South Korea’s venture ecosystem has entered a period of refinement. As venture capital firms take a measured pause after an intense funding cycle, early February 2026 reflects a maturing shift: capital is flowing toward startups with technical depth, data infrastructure, and scalable AI applications. The country’s innovation economy is transitioning from momentum-driven to performance-driven growth.

Early February 2026 Investment Snapshot: A Selective Market, Focused on Depth

Ten startups—including Mobiltech, BAT, Bonanza Lab, Dermatrix, and InnOwl—secured new funding rounds in the first week of February. According to government and industry disclosures, investment activity was concentrated in seed and pre-IPO stages, highlighting selective risk-taking by investors seeking defensible technology and visible market pathways.

While overall deal volume slowed, investors favored startups combining technical precision with commercial readiness. Funding rounds in physical AI, K-beauty technology, and data-driven healthcare suggest a market reshaping around institutional-grade innovation quality, not quantity.

Mobiltech Raises ₩13 Billion Pre-IPO from Major VCs

Spatial intelligence startup Mobiltech secured KRW 13 billion (USD 9.8 million) in a pre-IPO round led by Stonebridge Ventures, joined by SBI Investment, Leading Ace Capital, Fave Ventures, and IBK Industrial Bank.

Mobiltech develops 3D digital twin infrastructure that enables autonomous vehicles and robots to interpret physical environments. The company also partners with NVIDIA, supplying data to its Omniverse and Cosmos platforms for autonomous systems and simulation.

The new funding will be used to enhance Mobiltech’s physical AI models, scale its data-processing capabilities, and prepare for a KOSDAQ listing later this year.

Stonebridge Ventures Managing Director Lee Jong-hyun said the firm believes Mobiltech “translates all real-world information into precise data that allows AI to self-learn,” adding that it is “well-positioned to become a defining infrastructure player bridging virtual and physical systems.”

BAT Secures ₩7.5 Billion to Scale K-Beauty and AI Marketing

Integrated brand agency BAT (Brand Agency Team) raised KRW 7.5 billion (USD 5.6 million) in Series A funding from Hana Securities and K2 Investment. Founded in 2016, the company provides end-to-end brand strategy, consulting, and digital marketing solutions.

BAT achieved KRW 85.3 billion in revenue last year and turned profitable. Its K-beauty marketing business surged fivefold year-over-year, reaching KRW 18 billion in sales. With new funding, BAT plans to advance its proprietary AI-driven brand scaling solutions and evolve into a “K-Brand Scale-Up Company.”

The company currently supports more than 35 major brands, including Dr.G, Biodance, and Olive Young’s 12 private labels. BAT has also developed an AI agent integrated with its in-house platform AEer, automating media operations and providing real-time performance insights.

CEO Park Jun-kyu said the company is now positioned for long-term scalability:

“Beyond growth, we established a sustainable profit structure grounded in AI. With our proprietary AI agent and brand acceleration know-how, we aim to become a KRW 1 trillion-valued unicorn by 2030.”

Bonanza Lab Raises Pre-Series A for Institutional Digital Asset Infrastructure

Bonanza Lab, operator of the digital asset data platform Dayfin, closed a pre-Series A round from JB Investment and Samil PwC.

The company has built a full-stack infrastructure for digital asset data collection, verification, and processing, serving corporations and financial institutions that require compliance-grade information for operations and reporting.

Investors viewed Bonanza Lab as a critical bridge between digital assets and regulated finance, particularly in light of Korea’s emerging legal frameworks around stablecoins, tokenized securities (STOs), and real-world asset (RWA) integration.

Co-CEO Park Hye-yeon noted that the investment comes as institutional demand for standardized digital asset data accelerates:

“As digital assets—such as stablecoins and RWAs—enter mainstream finance, we’re enabling institutions to treat digital asset data with the same rigor as traditional financial instruments.”

Digital Healthcare Startups Dermatrix and InnOwl Secure Seed Rounds

Digital health innovation continues to attract early investment.

Dermatrix, founded by former Asan Medical Center dermatologist Dr. Kim Kyung-hoon, raised a seed round from Bluepoint Partners to advance its skin-health data automation platform. The startup aims to connect clinical data with patients’ daily skincare habits through digital integration.

Dr. Kim stated that Dermatrix’s goal is to “eliminate blind spots in skin health by bridging clinical workflows with everyday care,” emphasizing the company’s mission to deliver highly personalized dermatological treatment.

Meanwhile, InnOwl, a biomedical AI startup, raised a seed round from CNTTech and DB Capital. The firm is developing a precision diagnosis system for atopic dermatitis, combining microneedle patches, RNA analytics, and AI modeling. The technology is undergoing clinical trials with leading university hospitals, with commercialization targeted around 2028.

DB Capital’s investment team leader Kang Seok-min commented:

“Precision diagnostics will inevitably expand alongside therapeutics. InnOwl’s minimally invasive, data-based approach could set new benchmarks in personalized dermatology diagnostics.”

Selective Capital Signals Korea’s Venture Maturity in Early February 2026

February’s early investment patterns highlight a deeper evolution in Korea’s venture landscape: selectivity now defines success.

After several years of abundant liquidity and aggressive scaling, investors are shifting focus toward technological defensibility, regulatory resilience, and cross-border scalability, replacing momentum with measurable substance.

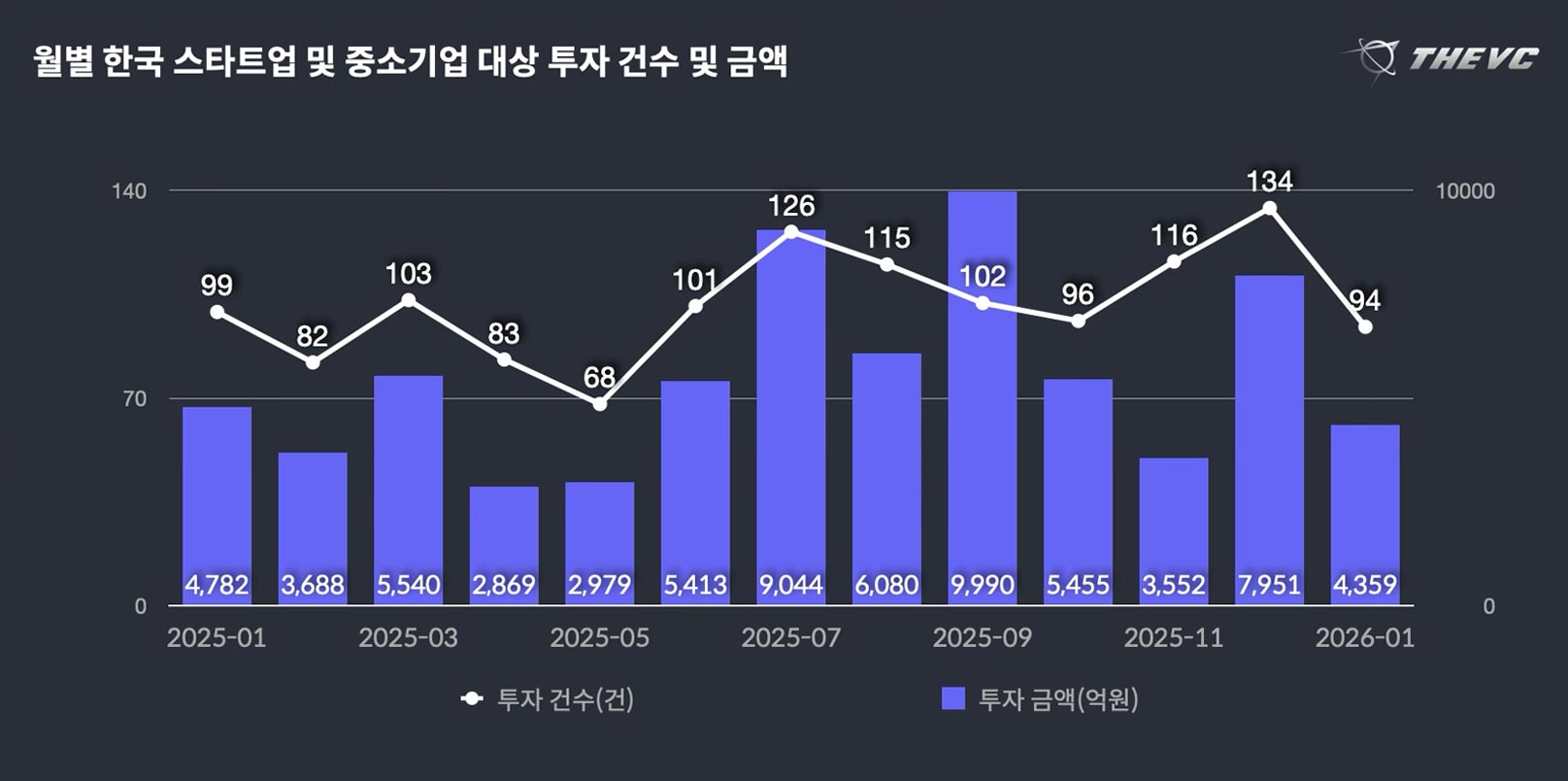

This recalibration builds directly on January 2026’s early rebound, when Korea recorded KRW 435.9 billion (≈ USD 327 million) across 94 deals—a recovery driven by AI, energy, and deep-tech fundamentals. The share of early-stage funding had climbed from 29 percent to 39 percent, reflecting a return of confidence in foundational innovation. That rebound was reinforced by the government’s 2.14 trillion KRW fund-of-funds program, which catalyzed KRW 4.35 trillion in total venture capacity aimed at early-stage sectors.

Now, February’s smaller but sharper deal set shows the second phase of that correction cycle.Capital deployment is narrowing toward AI infrastructure, healthcare diagnostics, and digital-finance data systems—precisely the six strategic domains of Korea’s industrial “ABCDEF” roadmap (AI, Bio, Content, Defense, Energy, Future Manufacturing). The alignment between market behavior and national investment policy confirms that public and private capital are beginning to move in concert.

For global investors, this moderation signals a disciplined market, not retreat. Korea’s venture ecosystem is transitioning into a sustainable innovation rhythm, where deal flow may slow, but valuation quality and technological readiness improve. Venture selection increasingly resembles institutional portfolio management—anchored in data and performance, not speculative acceleration.

A Quieter Month That Speaks Volumes

February’s funding climate illustrates that Korea’s innovation economy is consolidating, not cooling.

As venture capital pauses for recalibration, startups with verifiable progress, defensible technology, and transparent market validation are attracting capital. The country’s startup narrative is evolving from speed to structural durability—a defining hallmark of a mature ecosystem.

For founders and investors alike, the signal is unmistakable: quality, precision, and scalability now drive Korea’s venture-capital agenda.

Key Takeaway: Korea Venture Funding, Early February 2026

- Investment Scope: 10 startups raised new funding, concentrated in AI, data, and healthcare in February 2026 Week 1.

- Funding Pattern: Capital focused on seed and pre-IPO rounds, reflecting cautious yet strategic deployment.

- Key Deals: Mobiltech (KRW 13 B pre-IPO), BAT (KRW 7.5 B Series A), Bonanza Lab (pre-Series A undisclosed).

- Emerging Themes: Physical AI, digital-asset data infrastructure, AI-powered brand and healthcare solutions.

- Policy Link: Aligned with MSS fund-of-funds and industrial “ABCDEF” strategy.

- Investor Behavior: Selectivity signals maturity; capital prefers data and compliance-ready startups.

- Ecosystem Implication: Korea’s venture market is shifting from volume to value—strengthening its global credibility as Asia’s most disciplined deep-tech hub.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.