South Korea’s latest job forecast shows a revealing divide in its innovation economy. Semiconductor employment is projected to rise on AI-driven exports and capital investment, yet most other industries remain stagnant or in decline. This imbalance exposes a deeper question for policymakers: how to sustain the country’s AI and automation leadership while reviving human capital across the broader industrial base.

Semiconductors Shine While Other Manufacturing Jobs Stall

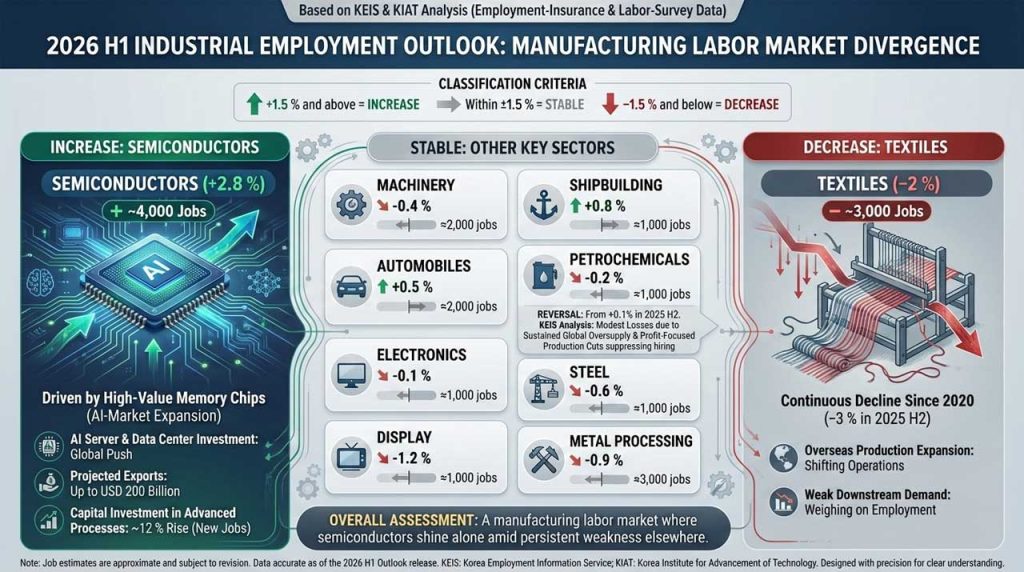

According to a joint report released on February 6 by the Korea Employment Information Service (KEIS) and the Korea Institute for Advancement of Technology (KIAT), Korea’s semiconductor industry is expected to expand employment by 2.8% in the first half of 2026, driven by a surge in AI-related demand and memory chip exports.

This increase marks the sector as the only clear job growth engine among the nation’s ten major manufacturing industries.

The analysis covered machinery, shipbuilding, electronics, textiles, steel, semiconductors, automobiles, displays, metal processing, and petrochemicals — all classified as Korea’s core industrial sectors.

While semiconductors continue to benefit from global AI infrastructure expansion, employment in textiles is forecast to fall 2%, and other sectors will remain largely unchanged. The overall manufacturing job market is expected to contract by around 1%, continuing a three-year trend of employment decline.

A Fragmented Recovery Behind Industrial Stability

Despite modest signs of stabilization compared with late 2025, the data reveal uneven recovery patterns across manufacturing.

Shipbuilding employment is expected to rise 0.8% as high-value vessel exports resume. Automobiles could edge up 0.5%, supported by new model launches and steady demand for eco-friendly vehicles.

However, machinery, electronics, steel, displays, and metal processing will see either flat or negative growth ranging from –0.1% to –1.2%.

The petrochemical industry, which briefly posted gains in late 2025, is turning negative again (–0.2%) due to global oversupply and margin-driven production cuts.

Analysts note that while employment losses are slowing, automation, cautious investment, and weak external demand are limiting the potential for rebound.

“Manufacturing employment may be stabilizing, but the foundation for sustained recovery is still missing,” KEIS commented, warning that the sector “requires export and investment revival to shift into positive growth.”

Stakeholder Observations and Policy Context

The latest data were jointly reviewed by both institutions under government coordination, offering policymakers a clearer picture of post-pandemic industrial transformation.

Their findings confirm that semiconductors remain Korea’s employment outlier, supported by expanding global data center construction and rising AI infrastructure orders.

Government projections suggest Korea’s semiconductor exports could reach USD 200 billion in 2026, with facility investment increasing about 12% year-on-year. These figures underline the role of AI-related manufacturing as the nation’s new growth pillar, directly tied to prior policies under the Ministry of SMEs and Startups (MSS) promoting “AI Transformation (AX)” in small and mid-sized enterprises.

At the same time, ongoing labor-policy coordination between the MSS and the Ministry of Employment and Labor (MOEL) — formalized through their January 2026 MOU — aims to address structural workforce shortages by aligning AI training programs with SME hiring demand.

That initiative could become a critical counterbalance to the manufacturing sector’s uneven job distribution.

The Human Side of Korea’s AI-Driven Economy

For the global startup and investor community, the report exposes how Korea’s industrial transformation is increasingly shaped by AI demand concentration.

While automation creates efficiency, it also deepens employment asymmetry between high-tech and traditional sectors — a challenge that directly affects the nation’s startup labor pipeline.

Startups in industrial AI, robotics, and deep-tech manufacturing may benefit from this momentum as capital and policy continue to prioritize semiconductor-linked innovation.

However, for early-stage ventures in textiles, consumer goods, or hardware production, a contracting employment base means talent mobility and mid-career recruitment could tighten further.

This is the same structural tension previously seen across Korea’s startup landscape — where public policy success coexists with human strain.

If left unaddressed, the divide between automated growth sectors and labor-intensive ones could weaken Korea’s innovation workforce at a time when AI and human capital need to advance in tandem.

Toward an Inclusive Industrial Transition

Korea’s manufacturing outlook reflects more than an economic forecast — it defines the next test for industrial policy.

The nation’s semiconductor strength underscores its technological leadership, yet it also exposes a systemic imbalance: an innovation economy expanding through AI investment but narrowing in job creation scope.

The question now facing Seoul’s policymakers is how to translate AI productivity gains into broader employment resilience. Efforts such as the MSS–MOEL partnership and expanded AI literacy programs for SMEs are early signs of coordination, but their effectiveness will depend on how quickly Korea can synchronize automation progress with sustainable workforce development.

For Korea’s startup ecosystem — and for global observers studying industrial AI transitions — this moment captures a key inflection: AI-led growth alone cannot define the future.

The next phase of competitiveness will depend on how effectively Korea rebuilds human capital around its technological core.

Key Takeaways on Korea’s H1 2026 Employment Forecast

- Semiconductors remain Korea’s only clear employment growth sector, with a projected +2.8% increase in H1 2026 driven by AI and export demand.

- Overall manufacturing employment expected to decline ~1%, extending a multi-year contraction.

- Textiles to fall 2%, while shipbuilding and automobiles see modest gains of 0.8% and 0.5% respectively.

- Automation, weak global demand, and conservative capital spending continue to limit hiring across industries.

- Korea’s policy focus now shifts to balancing AI-driven industrial growth with workforce sustainability.

- Coordination between the Ministry of SMEs and Startups and the Ministry of Employment and Labor will be central to building a sustainable talent pipeline.

- The 2026 labor outlook underscores the strategic need for human capital recovery to match Korea’s rapid AI transformation.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.