Korea’s venture market has roared back above the KRW 2 trillion mark, but the rebound tells two very different stories. Mega-rounds in AI and semiconductors are commanding global attention, while seed and early-stage startups face shrinking opportunities. This data from Korea’s Q3 startup investment signals not only shifting capital flows but also the direction of Korea’s innovation economy.

Korea’s Q3 Startup Investment Breaks Seven-Quarter Drought

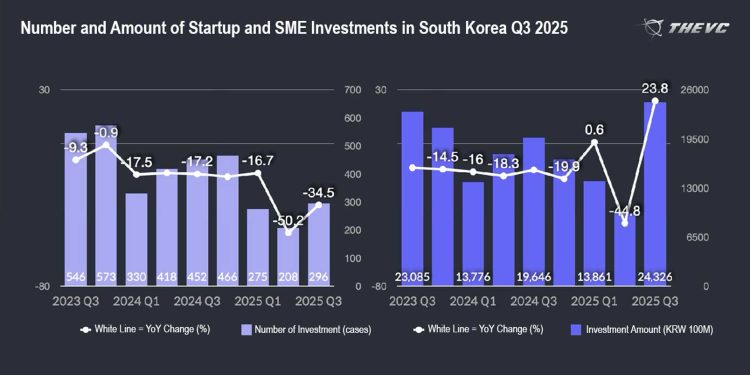

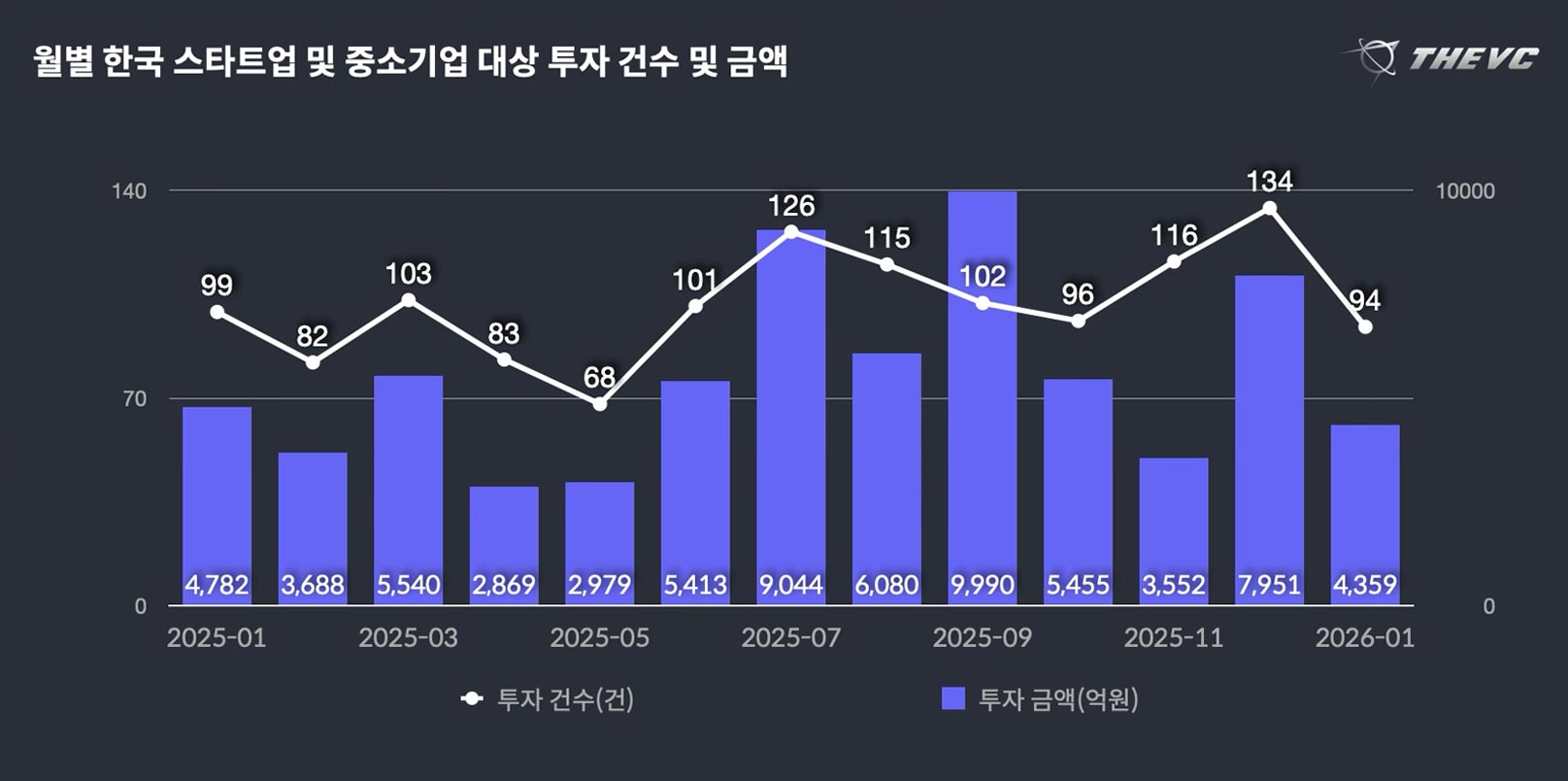

Korean startups and SMEs attracted KRW 2.43 trillion (approx. USD 1.8 billion) in funding during the third quarter of 2025, according to data from The VC. This represents a 152% increase from Q2 and a 24% rise compared to the same period last year. It is the first time in seven quarters—since late 2023—that investment has surpassed the KRW 2 trillion threshold.

Yet while funding volume expanded, deal activity contracted. Only 296 deals were recorded, down 35% year-on-year, underscoring a shift toward fewer but larger-scale investments.

Investment Trends: Mega Rounds Concentrated in AI and Semiconductors

Large deals drove the surge. AI semiconductor startup Rebellions secured KRW 340 billion (~ USD 247 million) in Series C—the largest Korean unlisted startup investment in the past three years. FuriosaAI and Medit each raised more than KRW 100 billion. In total, there were 11 investment rounds above KRW 50 billion and 64 rounds above KRW 10 billion.

Series B and C stages absorbed about 70% of the total investment value, up from 40–45% in earlier quarters. By contrast, early-stage rounds declined: seed and Series A deals fell 44% in volume and 16% in value to KRW 514.4 billion.

Sector Breakdown of Korea’s Q3 Startup Investment: AI, Semiconductors, and Select Consumer Platforms

AI remained a magnet for funding despite fewer deals. Only 51 AI-related investments closed in Q3 (down more than 40% year-on-year), yet total AI funding climbed 35% to KRW 300.1 billion.

Semiconductors and displays outperformed all other sectors, rising 259% year-on-year to KRW 605.4 billion, propelled by Rebellions and FuriosaAI. The consumer sector also showed resilience, with MarkVision and Kurly among the companies drawing notable rounds.

Inside Investor Mindset: Why Capital Now Favors Proven Scale-Ups

Numbers shown on Korea’s Q3 startup investment invite further questions on the shifting focus on the scale-ups. Byun Jae-geuk, CEO of The VC explained,

“The third quarter of 2025 showed a clear concentration of capital in verified companies, reflecting global venture market trends. This is not simply a recovery in investment volume but a restructuring of the market around firms that have already demonstrated technology and growth potential.”

Early-Stage Risks and Global Investor Signals

Korea’s Q3 startup investment trends show a tougher environment for early-stage ventures. A shrinking pool of seed and Series A capital raises concerns about the sustainability of the startup pipeline and whether innovation can keep pace if early entrants lose support.

Deal concentration also reflects both risk aversion and opportunity. Korea’s AI and semiconductor companies are now attracting mega rounds at scales that draw global capital, positioning them as serious contenders in the international chip race.

Meanwhile, policymakers also face a strategic dilemma. While large pools of money are flowing into globally competitive sectors, mechanisms to sustain early-stage innovation remain limited.

Without corrective measures, the ecosystem risks hollowing out. Therefore, striking a balance between nurturing disruptive newcomers and scaling proven firms will be critical to Korea’s long-term competitiveness.

Can Korea Balance Mega-Rounds with Startup Pipeline Growth?

Korea’s Q3 funding surge demonstrates that the country remains a significant venture hub in Asia, especially in AI and semiconductors. Yet the decline in early-stage capital signals a structural shift with long-term consequences.

With this shifting focus, Korea’s funding landscape is now entering a phase dominated by fewer, stronger companies absorbing the majority of capital inflows. The challenge now is preserving space for the next wave of innovators to emerge before the early-stage pipeline narrows beyond repair.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.