Across Asia’s gaming landscape, a quiet but undeniable shift has taken place. Chinese game studios, once dismissed for imitation, are now setting global benchmarks for innovation and storytelling. Meanwhile, Korea — once the creative engine of online entertainment — finds itself constrained by old success formulas and policy fatigue. The contrast captures a broader truth: innovation capital, much like financial capital, is leaving the peninsula faster than it’s being replenished.

China’s Game Ecosystem Gains Credibility as Korea Hesitates

Chinese game developers have moved far beyond the era of “copycat” accusations. With HoYoverse’s Genshin Impact (2020) redefining the open-world RPG experience, followed by Arknights: Endfield, Wuthering Waves, and Black Myth: Wukong, China has effectively reset global perceptions of what “made in China” means in digital creativity.

These titles combined cinematic design, technical ambition, and robust narrative continuity — enough to earn what industry observers now call trust capital. The result: international gamers no longer question the quality of a major Chinese release before trying it. They expect excellence.

According to recent data from Claight and Newzoo, China’s gaming market reached an estimated USD 66 billion in 2025, nearly five times larger than South Korea’s USD 13–14 billion market. And the difference is not only in scale but in strategic reinvestment.

Chinese publishers like HoYoverse, Tencent, and NetEase now channel multi-billion-dollar R&D budgets into global launches, while Korean studios rely on narrower monetization models centered on domestic users. This scale advantage translates into design freedom—Chinese developers can afford experimentation where Korean studios cannot.

In contrast, Korean releases such as Dragon Sword have met skepticism before launch, not for lack of competence, but for predictability. The assumption of sameness — “another similar RPG” — has become a barrier heavier than competition itself.

Korea’s Game Industry at a Crossroads: Losing Creative Ground to China’s New Power

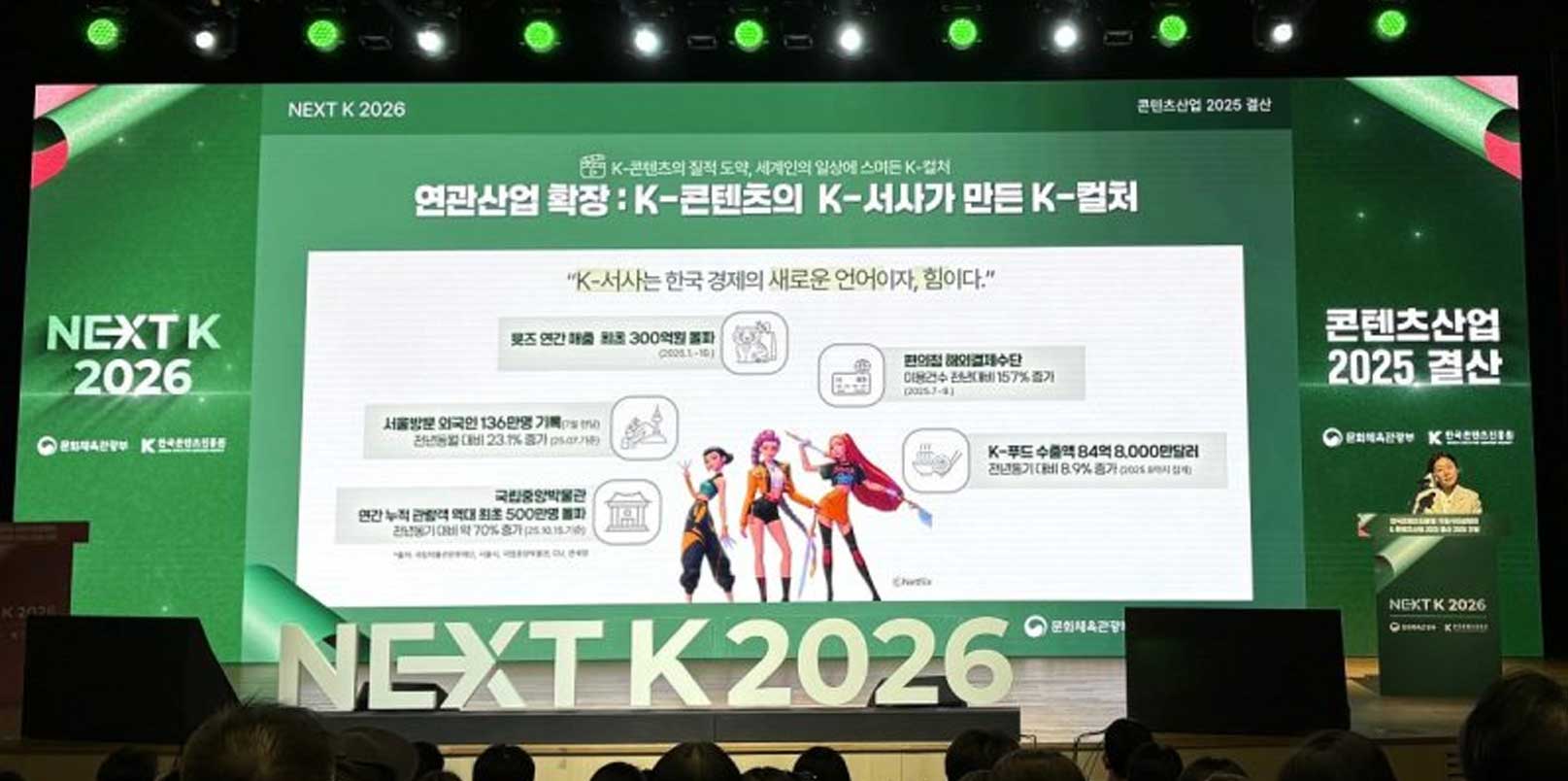

Korea’s gaming industry was once its cultural vanguard, driving exports, pop culture influence, and startup formation. But its creative edge has dulled under years of structural inertia. The sector has relied heavily on probability-based monetization and safe design templates instead of worldbuilding and narrative risk-taking.

While Chinese studios were investing in production pipelines and global expansion under state-supported ecosystems, Korea’s game policy was consumed by unproductive debates — such as whether gaming constitutes a disease rather than a creative industry. This is why only Nexon and Krafton sustain consistent global performance. Whereas smaller studios remain undercapitalized and risk-averse.

China’s competitive scale shows up clearly in revenue data. Sensor Tower reports that the top 30 Chinese mobile game publishers generated about USD 23.3 billion in global revenue in 2025, representing a dominant share of the world’s leading mobile gaming income and underscoring Chinese studios’ global commercial reach.

Chinese independently developed titles also generated over USD 9.5 billion in overseas markets in 2025, with the United States, Japan, and Korea among the largest import markets, reflecting export momentum beyond domestic demand.

In contrast, South Korea’s gaming industry — though globally significant — operates on a smaller overall market base and export scale, without comparable evidence of similar worldwide publishing revenue growth.

Now, the issue is moving beyond just the game itself. Instead, it reflects a systemic weakness across Korea’s broader innovation ecosystem — where policy caution and cultural conservatism often limit experimentation in creative technologies.

The Structural Friction Beneath Korea’s Policy Ambition

Korea’s public-private innovation model was built around efficiency, not imagination. Game development thrives on the opposite: iterative failure and cultural risk. In China, provincial governments treat games as instruments of digital soft power. Failure is absorbed as data for the next iteration.

Korea’s environment punishes failure with financial and social cost. Few young founders are willing to take the leap once taken by pioneers like Nexon’s Kim Jung-ju or Krafton’s Jang Byung-gyu. The pipeline of mid-tier creative studios that once bridged indie experimentation with large-scale success has eroded.

In short, Korea has an execution system, but not an exploration system — a model that delivers efficiency but struggles with originality.

China’s Creative Playbook Exposes the Limits of Korea’s Policy-Driven Innovation

China’s ascent proves that industrial-scale creativity can coexist with centralized policy, provided the incentives align with experimentation. Korea’s structure, by contrast, prioritizes regulation and compliance before growth, creating a ceiling for unconventional creators.

However, the Korean industry still retains significant leverage: deep engineering talent, cross-media IP infrastructure, and a proven export pipeline through global publishing. The question is whether those assets can evolve from manufacturing digital content to designing cultural experiences that resonate across borders.

The pivot must begin not with budget competition but with creative decentralization — empowering smaller studios, easing publishing barriers, and reforming tax incentives for original IP.

Why Asia’s Gaming Power Shift Matters for Global Investors and Partners

For international investors and publishers, this shift signals a realignment of Asia’s creative gravity. The next frontier in gaming — AI-driven design, procedural storytelling, and interactive world simulation — will emerge where creative tolerance outweighs risk aversion.

China is positioning itself as that hub. Meanwhile, Korea’s game ecosystem, though still globally respected, risks being perceived as premature rather than dynamic.

Global partners looking at Korea must therefore calibrate expectations: the opportunity lies less in blockbuster production and more in infrastructure partnerships — cloud gaming systems, cross-border publishing, and AI localization technologies that bridge ecosystems rather than compete with them.

Beyond Competition: Can Korea Regain Its Creative Confidence?

Korea’s game story is not one of decline, but of divergence. The nation remains an innovation powerhouse, yet it now faces a creative paradox — an ecosystem optimized for perfection, not invention.

The broader market data underscores how creative inertia links directly to investment inertia. With China projected to surpass USD 100 billion in gaming revenue by 2035 and South Korea expanding modestly from a smaller base, the competitive divide is widening rather than stabilizing. For Korea’s industry, this means that innovation policy cannot remain abstract—it must translate into funding mechanisms, cross-studio collaborations, and export-ready IP pipelines that restore both investor confidence and user expectation.

Unless policy frameworks and cultural incentives reorient toward creative experimentation, the most decisive shifts in Asia’s digital entertainment industry may continue to unfold just beyond Korea’s borders.

Innovation rarely disappears. It simply relocates to where it’s allowed to fail.

Key Takeaway on China VS Korea Gaming Innovation

- Market Scale: China’s gaming market reached roughly USD 66 billion in 2025 — nearly five times larger than Korea’s — enabling long-term R&D investment and export-driven IP growth.

- Creative Gap: Chinese studios have accumulated “trust capital” through consistent world-class execution, while Korean developers remain tied to monetization-heavy formulas that limit experimentation.

- Structural Divide: China’s ecosystem treats failure as a data point and rewards creative risk; Korea’s policy and capital environment still penalize it.

- Global Consequence: The next wave of gaming breakthroughs — AI-driven design, procedural storytelling, and transmedia IP — will likely emerge where creative tolerance exceeds regulatory caution.

- Strategic Outlook: Korea’s near-term advantage lies in infrastructure and cross-border partnerships — cloud systems, AI localization, and global publishing — not in competing head-on in blockbuster game production.

- Investor Signal: For global investors, the creative epicenter of Asian gaming has shifted eastward. Korea’s path back to leadership depends on restoring risk appetite and policy support for original IP creation.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.