Korean startup DeepSearch’s financial information platform provides insightful information about businesses, industries, financial news, etc, gathered through various big data analysis techniques and machine learning. DeepSearch’s Insight feature shares information and trends charted out by economic experts.

Naver and Kakao register the highest 3Q earnings

The sales and operating profit of Naver and Kakao in the third quarter of this year are record high. For both companies, growth was driven by the content and commerce sectors.

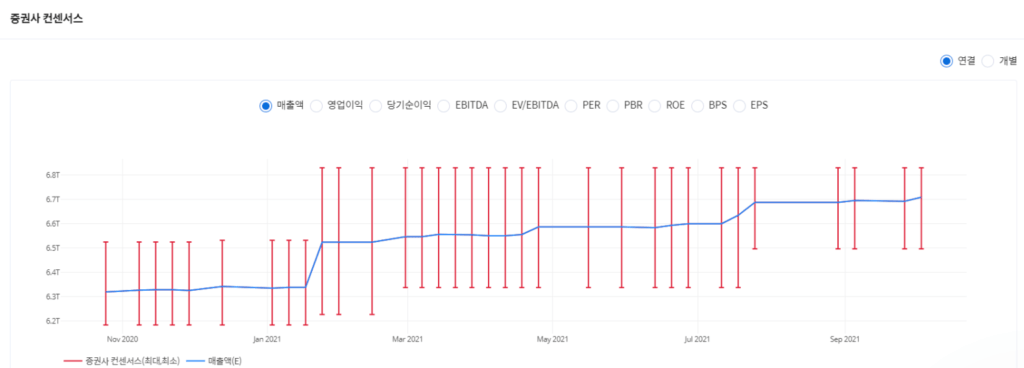

Securities firm consensus upward trend

The Naver earnings consensus trend estimated by securities companies is trending upward. Consensus is an average of expected performance so that it may deviate from actual performance. Therefore, whether the trend has changed is more important than the performance estimate.

The Kakao Consensus is also solid. Although there were many concerns about the ‘win-win’ issue, most of the areas pointed out do not significantly impact earnings.

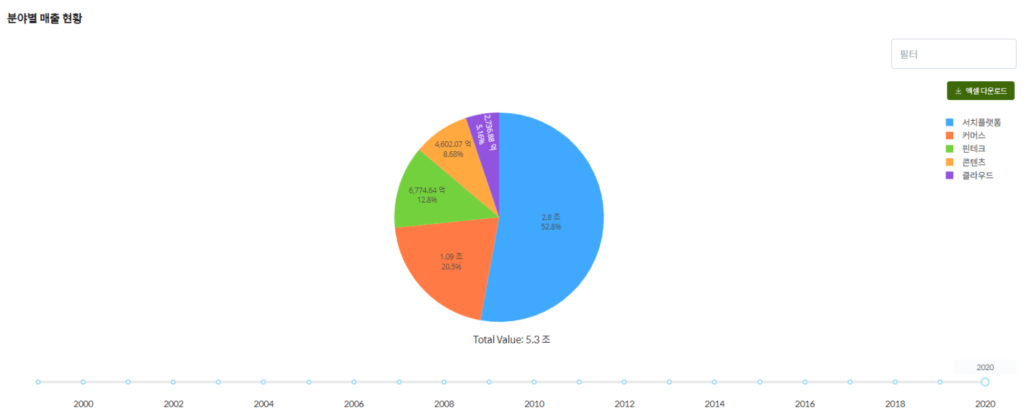

Driving performance of contents and commerce

Naver and Kakao are strengthening their content and commerce based on solid platforms. Naver is gradually escaping from its advertising-oriented revenue structure, such as search and securing revenue stability. In particular, since both companies aim to advance domestically and overseas, content is a highly anticipated sector in the future.

Changes with the COVID-19 landscape that the fashion industry expects

Many industries are changing due to COVID-19. The fashion industry, which is considered one of the ‘boring industries,’ is no exception. It is changing the atmosphere through the introduction of live commerce and overseas expansion.

F&F performance improvement expected, wins and down

F&F is one of the most popular fashion-related companies these days. Although the name is unfamiliar, F&F is a fashion company with brands that everyone knows, such as MLB and Discovery, especially in the Chinese market. Unlike other industries that want to enter China but are observing the market because of various regulations.

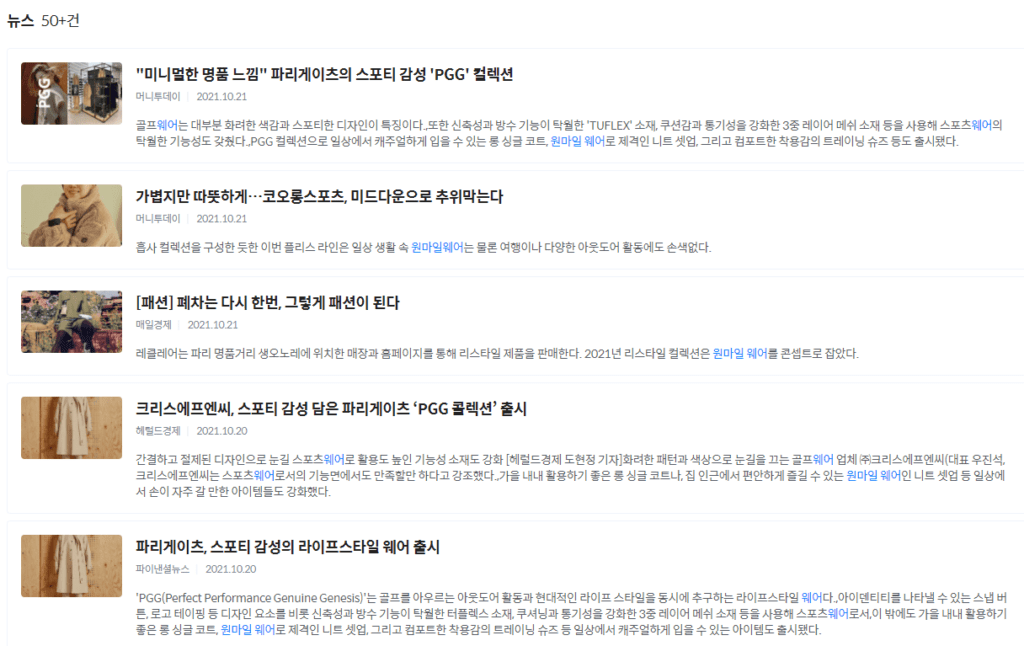

Strengthening live commerce, targeting the MZ generation

One of the marketing trends is ‘live commerce.’ Live commerce can be thought of as an evolution of existing home shopping. The biggest feature is that it has improved accessibility, such as on mobile devices. The fashion landscape has also changed after COVID-19. Comfortable yet sophisticated fashion is attracting attention to the extent that a new word called ‘one-mile wear ‘ has appeared. The increase in golf wear demand is mainly driven by golf users, but the impact of ‘one-mile wear’ cannot be ignored.

CJ ENM likely to acquire SM Entertainment

There are rumours that CJ ENM has decided to acquire SM Entertainment, and the two sides deny that the matter has been decided. However, looking at the past actions of CJ Group, it is judged that the deal has already been completed.

‘Shepherd Boy’ CJ Group?

CJ Group is known as a ‘shepherd boy’ in the industry. In the merger and acquisition (M&A) sector, rumours have already been circulating in the process of acquiring and selling numerous affiliates, but they never immediately acknowledged it. But the rumours have been ‘mostly’ true.

SM Entertainment to fill CJ ENM’s weakness

CJ ENM’s biggest weakness is none other than the entertainment sector. If you look at CJ ENM’s position to strengthen the content, it’s understandable enough. Since Lee Mi-kyung, Vice Chairman of CJ Group, also met with Lee Soo-man, SM Entertainment general manager, the possibility of the takeover is higher. Ultimately, if CJ ENM takes over SM Entertainment, it is expected to be a great help in enhancing corporate value in the future. It remains to be seen whether the stock price, which has been sluggish for a long time, can rebound.