Despite record government allocations, Korea’s K-Content funds are leaving vast amounts of capital untouched. A surge in unspent budgets, poor fund performance, and rigid investment criteria reveal structural cracks in Korea’s approach to intellectual property and creative industry finance. The situation raises urgent questions about how Korea can sustain its cultural influence globally while building an investable pipeline for the next KPop Demon Hunters.

Billions in K-Content Funds Remain Unused: A Systemic Warning

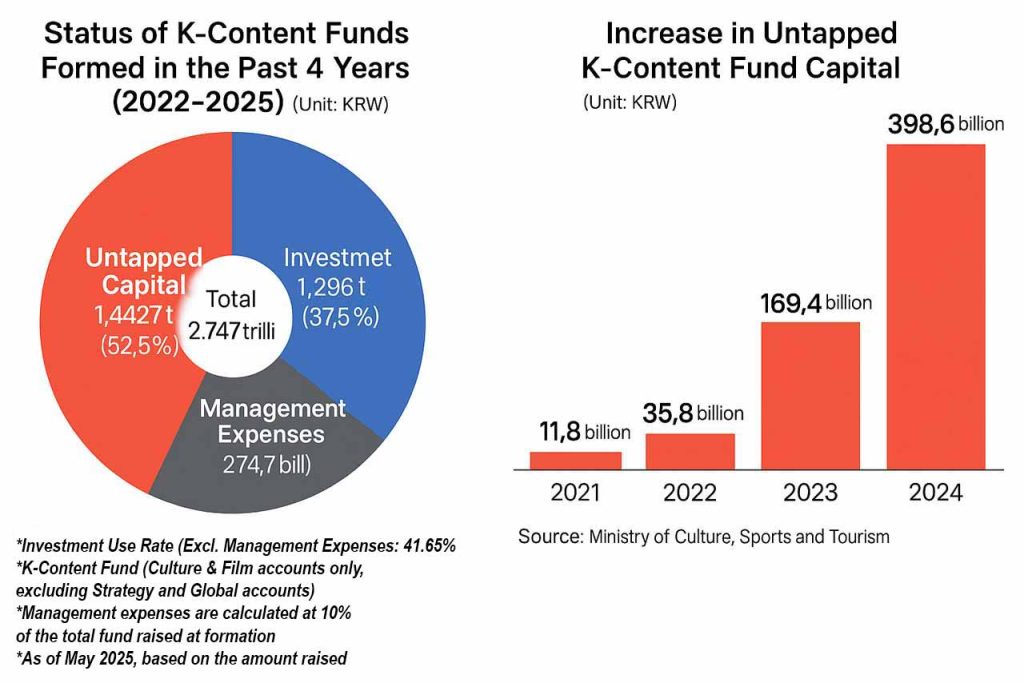

According to analysis of Ministry of Culture and National Assembly Budget Office data, K-Content funds formed between 2022 and May 2025 totaled ₩2.747 trillion (US$2 billion). Yet only 37.5% (₩1.03 trillion) has been deployed. After accounting for management costs, ₩1.44 trillion (US$1.05 billion) remains unspent.

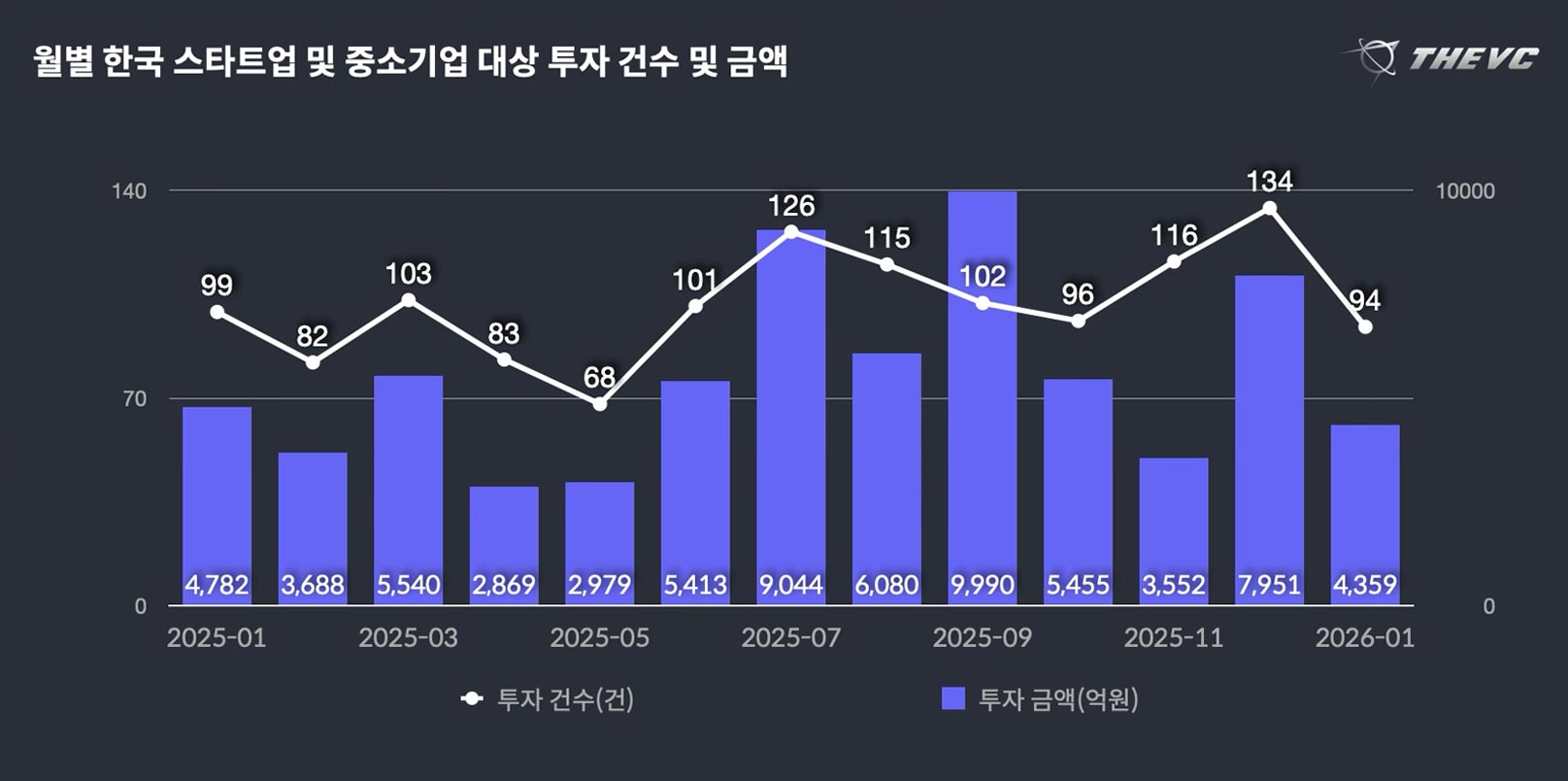

The scale of idle funds has grown rapidly. In 2022, just 10% of capital went unused. By 2023, the figure had exceeded 35%, and last year it surpassed 50%. This stands in stark contrast to Korea’s venture capital market overall, where dry powder was only 17.4% in 2023 and actual investments outpaced fund formation.

Why the K-Content Funds Struggle to Find Investment Targets

Industry insiders cite two main obstacles that caused the struggle of Korea’s K-Content development: poor profitability and rigid investment rules.

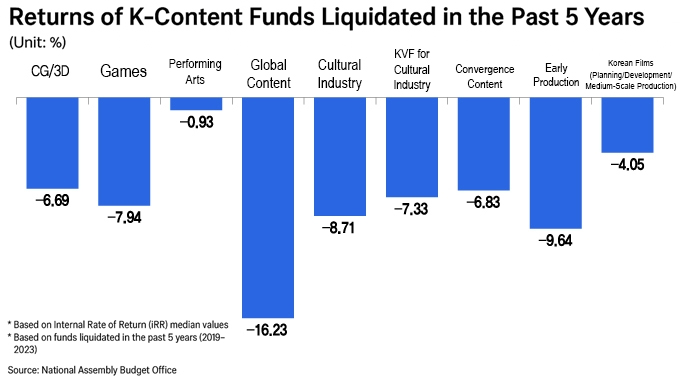

Between 2019 and 2023, nine sub-funds under the cultural and film accounts reported negative returns. Losses were sharpest in “Global Content” (-16.2%) and “Early-Stage Production” (-9.6%). Even the best-performing category, performing arts, posted -0.9%.

This track record discourages private limited partners (LPs). Several fund managers failed to raise matching capital in 2023 and 2024, returning their licenses. Complicated eligibility rules also block potential investments.

For example, a film that performs strongly in Korea but falls short of the “20% overseas revenue” benchmark may not qualify for global content funds. Startups that use cultural IP in products or cross-sector applications are also often excluded.

What VCs and Policymakers Say Must Change to Unlock K‑Content Investment

Venture capital executives are increasingly critical of the fund’s structure. One VC leader admitted, “We once invested in a drama and never recovered a single won. Since then, we avoid cultural projects altogether.” Another added, “With deep tech offering clearer returns, there is little incentive to choose a sector where rules are rigid and margins are uncertain.”

Policy analysts also warn against unchecked budget expansion. Song Jin-ho of the Fiscal Reform Institute noted,

“With 2024’s surge in cultural fund allocations still unspent, another large-scale injection risks locking up taxpayer money without results.”

Others argue for broader solutions. Lee Jong-myeong of the Korea Chamber of Commerce said,

“Korea lags the U.S., Japan, and even China in IP competitiveness. We need comprehensive legislation, even a dedicated IP sovereignty fund, to defend our position against global platforms.”

Korea’s Global IP Ambitions at Risk: Lessons for Startups and Investors

The issue highlights deeper vulnerabilities in Korea’s innovation strategy. Despite the global success of K-pop and K-drama, cultural exports still account for only about 10% of sales. Meanwhile, Korea has yet to break into the world’s top ranks for IP ownership.

Without reform, K-Content funds risk becoming a symbol of policy ambition without industrial traction. By contrast, sectors like pharmaceuticals and R&D commercialization have delivered double-digit returns, attracting private capital and sustaining long-term growth.

This reality has become a crucial lesson for players and innovators in the Korean startup ecosystem. The access to capital in creative industries is constrained not by lack of funds but by systemic barriers in allocation and IP monetization. And so, the challenge lies in designing vehicles that move beyond one-off projects toward sustainable IP pipelines and global expansion strategies.

Building an Investable K-Culture Future

Korea’s ambition to remain a cultural powerhouse requires more than headline budgets. Reforming K-Content funds to support IP ownership, diversify eligible investments, and align with global strategies is essential. Long-term, equity stakes in production companies, broader definitions of cultural ventures, and stronger international IP acquisition policies could transform losses into growth.

If Korea can shift its K-Content investment framework, the next KPop Demon Hunters may not only captivate global audiences but also generate enduring value for Korea’s innovation ecosystem. Without such changes, billions will remain unused, and Korea risks losing ground in the global IP race.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.