Korea’s next transformation is no longer about funding the next startup—it’s about engineering the next global standard. By aligning pension capital, deep-tech infrastructure, and international startup hubs, the nation is moving to redefine how venture ecosystems are built and scaled. What emerges is a strategic shift in how innovation, capital, and national ambition intersect.

Korea Launches ₩40 Trillion National Venture Investment Strategy

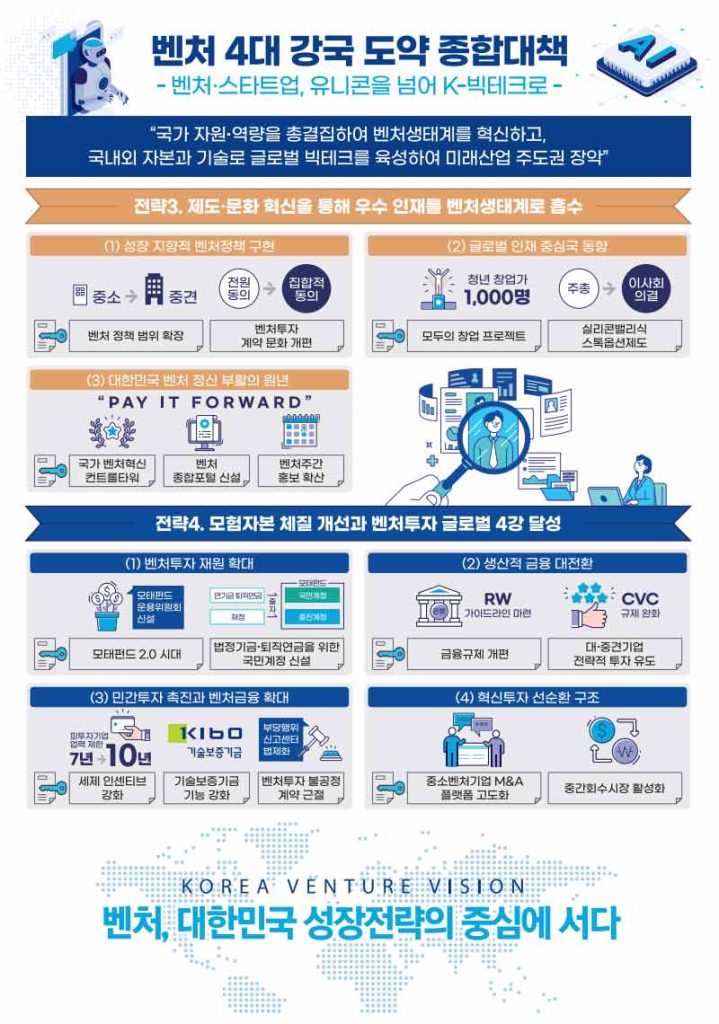

The Ministry of SMEs and Startups (MSS) has announced a sweeping plan to transform Korea into one of the world’s top four venture nations by 2030.

The comprehensive roadmap, titled “Leap into the Top Four Global Venture Nations,” outlines the government’s plan to cultivate 10,000 AI and deep-tech startups, produce 50 unicorns and decacorns, and expand the venture investment market to KRW 40 trillion annually.

This strategy aims to mobilize pension capital, accelerate AI and deep-tech development, and establish international startup hubs connecting Korea’s ecosystem with Silicon Valley, Singapore, Tokyo, London, and New York.

Strategic Investments: GPUs, Deep-Tech Industries, and AI Unicorn Creation

A central feature of the plan is the strategic allocation of 50,000 high-performance GPUs for startup R&D and product validation. The allocation will prioritize Korea’s six national strategic industries — AI, biotechnology, content, defense, energy, and advanced manufacturing — ensuring startups gain access to critical infrastructure for innovation and testing.

Through the Next-Generation Unicorn Discovery and Growth Project, the government will provide up to KRW 100 billion (~USD 66 million) in phased investment and guarantees per company, with total support reaching KRW 13.5 trillion by 2030. Additional follow-up investment will come through large-scale with follow-on investments linked to the National Growth Fund.

The Ministry also plans to expand the TIPS program with 10% preferentially allocated to ESG-focused and deep-tech ventures, ensuring equitable participation from regional and social innovators.

Along with the TIPS expansion, they will also launch the “Everyone’s Startup Project,” a nationwide initiative to discover 1,000 aspiring founders annually through multi-stage competitions and mentorship programs.

Complementing this, Korea’s open innovation framework will shift to a milestone-based system, tying funding to verifiable progress and fostering accountability across R&D and commercialization stages.

Capital Reform: Pension Funds and Financial Deregulation Powering a ₩40T Market

At the financial level, the government is creating a dedicated “National Account” within Korea’s Fund of Funds, enabling pension and retirement funds to invest in the venture market. To reduce institutional hesitation, the Fund of Funds will take first-loss positions, effectively derisking private capital participation.

The Ministry will also establish a cross-ministerial steering committee to enhance transparency and align fund operations with national growth priorities. Financial regulations will be restructured to promote venture investment, with banks receiving new risk-weighting guidelines for policy fund participation and securities firms—particularly large investment banks—required to supply risk capital for unlisted ventures.

Tax incentives will be expanded by extending the investment eligibility period for startups from seven to ten years and increasing tax credits for corporate venture fund contributions. The government’s goal is to position private capital as the new engine of Korea’s venture growth.

Global and Regional Expansion: Startup Hubs and Re-Challenge Support

The MSS will establish startup and venture campuses in major innovation cities — Silicon Valley, Tokyo, Singapore, London, and New York — while launching a Global Startup Hub in Seoul to connect domestic founders with global investors and accelerators.

Domestically, the ministry will designate ten regional startup cities under the KRW 3.5 trillion Regional Growth Fund and the “Five-Core and Three-Specialized Region (5극 3특)” development framework. Each hub will integrate local startup parks, creative economy centers, and science-and-technology universities to anchor deep-tech incubation centers and global startup collaboration facilities—ensuring balanced capital and talent dispersion beyond Seoul.

The government will also formalize a Re-Challenge Support Headquarters to oversee nationwide re-startup policies. This includes a KRW 1 trillion Re-Challenge Fund supporting founders who failed in earlier ventures and introducing new technology guarantees for re-established firms.

The Re-Challenge Headquarters will oversee 19 regional Re-Challenge Centers nationwide, serving as one-stop platforms for guidance, financing, and retraining. In addition, the ministry will establish technology guarantees for re-founded ventures, helping founders who previously defaulted on loans to re-enter the startup ecosystem with fairer conditions.

A National Bet on Innovation and Resilience to Become Top Venture Powerhouse

In statements supporting the announcement, Vice Minister Noh Yong-seok underscored the urgency of Korea’s transformation, stating,

“Becoming one of the world’s top four venture nations is tied to the country’s future survival. The success of our next-generation unicorns will depend on their global expansion capabilities and competitiveness in deep-tech innovation.”

Minister Han Seong-sook emphasized the same long-term vision in her remarks, adding,

“The next wave of unicorns will emerge on the AI highway. Korea must build a venture ecosystem capable of transcending domestic dependence and competing on the global stage.”

The roadmap also includes the creation of a Senior Venture Fund, enabling successful founders and early investors to reinvest in new startups, strengthening intergenerational collaboration within Korea’s venture scene. To commemorate ecosystem achievements, the ministry will institutionalize Venture Week, establish a Venture Hall of Fame, and introduce the Venture Milestone Club recognizing companies surpassing KRW 100 billion in annual revenue.

Industry leaders, including the Korea Venture Capital Association (KVCA) and Korea Venture Business Association (KOVA), welcomed the plan, calling it the most actionable blueprint yet for fostering a sustainable innovation cycle that bridges investment, M&A, and secondary markets.

Redesigning the Venture Growth Model

The KRW 40 trillion initiative represents a structural shift from a support-based to a growth-driven venture policy. It aligns Korea’s innovation strategy with global standards where public and private capital converge to scale startups from early R&D through global commercialization.

By mobilizing long-term pension capital and deregulating corporate venture participation, Korea is setting the foundation for a self-sustaining investment ecosystem. The introduction of secondary funds, M&A guarantees, and expanded exit channels aims to resolve a long-standing weakness in Korea’s venture cycle — limited liquidity for investors.

The ministry also plans to enhance Korea’s venture exit environment by upgrading its national M&A platform for integrated discovery, advisory, and financing. M&A guarantees will increase from KRW 30 billion in 2025 to KRW 200 billion by 2030, supported by an expanded suite of secondary funds—including general, LP interest, and continuation funds—to stabilize the mid-exit and reinvestment cycle.

The plan also places strong emphasis on inclusivity, linking re-challenge founders, regional innovators, and social ventures into a single national framework. This approach positions Korea not only as a venture capital powerhouse, but also as a model of sustainable entrepreneurial governance in Asia.

Toward a Connected, Global Venture Future

Finally, Korea’s new venture blueprint signals a decisive leap toward an integrated, globally relevant startup economy. By connecting capital, infrastructure, and policy across borders, it aims to turn the nation’s innovation ecosystem into a launchpad for the next generation of AI and deep-tech unicorns.

The coming decade will test whether this systemic redesign—anchored by pension-backed capital, high-speed computing access, and regional inclusivity—can deliver Korea’s ambition to stand alongside the world’s leading venture nations.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.