Korea’s ambition to build a balanced national startup ecosystem faces a critical funding challenge. New data reveal that the vast majority of venture and policy capital remains concentrated in the Seoul metropolitan area, raising concerns among global investors and policymakers about the country’s ability to sustain inclusive innovation and regional competitiveness in its next phase of startup growth.

Korea’s Funding Imbalance Raises Concern for Regional Startup Growth

A new government analysis has revealed a deepening concentration of startup and SME investments in Korea’s capital region, reigniting debate over the country’s regional innovation imbalance.

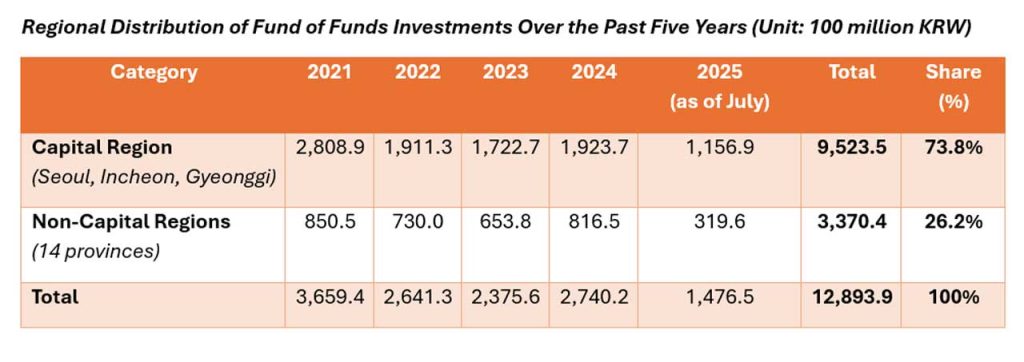

According to parliamentary data reviewed by the National Assembly’s Industry, Trade, Energy, SMEs and Startups Committee, 73.8% of the national “Fund of Funds” (Mother Fund) investments and 3.5 times more policy financing per region were directed to Seoul, Incheon, and Gyeonggi Province compared to the rest of the country.

The findings, presented by Rep. Oh Se-hee of the Democratic Party of Korea on October 12, show that the structural gap between metropolitan and regional ecosystems remains a major barrier to Korea’s balanced startup development strategy.

Capital Region Captures 74% of Korea’s Fund of Funds Investments

The Korea Fund of Funds — known locally as the Mother Fund — is a core national instrument for fueling early-stage venture investments and supporting innovative SMEs.

However, data show that capital-region startups received KRW 9.52 trillion (US$6.9 billion) out of the KRW 12.89 trillion total investment made between 2021 and July 2025.

By contrast, non-metropolitan regions received only KRW 3.37 trillion (26.2%), signaling that most venture capital flows are still concentrated where investor networks and accelerators are already established.

This concentration suggests that Korea’s venture ecosystem, despite years of decentralization efforts, remains heavily capital-centric, limiting growth opportunities for emerging innovation clusters in cities such as Busan, Daegu, Daejeon, and Gwangju.

Policy Financing and Startup Education Show Similar Capital Bias

The imbalance extends beyond investment into government policy financing and startup education programs.

Over the past decade, the total policy fund execution reached KRW 17.12 trillion, but regional distribution remained uneven when viewed on a per-province basis.

Each of the three capital-area regions received an average of KRW 2.46 trillion, while the 14 provincial regions received KRW 697.2 billion each — roughly 3.5 times less. Even the Youth Startup Academy, Korea’s flagship entrepreneurship training program, reflected this pattern. Out of 4,595 participants enrolled over five years, 1,835 (39.9%) were based in Seoul, Incheon, or Gyeonggi.

Analysts warn that such concentration may further accelerate the migration of young entrepreneurs to the capital area, weakening local innovation pipelines.

Calls for Structural Reform to Revitalize Regional Economies

Rep. Oh Se-hee emphasized the urgency of rebalancing government investment frameworks to prevent regional economic stagnation,

“With over half of Korea’s GRDP and most major enterprises already concentrated in just 12% of the national territory, government policies should not reinforce this pattern.

As the President has noted, balanced regional development is not about preference but about national survival. The government must urgently redesign its investment and support systems to ensure that regional economies can truly revitalize.”

Policy experts have echoed the concern, suggesting that without institutional changes — such as location-based investment incentives, more balanced regional fund-of-funds structures, and localized incubator networks — regional startups will continue to struggle to attract capital and talent.

What the Imbalance Means for Korea’s Startup Ecosystem

The findings highlight a core challenge in Korea’s innovation and decentralization agenda. While the regional mother fund and regional startup hub programs have recently succeeded in promoting Korea’s regional startup development, the underlying financial structure remains disproportionately urban.

This imbalance may discourage private investors from exploring opportunities outside Seoul, perpetuating a feedback loop where startups migrate to the capital to access funding, networks, and mentorship. And despite Korea’s effort to build its regional startup development, the imbalance in Mother Fund investment trends will still signal to global investors and partners that Korea’s innovation economy is thriving — but unevenly distributed.

If unaddressed, the gap could hinder Korea’s broader goal of establishing a nationwide startup corridor capable of sustaining global competitiveness beyond its metropolitan core.

Toward a More Balanced Innovation Framework

The government’s upcoming SME and Startup Policy Reform Plan, expected in late 2025, is seen as a potential turning point. Stakeholders across venture capital, academia, and policy sectors are calling for regional co-investment schemes, public-private matching funds, and cross-provincial accelerator networks to ensure fairer access to capital.

For now, the data signals a necessary reform for Korea’s policymakers: Korea’s startup success cannot remain capital-bound. Sustainable innovation requires nationwide participation — where every province, not just Seoul, becomes part of the country’s next growth chapter.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.