2021 could be the flourishing year for the IPO (Initial public offerings) market in South Korea as it expects to top $18 billion in valuation. This is said to be the largest amount in a single year for any country as many established corporations and a slew of Korean startups gear up to launch IPOs this year. Korean startup Coupang has already made a global noise with its IPO launch in February at the New York Stock Exchange (NYSE).

In the first quarter of 2021, at least 34 companies have applied to Korea Exchange for IPOs. In January, six companies were listed in the country’s main bourse – the KOSDAQ market. All the IPOs got oversubscribed and priced higher than their indicative range. As per analysts in 2021, companies ranging from a digital bank, game developers, EV battery makers, e-commerce startups are expected to lead the IPO drive.

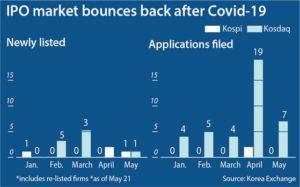

This record rise in the IPO market is in stark contrast to 2020, when in the first quarter, the impact of the COVID-19 pandemic played havoc. Many companies and startups had postponed their plans of 2020 IPO because of fear of recession.

According to data from the Korea Exchange, in 2020, the number of listed companies (excluding specifications) was 70, and the size of the public offering reached 4.4 trillion won. In 2021, the number of listed companies is expected to increase 10% to 77, and the number of public offerings is expected to reach 7.8 trillion won, an increase of more than 65%. This year seems to be promising for Korean businesses, and it could also mean an increase in investor trust in the rising Korean startup ecosystem.

KoreaTechDesk lists some of the top businesses and startups set to launch their IPO in 2021.

Market Kurly

The grocery e-commerce startup is gearing up for an IPO debut at the US stock market. As per reports, the startup has already set up meetings with underwriters in April for public offering strategies. It has designated Goldman Sachs, Morgan Stanley, and JP Morgan to manage its IPO process in the USA. The unicorn startup could be valued at $3.5 billion to 4.5 billion. Market Kurly had a fruitful 2020 as the pandemic boosted e-commerce businesses. The company’s 2020 annual revenue was almost double its revenue in 2019. There are also reports of Market Kurly going for a dual IPO with one in the domestic KOSDAQ bourses. Market Kurly was founded in 2015 by an ex Goldman Sachs Banker Sophie Kim with providing fresh and healthy food supplies to the growing working-class members of Korean households, with the money to buy but no time to go to the market.

Yanolja

The largest travel platform in South Korea has been preparing for an IPO since 2019, and it looks like this year it will see success. Yanolja’s IPO is expected to be launched in the second quarter of 2021. Yanolja is also looking at dual IPOs with listing in KOSDAQ and overseas. The startup is aiming for a valuation of more than $ 4 billion, as per media reports. Though the year 2020 has been catastrophic for the travel & hospitality industry globally due to the COVID-19 pandemic, the Seoul-based accommodation and leisure activity booking platform, saw sustainable growth. Yanolja made a good stride in 2020 as per a data from Wise App, a data analysis service showing a growth of about 4 percent in year-on-year sales as many Koreans opted to travel local destinations over overseas trips. In November 2020, Yanolja appointed Mirae Asset Daewoo as its lead underwriter and also selected Samsung Securities as a co-underwriter for the IPO.

Krafton

The maker of the famous PUBG (PlayerUnknown’s Battlegrounds) game is likely to announce its IPO in 2021, which is touted as the biggest debut this year. As per media reports, Krafton’s IPO could take the company’s valuation to $27.2 billion. The IPO could also make the startup one of the biggest gaming companies in the world. Krafton’s PUBG has grown tremendously since its launch in 2017, with more than 70 million copies sold till the second quarter of 2020 and selling more. PUBG has been ranked as the top-grossing game of 2020 with more than $2.6 billion in revenue. With the IPO, Krafton’s CEO Kim Chang-han, a coding champion, could look at the prospect of joining the billionaire’s club. Krafton has hired Mirae Asset Daewoo to lead the IPO plan.

TMON

The online shopping mall company has been preparing for an IPO since last year. TMON has raised a $277.55 million investment in February 2021 to bolster its capital base in preparation for the public issue. Investors participated in TMON’s capital increase by acquiring exchange bonds (EBs), which can be fully exchanged into the capital in the future. This will improve TMON’s current financial structure as it suffered losses in recent years, with overwhelming capital of 550.6 billion won as of 2019. To accelerate its IPO plans, TMON appointed the former CFO of Big Hit Entertainment, the agency representing K-pop sensation BTS ― Jon In-Chon in 2020. TMON’s IPO deal is being managed by underwriter Mirae Asset Daewoo. The company operates in three key verticals – Goods, Local, and Travel – and offers over 47,000 SKUs through partnerships with approximately 15,000 merchants.

SK IE Technology (SKIET)

SKIET, the subsidiary of EV battery maker SK Innovations, is also expected to make its market debut on KOSPI soon. SKIET has filed a preliminary registration statement with the Financial Services Commission (FSC) in January for its KOSPI IPO by May, according to reports.

SKIET manufactures lithium-ion battery separators (LiBS), a core material for electric vehicle battery production. It is also developing a flexible cover window (FCW), a type of colorless polyimide. SKIET has decided to issue 8,556,000 new shares, and about 22 percent of SK Innovation’s stake, for the market. The company has set a price band of 78,000 won to 105,000 won per share, and with it, its corporate value is set to reach 7.5 trillion won. This will be SK Group’s another big IPO following SK Biopharmaceuticals in 2020 and SK Bio Science in 2021. SK Bioscience had an explosive listing in January. The biotech company has got in a deal to contract manufacture COVID-19 vaccines developed by the UK‘s AstraZeneca and US’ Novavax.

LG Energy Solution Ltd.

Another of the leading EV battery-making units, a spin-off from LG Chem Ltd, has kicked off the IPO process as the market anticipates it to be the biggest IPO in Korean history. LG Energy Solutions has appointed KB Securities and Morgan Stanley for managing its IPO and selected five brokerages, including Shinhan Investment Corp. Daishin Securities Co., as book-runners for the IPO, according to reports. The company, which is the second leading supplier of EV batteries in the world, has pledged to invest $4.4 billion over the next four years for its US operations. The company supplies EV batteries to some of the leading global companies that include Tesla, General Motors, Ford, Renault, Volvo, Volkswagen, and South Korea’s largest automakers — Hyundai Motor and Kia Corp. The company is expected to list its issue on KOSPI by the second half of the year

Kakao Bank

South Korea’s leading Kakao group’s digital banking arm Kakao Bank is readying for an IPO debut. The internet-only lender will launch the IPO in the second half of 2021. In anticipation of the IPO, the bank recently announced that it would widen its loan business portfolio, focussing on mid-interest-rate products. Kakao Bank has benefited from its affiliation with the Kakao chat app and has seen an increase in customers since its launch in 2017. The mobile-only baking service will be the second of Kakao’s subsidiary to go public after the Kakao Games.

Kakao Bank is expected to make a strong IPO launch, with its post-IPO valuation estimated to be more than 30 trillion won. Kakao bank is being traded at around 74,000 won per share in the over-the-counter market. Kakao’s other two subsidiaries Kakao Page and Kakao Pay, are also likely to follow the IPO trend.

ONE Store Corp

The mobile app market run by mobile carriers SK Telecom, KT, LG Uplus, and tech company Naver is launching its IPO this year. Headquartered in Pangyo techno valley, one of Korea’s largest tech industry complex, ONE Store was established in March of 2016. It allows users to download apps that are limited in Korea only. It provides games, apps, mobile commerce, e-books, and video content to over 35 million members. South Korean telecommunications companies KT Corporation and LG Uplus invested a combined $23 million to acquire a 3.8% stake in ONE Store in January 2021 and support the IPO process.

ONE Store appointed KB Securities, NH Investment & Securities, and SK Securities as its underwriting team in September 2020. The parent company SK Telecom has created a dedicated team for IPO management, sparking talks about it preparing a listing of all its non-listed affiliate companies besides ONE Store like digital content provider SK Planet, internet provider SK Broadband, security service provider ADT Caps, mobility service T Map Mobility, e-commerce platform 11Street, and over-the-top service Wavv. SK Telecom is South Korea’s largest wireless carrier with a 50.5 percent market share.

Also Read,