billion.

Therefore, NPS’s adoption of a “unified portfolio” approach — moving away from rigid asset-class distinctions — also opens the door for more flexible domestic allocations.

National Pension Service (NPS) Stakeholder Views: Returns vs. Economic Vitality

During a recent Fund Operational Evaluation Committee meeting, some NPS members suggested raising the share of domestic VC commitments.

One NPS expert explained,

“There are concerns about whether it makes sense to continue investing the additional contributions overseas as planned. From a portfolio diversification perspective, it may be time to reconsider and increase commitments to domestic VCs.”

Others warn that while domestic VC investments may aid Korea’s startup ecosystem, they carry higher risk.

An anonymous source noted:

“If NPS prioritizes domestic VC investment in the name of boosting today’s economy, it risks intensifying resentment among future generations, who already view the pension system as skewed against them.”

This tension highlights the delicate balance between maximizing returns for pension sustainability and supporting domestic innovation.

Could Pension Reform Unlock a New Wave of Venture Capital in Korea?

Now, the outcome of this debate could be decisive for Korea’s startup ecosystem.

Greater participation from the National Pension Service (NPS) in domestic VC would inject significant new capital into early-stage and scale-up companies. It could also accelerate Korea’s efforts to strengthen its venture capital hub, expand the pipeline of globally competitive startups, and stabilize funding cycles that have often been vulnerable to global capital flows.

On the other hand, if National Pension Service maintains its overseas-heavy strategy, Korea’s startups will continue to rely on government programs and private sector initiatives to bridge funding gaps.

The contrast reflects a broader challenge faced by many countries: how to balance pension fund obligations with the role of institutional investors in shaping national innovation ecosystems.

Strategic Crossroads: Pension Sustainability or Startup Growth?

Finally, the pension reform ensures that Korea’s National Pension Service will command vast new resources over the next decade. And how those funds are allocated, either toward overseas markets with historically higher returns, or into domestic VC to energize Korea’s economy, will shape both the sustainability of the pension system and the trajectory of the nation’s startup ecosystem.

And so, for founders and investors watching closely, the NPS’s investment direction will be more than just a financial decision. It will become a signal of how Korea plans to align pension sustainability with long-term innovation and economic growth.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.