The insurance industry worldwide is going through a dramatic transformation, with technology playing a major role. In South Korea, while the market is continuously growing in size, the insurance industry has yet to break away from the traditional way of promotion and sales. Insurers and agents rely on face-to-face sales to sway their customers, and the level of consumer understanding in products remains low. Korean startup CONCAT Inc., which is a newly set up FinTech firm, is launching two unique insurance products to bring in innovation in the insurance sector.

Customer Management & Dental Insurance

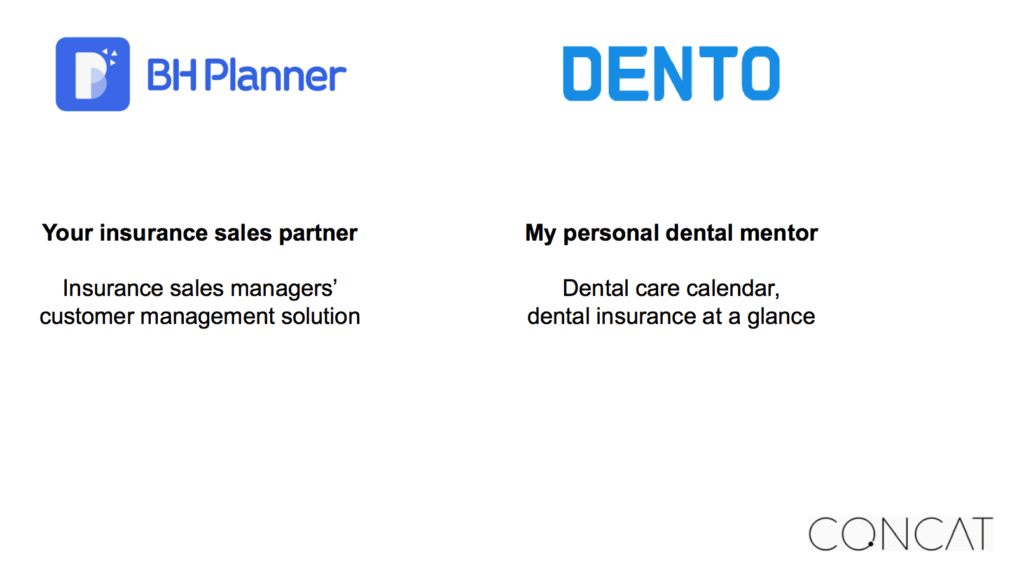

CONCAT is introducing a smart solution specifically designed for insurance agents called BH Planner. The smart app is developed to help agents with their business activities by providing insurance guarantee analysis, product recommendation by the customer, and customer management services. BH Planner will act as an insurance sales partner for the agents so that they can manage customer service efficiently.

The second product by CONCAT – Dento is specialized for dental insurance combined with everyday dental care capabilities. Dento is a comprehensive solution that combines dental practice management, dental check-up diary, and dental insurance services. This service helps the user to take care of their teeth in a healthier and financially rational manner. Users can fit in brush habit calendars, dental clinic records, and personalized dental insurance analysis reports using Dento.

CONCAT will be releasing both its innovative solution in the first quarter of 2020, which is February 2020. The startup’s revenue model will be based on service fees and commission from affiliated general agency partners. For BH Planner, the company intends to keep a subscription-based model and brokerage fee for new customer referrals.

Aspiring to lead smart solution in the insurance sector

Started in 2018 by a core engineering team with capabilities in deep learning and data analytics technologies, the startup has a track record of developing and operating an insurance app named Bople. Managed by A+ Asset Inc., the Bople app available for both Android and iOS helps users analyze insurance coverage through various variables like death, cancer, cerebrovascular disease, cardiovascular disease, loss, and surgery, etc.

Bople is quite a successful app, with more than 300 million customer subscriptions. Now with the two more apps, CONCAT hopes to cover a major share in the smart solution for the insurance sector in Korea.