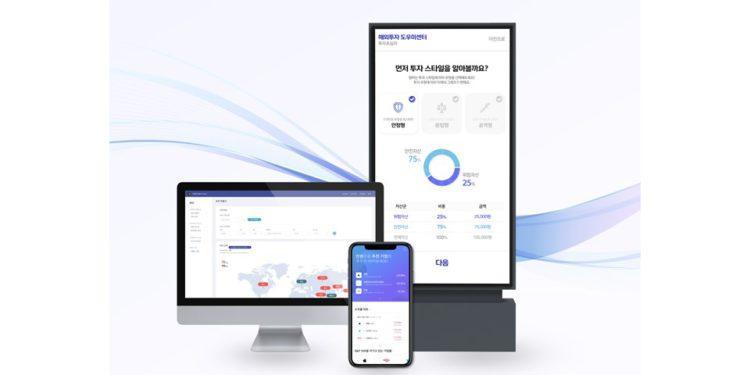

FinTech startups are bringing in innovative ways to manage assets. Korean startup Quantec has developed a Robo-advisor technology that helps analyze asset values and recommends suitable products.

Quantec’s AI-based technology called ‘Q-Engine’ helps users construct a customized asset management portfolio. The FinTech startup recently attracted a Series B investment of over $6.6 million or 7.5 billion won. Quantec plans to accelerate the establishment of a hyper-personalized financial investment platform and the advancement of investment algorithms.

Advanced algorithms that provide real-time advise

Quantec was founded in 2016 with the goal to develop a ‘super personalized financial investment platform service based on AI algorithm development technology. Quantec uses advanced algorithms and big data to provide customers with real-time automated portfolio design and customized asset management through investment product recommendations.

Its primary technology ‘Q-Engine’ is a customized asset management solution based on Artificial Intelligence (AI). Q-Engine consists of propensity analysis, stock selection, real-time asset allocation, and risk management modules to provide customized portfolios in real-time. The total amount of customer-managed assets (AUM) operated by Quantec’s ‘Q-Engine’ solution in domestic financial institutions reached $97 million or 110 billion won as of March, reaching $88 million or 100 billion won in the shortest period among Robo-advisor companies.

Quantec has the largest number of stock-type algorithms in Korea that have passed the examination by the Koscom Robo Advisor (RA) testbed hosted by the Financial Services Commission. As of the end of March 2021, more than a third of all algorithms in the testbed available for commercial service were made up of Quantec algorithms. In addition, the technology is highly recognized as it achieved an initial triple-digit return of 102.67% based on one-year operability.

Investment optimization and future plans

Based on ‘Q-Engine,’ Quantec is set to launch untact finance management solutions like ‘IRA’ and ‘Q-OSK’ that can be utilized by financial companies as well as asset management platforms. Also, it plans to launch ‘MONEYPOT’ for general customers. In recognition of ‘Q-Engine,’ the startup has been selected for the ‘Shinhan Future’s Lab’ by Shinhan Financial Group and the ‘Dreamplus’ by Hanhwa Life Insurance.

The latest investment for Quantec comes from three companies, including Orbitek and Shinhan Capital, that participated as the main investors. Quantec had previously attracted approximately 3 billion won or $2.6 million worth of Series A investment in 2019 from Industrial Bank of Korea, Wonik Investment Partners, AG Investment, and Shinhan Capital, and as a result, the cumulative investment exceeded 11 billion won or $9.7 million.

With the latest investment, Quantec plans to speed up its existing super-personalized financial services. Since the Data 3 Act (Personal Information Protection Act, Information Communication Network Act, and Credit Information Act amendments) in South Korea came into effect in August 2020, personalized financial services using My Data have become possible. Quantec is developing various customized financial products based on ‘Q-Engine’ and recently signed an MOU with Kyobo Securities to provide a data-based super-personalized Robo-advisor asset management service.

Lee Sang-geun, CEO of Quantec, said in a media statement, “I think this investment attraction is a case in which Quantec’s technology and competitiveness in the B2B market have been positively evaluated. In the management market, we will focus on a super-personalized financial investment platform so that anyone can receive customized asset management services without discrimination.”

Read more about FinTech startups in Korea,

- 5 FinTech Korean Startups that are minting success

- Fintech startup Jireh Exim launches app to make payment transactions handsfree

- Korean FinTech WireBarley reaching global heights with its cross-border remittance service

- Leading FinTech startup Viva Republica receives preliminary approval for a digital bank license