Korea’s venture ecosystem is entering a defining moment. The Korea’s Fund of Funds (Mother Fund)—a central pillar of Korea’s venture-investment ecosystem—has reached its 20-year milestone. Government officials, lawmakers, and industry leaders gathered in Seoul to examine its legacy and debate how it must evolve as global competition in AI and advanced technologies intensifies. Their discussions signal critical changes ahead for Korea’s capital formation strategy.

Korea’s Fund of Funds Marks 20 Years at Policy Forum in Seoul

The Ministry of SMEs and Startups hosted a policy forum on November 14 at the Kensington Hotel in Yeouido to commemorate the 20th anniversary of Korea’s Fund of Funds (Mother Fund).

The event was co-organized with Korea Venture Investment Corporation (KVIC) and brought together policymakers, venture capital firms, startup leaders, and academic experts.

Participants reviewed two decades of performance and examined core issues shaping the next phase of Korea’s venture-investment system. Key topics included extending the Fund’s statutory lifespan, strengthening its role in attracting private LPs, and expanding support for national strategic industries.

Korea’s Fund of Funds: A Two-Decade Role in Building Venture Investment Backbone

The Fund of Funds was launched in 2005 as a government-backed “mother fund” meant to seed private venture funds, and over the past two decades it has become a key pillar of early-stage funding in Korea.

At its 20th-anniversary forum, participants pointed to several structural factors behind its sustained influence. They noted its stable organization and budgeting, which allowed long-term professional capacity to develop. They also highlighted its role in shaping the investment cycle that drives modern venture markets and its ability to draw in private investors, including pension funds, retirement funds, corporations, banks, and public enterprises.

By the first half of 2025, Korea’s Fund of Funds (Mother Fund) had accumulated approximately KRW 10.9063 trillion (~ USD 8.39 billion) in committed government capital, which private partners leveraged to create roughly KRW 45.0896 trillion (~ USD 34.68 billion) in sub-funds.

Shaping the Korea’s Fund of Funds Discussion

Minister Han Seong-sook opened the conversation by reaffirming the Fund of Funds’ long-standing role in Korea’s venture landscape,

“The Fund of Funds has been a strong pillar and growth engine of Korea’s venture-investment ecosystem over the past 20 years. We will strengthen its role so diverse capital can flow into the venture market and establish it as a sustainable platform.”

Smilegate Investment CEO Nam Ki-moon shared what the Fund has meant in practice. His firm built 22 funds and backed nearly 600 companies, starting with early support from the Fund of Funds, noting:

“Venture funds require long operational horizons. Without the ability to invest beyond seven years, the venture ecosystem becomes unstable.”

Mission Law Attorney Lee Soo-jin added a policy perspective, noting that the Fund’s purpose is rooted in supporting risk capital.

“The core of the Fund of Funds is policy support for risk capital. Competing with large global AI companies demands comprehensive and systematic support.”

At the same time, participants also emphasized that the Fund must expand its role in attracting new LPs and strengthen its support for AI, deep tech, and non-metropolitan investment.

More Demands for Longer Lifespan for Korea’s Fund of Funds

One central issue dominated all discussions: the Korea’s Fund of Funds is legally set to expire in 2035.

Given that most venture funds operate for seven to ten years, experts warned that new commitments could begin declining as early as 2027. Multiple sources noted concerns that this would constrain long-term investment capacity at a time when global tech competition is intensifying.

Comparative insights from the forum include:

- AI and deep-tech race: Participants repeatedly underscored that Korea must sustain long-term capital availability as global technology leaders accelerate investment in advanced sectors.

- Regional investment gaps: Non-metropolitan regions still require policy-backed capital to attract early-stage investors.

- Private LP participation: Recent examples—such as the Trade Insurance Fund joining venture investment for the first time—were cited as signs that the Fund of Funds can pull new institutional capital into the ecosystem.

- Legislative movement: A bill introduced in September would restructure the Fund’s statutory duration into renewable 30-year periods, removing the single-end-date constraint.

Therefore, more calls for extension were consistent and strongly aligned with Korea’s national innovation priorities.

Ecosystem Significance for Korea and Global Stakeholders

The 20-year anniversary arrives at a moment when Korea is aiming to position itself as a top-tier global AI and venture hub. That is why the implications are notable for investors, founders, and international policymakers:

1. The Fund of Funds remains central anchor of Korea’s venture-investment landscape.

The long-term stability of Korea’s Fund of Funds (Mother Fund) has shaped the venture-investment landscape more than any other policy instrument, especially in early-stage and deep-tech funding.

2. Strategic industries depend on sustained capital cycles.

AI, semiconductors, biotech, and frontier technologies require multi-cycle investment horizons. Without extending the Fund’s lifespan, Korea risks losing ground in sectors where global competitors invest aggressively.

3. Korea is actively seeking more institutional LPs.

The emergence of the “LP First Step Fund” and “Startup Korea Fund” reflects the government’s intent to broaden participation from pension funds, banks, and corporates. This shift may reshape LP dynamics in Asia’s venture markets.

4. Non-metropolitan innovation remains a national priority.

Participants also highlighted the need for policy-backed capital outside the Seoul capital region. This is an area with ongoing structural funding gaps, in which the country is currently improving with various regional development strategies.

5. Upcoming national strategy will set the direction.

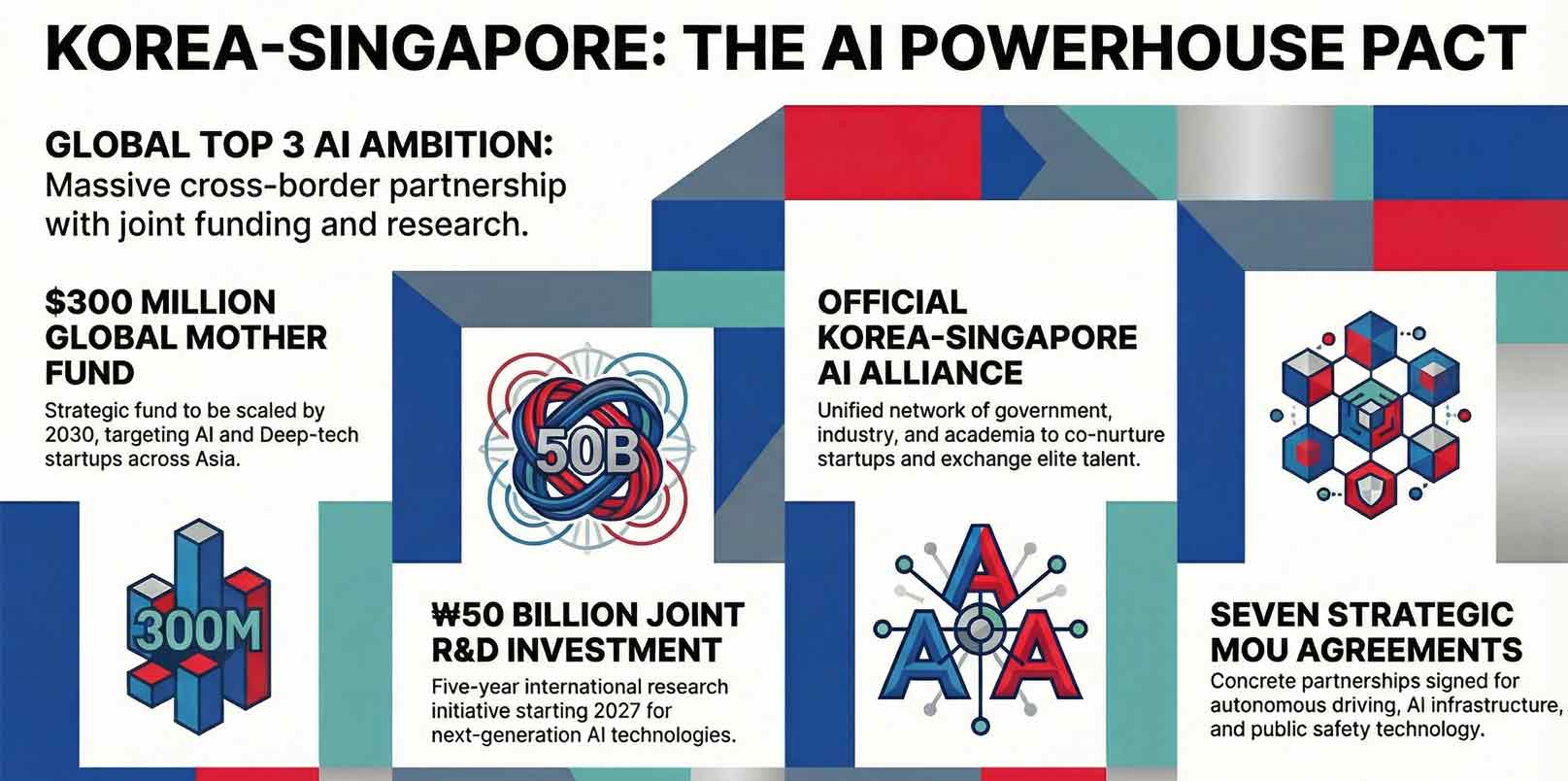

The Ministry of SMEs and Startups plans to embed future Fund-of-Funds strategy into its “Top Four Global Venture Powerhouse” strategy expected later this year.

What This Means for Korea’s Next Stage of Venture Growth

Korea’s Fund of Funds has finally reached a pivotal turning point. Its first 20 years built the foundation for the country’s modern venture ecosystem. Its next phase will determine how Korea competes in an era defined by AI acceleration, deep-tech breakthroughs, and increasingly complex global capital flows.

Stakeholders across government, finance, and industry expressed a clear message at the forum: long-term capital mechanisms remain essential for Korea to scale frontier industries, attract institutional LPs, and maintain momentum in non-metropolitan innovation hubs.

As the government prepares its new national venture strategy, the future of the Korea’s Fund of Funds (Mother Fund) will shape the investment landscape for founders, investors, and stakeholders watching Korea’s position in the global venture landscape.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.