Korea’s startup map has always tilted toward Seoul. Now, the government is trying to redraw it. With the 2026 Fund of Funds and TIPS programs introducing regional quotas, the Ministry of SMEs and Startups (MSS) is forcing capital to flow beyond the capital region. The question is whether this decentralization will expand innovation or simply dilute already limited resources.

Government Enforces Regional Quotas in Fund of Funds and TIPS Program

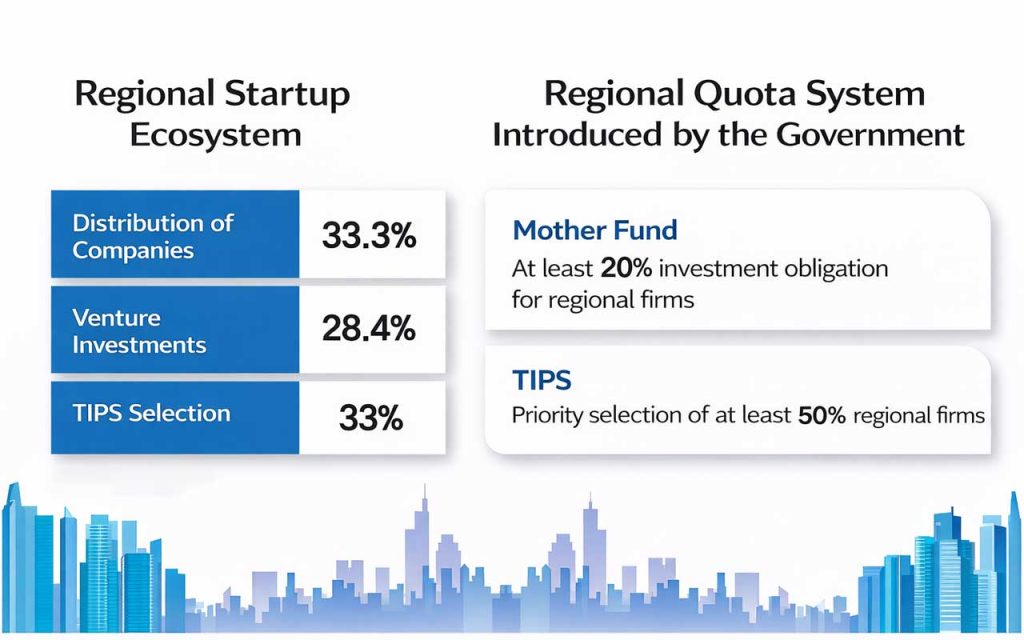

The Ministry of SMEs and Startups (MSS) confirmed that all sub-funds formed under this year’s Fund of Funds will be required to invest at least 20% of their committed capital in startups outside Seoul and the surrounding metropolitan area.

This is the first time such a quota has been imposed within Korea’s core venture capital mechanism. The rule applies to all categories except for mid- to late-stage AI and deep-tech scale-up funds and the corporate succession M&A fund. Based on current allocations, the quota will direct approximately KRW 470 billion toward regional startups this year.

Parallel to this, regional parent funds in Gangwon, North Gyeongsang, South Chungcheong, Busan, and South Gyeongsang—each mandated to invest more than half of their total capital locally—are expected to inject an additional KRW 450 billion. Combined, Korea’s regional venture funding pool could expand by over KRW 700 billion in 2026.

The regionalization drive also extends to TIPS, the government’s flagship R&D support program for startups. Of the 620 new startups to be selected this year, at least 50% (310 companies) will come from regional areas.

For TIPS applicants, the minimum private pre-investment requirement has been lowered to KRW 100 million for regional startups—half of the capital needed in the Seoul area. The new Scale-up TIPS track will adopt the same 50% regional quota.

Regional Quotas Mark Structural Shift in Korea’s Startup Capital Flow

For a decade, Korea’s innovation capital has flowed unevenly. As of 2024, only 33.3% of startups and venture firms were headquartered outside Seoul—a decline from 38.9% in 2014. The imbalance deepened despite continuous policy funding, regional accelerators, and local startup parks.

The new quotas mark a shift from incentive to enforcement. They follow the government’s 2026 Fund of Funds execution plan, which institutionalized a 20% regional investment mandate for public–private funds. Together, the Fund of Funds, regional parent funds, and TIPS quota create a synchronized mechanism to counter the “Seoul gravity” that dominates Korea’s startup economy.

For regional ecosystems, this offers not just capital but legitimacy. It ties into a longer policy arc that began with the KRW 5.5 trillion Regional Growth Fund (2025–2030), designed to build 14 provincial startup hubs. The quota system now turns that long-term ambition into immediate financial obligation.

The Friction Beneath the Policy: Allocation Without Readiness

While few contest the need for regional investment, the policy’s execution friction is real. Industry insiders warn that the TIPS 50% quota may outpace the readiness of local startups and investors to absorb such funding efficiently.

Last year, non-capital startups accounted for 28.4% of venture investment and 33% of TIPS selections. Doubling that share in one year risks stretching evaluation pipelines and mentor networks that are still concentrated in Seoul.

A senior venture association source told local media,

“As of the third quarter of last year, non-capital regions already accounted for 28.4% of total venture investment. A 20% Fund of Funds allocation won’t change much.

However, allocating 50% of TIPS projects to regional startups all at once could disrupt balanced resource distribution.”

The sentiment reflects an underlying tension: policy ambition is racing ahead of infrastructure.

This friction is not unique to Korea—it mirrors global decentralization efforts where regional innovation goals clash with market efficiency. Korea’s challenge is ensuring that redistribution does not degrade venture discipline.

How Regional Quotas May Boost Local Startups — but Not Fix Structural Gaps

The quota system could democratize startup opportunity across Korea’s provinces, stimulating early-stage founders who have struggled to access capital. It will likely energize local universities, accelerators, and municipal innovation offices to form stronger regional consortia.

However, this does not solve structural issues. Regional funds often face smaller deal pipelines, limited co-investment partners, and weaker exit markets. Without stronger secondary and M&A channels—which the 2026 Fund of Funds only partially addresses—the sustainability of regional capital cycles remains uncertain.

In essence, the policy provides liquidity, not yet velocity.

What Korea’s Decentralization Push Means for Global Investors and Partners

For global venture investors and corporate partners, Korea’s quota system signals a regulatory tilt toward geographic equity. This shift may open co-investment opportunities in regional manufacturing, green tech, and cultural sectors that traditionally sit outside Seoul’s venture radar.

It also aligns with Korea’s 2026 venture governance reforms, which introduced transparency mandates, sub-fund disclosure, and performance tracking through the Fund of Funds portal. Together, these frameworks make regional fund participation more predictable and potentially more attractive to global limited partners seeking stable, government-backed exposure in Asia’s mid-market startups.

For foreign accelerators and funds, Korea’s regional push could redefine entry strategy—from Seoul-first to province-linked partnerships, especially in industrial and research-heavy zones like Daegu or Gwangju.

Korea’s Real Test: Can Regulation Build Startup Ecosystems Beyond Seoul?

Korea’s regional quota policy is less about fairness than about endurance. It’s a test of whether balanced innovation can survive the gravitational pull of the capital.

The next phase will show if regulation can build ecosystems—or if ecosystems still have to earn their own gravity.

Key Takeaway on Korea’s Regional Policy 2026

- Policy Update: MSS introduces mandatory regional quotas in both the Fund of Funds and TIPS programs starting 2026.

- Fund of Funds: Sub-funds must invest ≥20% of their capital in non-capital startups.

- Regional Venture Funds: Newly established regional mother funds in Gangwon, Gyeongbuk, Chungnam, Busan, and Gyeongnam will inject ~₩450B locally.

- TIPS Program: Of 620 startups, at least 50% (310) will be regional; minimum investment threshold halved to ₩100M.

- Motivation: Counter Seoul’s dominance—only 33.3% of startups are currently region-based.

- Industry Concern: Rapid quota expansion may strain regional capacity and distort resource allocation.

- Strategic Implication: A real-time test of Korea’s decentralization model—balancing national ambition with market maturity.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.